Viacom Reports Lower Fourth Quarter Profit

Viacom, under pressure in a changing media world and facing questions about leadership from investors, reported lower profits and revenue in the calendar fourth quarter.

Net earnings in the quarter—Viacom's first fiscal quarter of 2016—dropped 10% to $449 million, or $1.18 a share, from $500 million, or $1.29 a share, a year ago.

Revenues fell 6% to $3.2 billion.

Earnings were in line with Wall Street estimates, though revenue was a bit lower than expected. And despite cheerleading from management on a conference call with analysts, Viacom's stock plunged, trading down more than 14% at midday.

RELATED: Viacom Makes Ad Deal With Snapchat

Viacom’s revenues have been disappointing as ratings at its cable networks fall because their young viewers are shifting to digital forms of entertainment. Some investors have called for new management to face these strategic challenges.

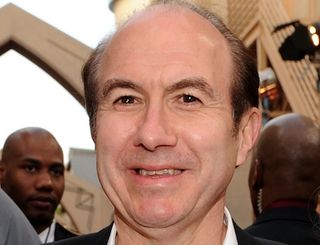

At the same time, 92-year-old Sumner Redstone, the media mogul who controls Viacom, is in declining health and gave up his post as chairman last week. He was replaced by CEO Philippe Dauman, a decision that was opposed by some shareholders, notably Shari Redstone, Sumner Redstone’s daughter.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

While Sumner Redstone's assets will go into a trust when he dies, questions about who will control the trust surrounds Viacom.

In a statement, Dauman noted that “2015 was a challenging year operationally as we redesigned ourselves and adapted to significant industry disruption. Our first fiscal quarter of 2016 reflected these challenges.”

But he said the company was investing in content, technology and innovation.

“As the media industry continues to evolve quickly, Viacom is generating sustainable opportunities using great new content, innovative technology, marketing and data applications, along with the benefits of our substantial footprint in key international growth markets,” said Dauman. “Our investments in new content have led to higher ratings at most of our networks, including VH1, Spike, BET, TV Land, CMT and Nick at Nite, as well as Nickelodeon, which recaptured its lead as the top network for kids 2 to 11.”

Dauman added that “we saw significant sequential improvement in domestic advertising sales, due to the success of our new programming and our highly-desirable new advertising products.”

On Viacom's earnings call Dauman addressed the criticism of Viacom that has intensified because of lawsuits challenging Redstone’s ability to make his healthcare and financial decisions.

He noted “speculation about Viacom” and its future and said much of it is “distorted” and comes from “publicity seekers.”

“We will not be deterred from building the bright future ahead of us,” he said. “I will work tirelessly and leave no stone unturned.”

Dauman noted that he has worked with Redstone for 30 years building a media empire. He thanked Redstone and the Viacom board for “believing in my abilities and character” in electing him as executive chairman succeeding Redstone. Restone was listening in on the call, Dauman said.

He said his “singular objective is to protect and build value for all Viacom shareholders.”

“Let me be clear. I could not be more focused on getting Viacom stock price back up. . . no one should doubt my resolve.”

The market wasn't buying, nor was it favoring any of the other media stocks. Discovery was down 5% at midday, Scripps Networks Interactive and Time Warner weree down more than 4%. Nearly all of the other media companies were down 2% or more as concerns about the industry percoluated on Wall Street.

Operating income was down 4% to $1.06 billion at Viacom’s media networks division, which includes MTV, Nickelodeon and Comedy Central. Revenues were down 3% to $2.57 billion.

Domestic advertising revenues were down 4%. The company said price increases were more than offset by a decline in traditional ratings at some of its networks.

On the call, Dauman said that current ad demand was strong, with scatter pricing up 20% over upfront levels. He said he expected ad growth to accelerate over the next few quarters. "We are determined to get back to ad growth," he said.

Domestic affiliate revenues were flat because of the timing of some subscription video on demand deals.

Operating income and revenues at Viacom’s movie business were also down.

"Usually the debate on how the stock will react to this earnings report center on which would carry more weight: slightly better than expected (but still very negative) domestic advertising, or slightly worse than expected affiliate fees," noted analyst Todd Juenger of Sanford C. Bernstein. "At this juncture, we think the stock is being driven much more by handicapping of the Dish renewal, and any continued drama surrounding changes in control. None of which is addressed in the press release, and probably won't be addressed on the conference call either"

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.