VR Headset Adoption Shows Signs of Life

Mass-market adoption of virtual reality (VR) and augmented reality (AR) hasn’t arrived, but the product sector appears to be gaining momentum.

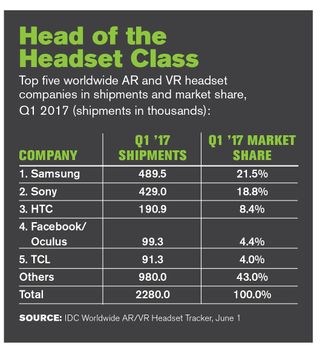

Worldwide shipments of those products eclipsed 2.3 million in first-quarter 2017, International Data Corp. (IDC) found in its latest headset tracker report.

VR, at more than 98%, represents the vast majority of the headsets shipped in the period, and about two-thirds of all VR headsets shipped in Q1 were “screenless viewers,” such as Samsung’s Gear VR and Google’s Daydream View, which must be paired with a compatible smartphone.

Higher-end tethered VR headsets, including the HTC Vive, Oculus Rift and Sony’s PlayStation VR, captured about one-third of the market, IDC said, noting that the market continues to skew to young consumers while some others take “a cautious approach” to the emerging platform.

Among that tethered group, Sony reached a PR milestone of sorts recently by announcing it had shipped more than 1 million PS VR headsets, which went on sale last October. IDC estimates that Sony shipped 429,000 units in Q1, or 18.8% of the market.

Shawn Layden, president and CEO of Sony Interactive Entertainment America, acknowledged to The Verge that PS VR shipments are still way behind the massive installed base of PlayStation 4 owners, which number about 60 million.

“It’s still just a million units,” he said. “With VR, it’s a totally brave new world … We’re still trying to understand exactly what people are going to want to do in that medium. It’s hard to make predictions about it. People will want it to be smaller, lighter, wireless — these are all things we’re looking at from a conventional iteration process.”

Still that shipment milestone shouldn’t be underplayed, according to Stephanie Llamas, vice president of research and strategy and head of VR/AR at SuperData Research.

That’s because PS VR is starting to hit some big round numbers even as other higher-end products, including the HTC Vive and Oculus Rift, struggle to capture share. SuperData Research expects Sony to ship 2.6 million PS VR units by the end of the year, versus 553,000 for the HTC Vive and 346,000 for the Oculus Rift.

SuperData Research predicts the Samsung Gear VR and Google Daydream View will sell a respective 6.7 million and 3.5 million units by the end of the year.

But the product market appears to agree with Layden’s belief that VR adoption should do better as the headsets become lighter and more capable. Standalone VR headsets represent the next frontier in the category, and should help to reduce consumer friction.

Google recently announced it had teamed with HTC and Lenovo to build new, standalone virtual reality headsets that will launch sometime later this year and lean on Google’s Daydream platform. Google is also working with Qualcomm on the reference design for the standalone VR platform.

Facebook-owned Oculus is also at work on a standalone VR headset, but has not announced launch timing.

VR and AR traffic is on pace to produce a compound annual growth rate of 82% from 2016 to 2021, according to Cisco Systems’ latest Visual Networking Index study. Global VR/AR traffic is expected to rise to 1.72 exabytes per month by 2021, a 20-fold increase from 2016 levels, but still represent just 1% of the internet’s “entertainment” traffic.

APPLE HOPES VR, AR BEAR FRUIT

Adding to the momentum is Apple. After standing on the sidelines, Apple announced last week at its Worldwide Developers Conference that it was amping up its activity around both VR and AR.

On the VR front, a new line of iMacs will pack enough horsepower to support virtual reality services and applications. That optimized VR software for the new macOS, called High Sierra (set to ship this fall following a beta period), will work with the Valve, Unity and Unreal engines.

In an effort to take augmented reality to the next level, Apple also unveiled a new core technology called ARKit that will use the capabilities of the iPhone to identify surfaces such as a table and to let users add an object such as a lamp, coffee cup or vase.

The ARKit — to be supported in iOS 11, to be released this fall — uses the phone’s sensors and cameras to find those surfaces and to estimate ambient lighting. Hundreds of millions of iPhones and iPads will be capable of using ARKit, making it “the largest AR platform in the world,” Craig Federighi, Apple senior VP of software engineering, claimed, lobbying a competitive shot at Tango, Google’s AR platform for certain Android devices.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below