Worry Colors Second-Half Outlook

Two recently published numbers are raising big questions

about how good the second half of 2012 will be for the national television

industry.

The first number came in a report from the Labor Department, stating that the

U.S. added only 80,000 jobs in June. The figure was taken as an indicator that

the economic recovery in the country was slowing down. The stock market fell

124 points, or almost 1%, the day the number came out, taking nearly all of the

major media stocks down with it. Worries about the economy have already

contributed to an upfront advertising market that was less robust than

expected.

The second number came from Netflix, once the industry's scary Death Star for

providing a cheap streaming alternative to cable. It became a cash machine for

most media companies by writing billion-dollar checks and opening a new digital

video syndication window. But when Netflix said that it exceeded 1 billion

hours of online video views during June, it sent a chill down the spines of

traditional TV followers worried about cannibalization and lower ratings.

Olympics and election years are generally buoyant ones for the television

industry. But will the second half of 2012 end up being as strong as originally

forecast in terms of revenue growth and corporate profits?

"Once we finish worrying about the shortterm, then we can get to worrying about

the long-term," says Brian Wieser, analyst at Pivotal Research Group and a

former media agency forecaster. "There are still a lot of dark clouds that over

time need to get worked through."

Wieser says it appears that revenue growth for the industry will be

decelerating in the second half of the year. While some observers see

advertising as a trailing indicator of economic activity, Wieser believes

advertising moves concurrently with the times. "To the extent that what we're

seeing now is going to be negative, then the second half will be bad," he says.

"If it's not as bad as we fear, then we turn to the longer-term issues."

Worrying and Waiting

With advertising becoming a smaller chunk of their revenue

streams, and with cost controls remaining tight since the recession started,

most media companies will probably still have healthy earnings in the second

half of the year, even if the ad market tanks. "It would take a really

cataclysmic event for pro! ts to lose steam," Wieser notes.

Indeed, until recently, worries about the economy had been to the TV business

like water off a duck's back.

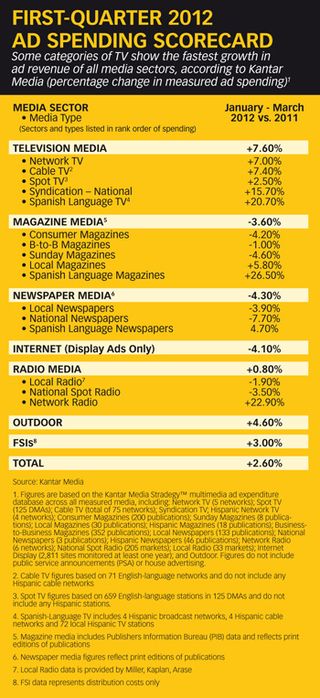

In the first quarter, every category of TV saw increases in advertising

expenditures, according to Kantar Media, which pegged TV media growing at a

7.6% clip compared to advertising growth in all media of just 2.6%. The biggest

gainer, according to Kantar, was Spanish-language TV, up 20.7%, but cable TV

showed a 7.4% gain, broadcast was up 7% and syndication jumped 15.7%.

Even while noting worsening economic indicators, media agency ZenithOptimedia

called for generally increasing television spending in its most recent forecast

for 2012. In fact, Zenith saw cable TV as one of the healthiest media segments,

forecasting 10% growth.

According to Zenith, while cable is expected to grow by double digits in 2012,

network TV is forecast to show a 1% decline. Historically, the Olympics have

given broadcasters a boost, but Zenith says live events from London are more

likely to be viewed on cable or over the Internet.

Analyst Michael Nathanson of Nomura Securities noted last week that most media

stocks showed big gains in the first half. Then he cut his second-quarter

earnings estimates for most of the companies in the sector because of a

slowdown in advertising revenue increases. Media companies will start reporting

Q2 earnings later this month.

Short-term economic conditions will make it tough for companies in the TV

business to beat Wall Street forecasts for the rest of the year, and that's

what makes the stock market happy, according to David Bank, managing director

for global media and Internet research at RBC Capital Markets. "I think things

are fine. But the ability to outperform is going to get harder and harder,"

Bank says.

"You could take your cue from the upfront market, which was fine," Bank adds.

"Pricing was probably in line with expectations. Volumes were a little lighter.

So it's not that it was a disappointment, but it certainly wasn't

outperformance, and it doesn't really set us up for great outperformance" in

the next TV season.

But he notes that the TV business is probably still doing better than anyone

would have thought.

"To be honest, it shouldn't even be this good. If you described the broader

[macroeconomic picture] and then you described the general business conditions

right now, it's shocking that it's this good," Bank says.

In a recent report, Anthony DiClemente of Barclays Capital writes that "despite

muted global growth expectations given the ongoing challenges in Europe, the

U.S. ad market remains relatively resilient. Our global ad forecast calls for

below-consensus advertising growth of 3.5% this year, while our U.S. ad

forecast calls for above-consensus growth of 4.6% in 2012, boosted by tailwinds

from political and the Olympics."

DiClemente notes that prices on a cost-per-thousand basis and sellout levels

during the upfront "came in slightly below our expectations, which we believe

was largely due to macro concerns from ad buyers. Nevertheless, we believe that

the broadcast and cable networks' ability to lock in mid-to-highsingle- digit

pricing increases is evidence of the resiliency of TV advertising."

DiClemente adds that if macroeconomic trends manage to improve during the

second half of 2012, the "scatter market could see robust pricing premiums." He

points out that during 2010, concerns about a double-dip recession and European

banking issues were in the news while upfront negotiations were going on,

hurting demand. "However, when macro concerns subsided and the economic outlook

improved in 4Q10 and 1Q11, scatter pricing premiums went as high as 25-40%

above upfront levels," Di- Clemente says. "Additionally, potential ratings

shortfalls at certain networks could reduce available scatter inventory and

therefore inflate scatter pricing."

Tech Is All the Talk

The advertising market isn't the TV business' only concern.

The industry's economic ecosystem is under assault from Barry Diller's Aereo,

which retransmits broadcast signals over the Internet without consent or

payment (and which had a good day in court last week), and Charlie Ergen's

Hopper digital video recorder, which subscribers can program to wipe out ads

from recorded broadcast programs with the touch of a button. At the same time,

the question of whether Netflix is friend or foe is resurfacing.

"Thematically, in the second half, this feels like the first time in the last

two to three years when the technology doesn't feel all on our side," Bank

says.

BTIG Research analyst Richard Greenfield figures that with 1 billion hours

viewed in June, Netflix would have ranked No. 7 among all TV networks and No. 2

among cable networks, behind Disney Channel. Adjusting for distribution,

Netflix would have been No. 1 among all television networks.

And yet, despite the clouds, the media industry is in good shape fiscally and

TV executives are mostly upbeat.

David Levy, president of ad sales, distribution and sports for Turner

Broadcasting, says Turner finished at the high end of the industry during the

upfront in terms of volume and pricing. But he says, "there were a few

categories that were definitely down. I don't think it had anything to do with

the economy," but with changes in those industries. Other categories, such as

quick-serve restaurants, auto, retail and technology, were up.

As for the second half of the year, "I'm already seeing third- and

fourth-quarter scatter relatively stronger than first and second of this year,"

Levy says. "I actually think scatter is going to be strong because I don't

think people put as much of their scatter money in the upfront as they have in

the past."

Levy says he's not adjusting his budgets for the second half. "I still think

that people have to sell product during Christmastime," he says, adding, "Obama

and Mitt Romney are raising more money than I've ever seen in my life, which

will tighten up the marketplace."

Joe Abruzzese, president of advertising sales at Discovery Communications, says

that while some advertisers may have pulled back a little during the upfront,

he is not seeing many completely pulling back.

"We had two years of 40% and 20% volume growth, so to get growth on top of

those years is still pretty good," Abruzzese says. "But I don't really see a

lot of clients totally pulling back. And I also don't think this is all the

money we're going to see. This is just the money we're seeing for now."

At Crown Media, which runs the Hallmark Channels, "we're con! dent in the way

the upfront went, and all signs are we're going to have a very strong fourth

quarter and the third is a little softer than we'd like," says CEO Bill Abbott.

"Once the upfronts are written and with the 4th of July passed, we're hopeful

that activity will begin at more of a pace that we're accustomed to."

All Eyes on Washington

The election has the potential to pour billions of dollars worth of political

advertising into both broadcast and cable. And contractual terms are in place

that call for year-by-year increases in subscriber fees for cable networks and

retransmission fees for broadcasters.

"It makes the fundamentals relatively attractive," says Bank. "There is all

this great secular trending for things that are contractual, things that are

hard to see them go wrong."

Pivotal's Wieser warns that business might get even more conservative as the

end of the year nears because unless things change in Washington, a combination

of spending cuts and tax increases is set to kick in.

"I think with these macro headwinds that are present and looming larger,

especially as we approach the fiscal cliff, that there's increasing chances of

numbers being missed towards the end of the year," Wieser says.

Concern about what's happening in Washington will encourage businesses to

withhold spending until the last minute, Wieser adds. "It feels like

uncertainty is going to be the name of the game, and I don't know that there's

anything the CEOs of media companies will be able to say that can persuade

investors that things are certain."

While there has been a great deal of concern about technology in general and

cord-cutting in particular, RBC's Bank says Wall Street types are joining TV

executives in looking at a familiar metric. "I've never seen the investor base

so laser-focused on ratings," Bank declares. "I think the wild card in the

second half for a lot of companies is almost more about content cyclicality

than economic cyclicality."

Ratings are becoming increasingly important because they pack a one-two punch.

Lower ratings not only translate into lower ad revenue, but they also indicate

increased program development spending in the future. "Companies are keenly

aware of that, and there's a lot riding on these schedules," Bank says.

That means analysts hang on Food Network ratings to see if Scripps Networks

Interactive has the right recipe; they look at the turnaround on TBS and wonder

if Time Warner can find similar magic on TNT; and they question whether

Discovery can keep pumping out monster ratings gains at some of its networks,

and if Viacom can arrest slides at Nickelodeon and MTV.

"Those are things that are going to be more impactful over a longer period of

time than the economic cycle right now. The content cyclicality is very

powerful, and it drives what you have to invest in content," Bank says. "I also

think it drives long-term value-if you have a hit show, it eventually becomes

syndicatable."

Predicting ratings isn't any easier than predicting the economy. So, will the

second half be one the TV industry can look back on with a smile or a shake of

the head?

"This is what it boils down to: When we look at what's coming in the second

half, is it more likely to make bulls more bullish or bears more bearish?" says

Bank. "And I think the jury is kind of out on that one."

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.