Weaker Upfront May Put Pressure on Scatter Market

The broadcast upfront market was weaker than expected, which

means the networks will have to sell more of their commercial inventory in the

scatter market.

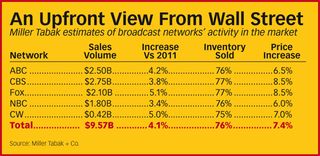

Broadcasters typically aim to sell about 80% of their inventory in the upfront,

but analyst David Joyce of Miller Tabak + Co. estimates they sold only about

77% in this upfront so they could maintain price increases, which were in the

6% to 9% range. Economic factors including the stock market, unemployment and

global financial issues impacted the scatter market and "had the effect of

dampening the upfront negotiations," Joyce said in a report.

Information about the upfront is carefully guarded by the networks, which opted

not to comment on their negotiations. Most media buyers said volume for the broadcast

upfront was down compared to last year's booming upfront. But according to

sources familiar with the negotiations, CBS and NBC, the networks at the top

and the bottom of the food chain respectively, both registered small increases

in volume, while Fox, ABC and The CW were flat.

Also, General Motors, looking to reduce its media costs, shifted some spending

from broadcast to cable, where prices for original programming are lower. It

was not clear if GM had done deals with all the major broadcasters by the end

of last week.

In his report, Joyce estimated the broadcast upfront totaled $9.6 billion, up

4.1% from 2011. But Joyce's figures appear to be overly bullish, according to

sources on both the buy and sell sides of the negotiating table.

David Bank, analyst at RBC Capital Markets, said that amid

the murkiness surrounding upfront volume and pricing, it's more important to

look at inventory levels. "That is more interesting to me than volume, because

of the environment it sets up for the scatter market," Bank said.

"You could argue that the CBS pricing was a touch lower [than expected], but as

far as Wall Street is concerned, we're pretty indifferent between a 10 and a

9," Bank said. "What you're less indifferent about is, did we preserve some

sort of scarcity in inventories, and it feels like inventories [sold in the

upfront] were a little light. They probably held back more than they would have

liked to. And that puts a little bit of a headwind on the scatter environment

next year."

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Joyce estimated upfront sales as a percentage of the broadcast nets' total

sales would be 61.8%, down from 62.5% in the 2011-12 season.

Some network execs believe it's important to maintain pricing levels, even if

that means turning away sales, because once cut, it can take years to push

rates back up to their former levels. That can result in lower revenue in a

weak market.

"The [network that] benefi ts most if they did hold back inventory to maintain

price integrity is [the one that] has the least amount of risk in their

schedule, and that's CBS," Bank said. "If [the other networks] have a ton of

make-goods, the only guy who's going to have dry powder is going to be CBS. And

they're the guys that it matters most to."

To Wall Street, the upfronts, and ad sales in general, are becoming a less

significant part of how the companies that own the broadcasters are valued.

"All the other factors-the affiliate fee growth, the digital-distribution sales

to Netflix, Amazon, Hulu, retransmission- those are far bigger drivers, and

they're the reason we're so bullish on the sector," Bank said. "All I need is a

stable ad environment."

With broadcast wrapped, buyers have turned their full attention to cable and

syndication.

Negotiations were moving at a more deliberate pace than last year's, but cable

sales execs said that while budgets weren't as strong as expected, they were

looking at a market that would be up between 5% and 7% overall.

"It's hard work," said Mel Berning, president for ad sales at A+E Networks. "Last

year was a one in 10, one in 12 kind of year. The fact that we're up versus

last year is remarkable. It's actually a fairly solid marketplace when you're

talking [price] increases that are mid-to-upper singles. That's not too

shabby."

Volume appeared to be up, with dollars "up 5%," Berning said. "If you've got

ratings points, you'll see more than that, as long as you're reasonable. I

think money moved away from broadcast and stopped first at top-tier cable

networks."

Many of the major cable network groups were more than halfway sold at the end

of last week.

Syndication was also moving toward completion. "It appears that it's a fair,

flat market for syndication," said Michael Parent, senior VP and director of

broadcast at media agency TargetCast tcm. "There are a lot of untested shows in

daytime," Parent said, noting new fall talk shows hosted by Katie Couric, Jeff

Probst, Ricki Lake and Steve Harvey. "The Oprah void has never been

filled, and the viewership has trickled all over the place. The agencies are

getting the prices they're looking for."

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.