We've Been Left to Our Own Devices

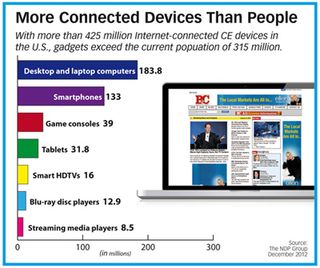

Consumer electronics (CE) devices connected to the Internet—more than 425 million— now outnumber people in America, NPD Group reports. With about 20,000 new electronic gadgets rolled out last week during the 2013 International CES show, CE has potentially historic implications for the TV industry.

So far, much of the impact has been positive. Better, smarter, larger HDTV sets have encouraged more TV viewing, while the growing popularity of smartphones and tablets has opened up new opportunities for consumers to watch programming.

But consumer electronics manufacturers’ expansion into the mainstream of video consumption also raises a number of competitive issues. As the major CE companies become an important video pipeline to consumers, they are also looking to get a bigger piece of the $130 billion television advertising and subscription pie.

Some of these technologies also raise thorny legal and regulatory issues. Broadcasters, for example, have been suing Aereo to block its subscription-TV service that delivers broadcast signals to Internet-connected devices without paying networks and stations. During the CES show, Aereo CEO Chet Kanojia said the company has raised an additional $38 million to expand into another 22 markets in the first half of 2013. A nationwide rollout of Aereo is likely by the end of this year.

Here’s a look at some of the big trends from last week’s 2013 International CES that TV executives need to be watching.

SMARTPHONES

Biggest Changes: Smartphones have moved firmly into the mainstream, with 55% penetration in the U.S.; globally, they are now the best-selling consumer electronics device.

Improvements: Faster processors, higher-quality HD screens, tighter integration with other devices for sharing content, 4G capabilities and better cameras continue to boost smartphones’ popularity.

The Players: Apple faces increased competition from Samsung, which market researcher Strategy Analytics expects will be 2013’s biggest smartphone producer, while Sony and Microsoft are battling for a bigger slice of the pie.

How They Will Change Things for TV: As smartphones get more intelligent and powerful, they are becoming a hub for many other activities, acting as the remote control for TV sets or a platform for second-screen apps.

Manufacturers are also rolling out more 4G-capable smartphones with larger, better screens, like the Samsung Galaxy and Sony’s new 4G Xperia Z, which has a five-inch 1080p HD screen. This will likely boost viewing of TV programming and movies on these devices.

Mobile app analytics company Flurry reported that in December 2012, U.S. users spent about 127 minutes a day on mobile apps, versus about 168 minutes watching TV.

“The buying public is not making a gradual shift to mobile entertainment,” Dish president and CEO Joseph P. Clayton said during CES. “It is a full-blown sprint.”

And those numbers will likely grow as more consumers get faster 4G phones, noted Jack Perry, CEO of Syncbac, which is working with 112 stations (reaching about 35 million homes) to stream live broadcasts over cellular networks.

CES also saw the introduction of more new devices that can receive the mobile DTV signals many broadcasters have launched using a portion of their over-theair spectrum.

But those efforts face some potential tough competition from mobile carriers. During a CES keynote, Lowell McAdam, Verizon chairman and CEO, said the company might begin broadcasting video over 4G LTE networks as early as 2014 using technologies he believes could even handle the traffic generated by the Super Bowl.

TABLETS

Biggest Changes: Less than three years after Apple introduced the first iPad, the tablet’s shipments are expected to hit $37 billion in the U.S. in 2013; eMarketer is predicting more than half of all Internet users in the U.S. will have a tablet by 2015.

Improvements: Better screens, faster processors and lower costs are making tablets a potential replacement for PCs, laptops, small TVs and even game consoles.

The Players: Apple will continue to dominate the category, but it is facing stiffer competition from Amazon, Samsung and others that have launched less-expensive 7-inch tablets, which will account for about one-third of the global market in 2013, noted market researcher IHS iSuppli.

How They Will Change Things for TV: With the number of tablet users expected to approach the 100-million mark by the end of 2013, lower-priced 7-inch tablets will continue to push these devices into the mainstream. That’s good news for broadcasters, who will be able to reach larger audiences on these videofriendly devices. But it puts more pressure on programmers to find ways to boost their paltry mobile revenue; it creates more competition for Apple; and it is bad news for TV set manufacturers and computer makers.

Just as tablets have cut into PC sales, “We have seen tablets cannibalize small-screen TV sets, which are down 20% year-over-year,” Shawn Dubravac, Consumer Electronics Association chief economist and senior director of research, said during the show.

Like smartphones, tablets are increasingly becoming a hub for wider video and media usage, with a number of CE makers touting the ability to easily share content among their tablets, smartphones, TVs and gaming consoles, and how they can work together in a variety of second-screen activities. “One screen isn’t enough for consumers,” said Yoon Boo-keun, president of Samsung Electronics. “They want all their devices connected and to be able to move their content freely between devices.”

SMART TVS

Biggest Changes: The old boob tube keeps getting more intelligent.

Improvements: Faster chips, better apps, bigger screens, voice and motion controls, and higherresolution 4K video are designed to strengthen the TV’s position as the center of the living room.

The Players: Samsung continues to lead the pack in this extremely low-margin business, but it faces tough competition from Panasonic, Sony, LG and others that are also pushing smarter sets into the market.

How They Will Change Things for TV: Consumers are rapidly embracing the idea of smarter, betterconnected TVs. A recent survey from Frank N. Magid Associates and YuMe found that 45% of consumers expect to purchase a new TV in the next year, a much higher rate than usual, noted Ed Haslam, YuMe senior VP of marketing. And eMarketer projects that the share of all homes with an Internet-connected TV set will rise to more than 43% by 2016, up from 22.5% in 2012.

More notable developments include faster processing power and improved apps that are making these sets much more intelligent, with better features for interactivity, search, social TV, content-sharing among devices, and user interfaces, noted Ashwin Navin, CEO at Flingo, a major publisher of connected-TV apps.

Increasingly, these TVs also enable users to view all of their content—linear broadcast and cable channels, DVR recordings, video-on-demand, subscription overthe- top services, and personal photos and videos—on one screen, searchable with voice or motion controls.

That is good news for viewers, but it also means programmers will have to acclimate themselves to a world where their content appears side-by-side with subscription video providers such as Netflix.

Screen technologies have also continued to improve. At CES, about 10 manufacturers were offering around 50 models of higher-quality 4K or Ultra HD screens; the latter feature four times the resolution of current HD screens. The CEA is predicting sales of only 23,000 Ultra HD units in 2013, but it expects unit sales to rise to around 1.4 million in 2016.

GAMING CONSOLES

Biggest Changes: Gaming consoles have evolved into alternative entertainment platforms that connect TVs to a wide array of media and video.

Improvements: More apps and content deals continue to expand usage.

The Players: Microsoft and Sony are battling to build large content ecosystems for their consoles.

How They Will Change Things for TV: Game consoles have been widely used to connect TVs to the Internet and are now by far the most popular way to access over-the-top content on TV screens, making console manufacturers key content partners for digital distribution.

This is particularly evident at Microsoft, which has a global installed base of more than 70 million, with more than 40 million Xbox Live subscribers worldwide who can access content from 90-plus companies. Currently, 42% of Xbox Live subscribers in the U.S. are watching an hour of TV or movies on the Xbox every day and are spending an average of 84 hours a month on the Xbox Live platform.

“We have made a fundamental shift from being a game console to being an alternative entertainment platform and service,” said Ross Honey, general manager of entertainment and advertising at Microsoft. “Our users are now spending more time consuming video than playing multiplayer games.”

Microsoft has cut content deals with many of the largest U.S. programmers and launched a studio for the creation of original Web content. The company also has been working closely with multichannel operators on apps that allow subscribers to find and access content with Xbox’s voice and motion commands or via its new Windows 8 operating system.

“As [operators] offer more and more content, we offer a unique value proposition of helping them make it easier to " nd and interact with that content,” Honey added.

SET-TOP BOX REPLACEMENTS

Biggest Changes: Standard set-top boxes are increasingly being replaced by larger media hubs, whole-home DVRs or CE devices.

Improvements: More storage, faster processors and improved apps promise to transform the way subscribers access and interact with content.

The Players: A growing number of CE manufacturers, from Samsung to Microsoft, are working with operators to hook up their TVs, game consoles and other devices directly to multichannel providers.

How They Will Change Things for TV: The move to Internet-connected devices and IP infrastructures for delivering video has enormous implications for multichannel providers and the way they deliver video into the home. Increasingly, operators are deploying wholehome DVRs, which work like video servers to deliver content to multiple devices, or are directly connecting their networks to smart TVs or game consoles so subscribers can watch programming without a set-top box.

Those trends were particularly evident during CES, when Dish unveiled its Hopper with Sling whole-home DVR and several new apps.

Vivek Khemka, VP of product management at Dish, said the new Hopper will allow subscribers to access live TV programming, DVR recordings and on-demand content on any Internet-connected device—inside or outside the home. Khemka showcased a new feature called Hopper Transfer that will permit subscribers to move DVR recordings to an iPad so they can be accessed outside the home even when users don’t have the WiFi connection needed for the Sling features. “It completely transforms the viewing experience,” Khemka said. “They will have access to everything they have on their TV on every other device.”

E-mail comments to gpwin@oregoncoast.com and follow him on Twitter: @GeorgeWinslow

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below