U.S. Dealmakers Are Thinking Globally

Related: Hollywood Eyes International Digital Gold

Several top cable programmers have cast an increasingly enthusiastic eye toward acquisitions outside of the U.S. over the past year, with perennial international powerhouses like Discovery Communications, Viacom, AMC Networks and others tossing billions of dollars at a wide variety of properties. But despite the renewed appetite for global transactions, most acquirers see their recent deals not as a way to gain scale, but as a path toward building on the assets and influence they already have.

Discovery Communications, a pioneer in the international market since it first began investing outside of the U.S. about 25 years ago, is a prime example. Discovery was particularly aggressive on the acquisitions front, pairing up with international distributor Liberty Global to purchase production house All3Media for about $930 million and spending about $1.2 billion for a controlling interest in international sports channel Eurosport International.

The Eurosport purchase came on the heels of Discovery’s 2013 buy of Scandinavian broadcaster SBS Nordics for $1.7 billion and was the nonfiction-programming giant’s first foray into the sports market.

Other U.S.-based media companies have also been on the international deal hunt. In the past year:

● AMC Networks surprised many with its $1 billion acquisition of Chellomedia from Liberty Global.

● Viacom, which had opted for the sidelines in the international M&A fray in the past, shelled out $757 million for U.K. commercial broadcaster Channel 5.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

● Liberty Global purchased a 6.4% interest in U.K. broadcaster ITV, to go along with its pairing up with Discovery to acquire U.K.-based All3Media for about $930 million.

Opportunity Knocks

The deal market was robust in 2014, and each party will likely at least look at other deals in the coming year. It even drew in usually-quiet Viacom, though Viacom International Media Networks CEO Bob Bakish said that doesn’t mean the company’s core strategy has changed.

The Channel 5 opportunity presented a chance to build on an existing strength.

“We’re not a company that makes acquisitions a fundamental part of our strategy,” Bakish said. “When we saw Channel 5, we saw something intriguing. We saw the opportunity to take what was our biggest market and become an important scale player.”

With Channel 5, Viacom gets access to programming blocks that complement its existing shows, such as the “Milkshake” preschool block, which pairs nicely with Viacom’s own kids’ programming. It also gets an outlet for shows that aren’t currently on pay TV in England, such as Spike TV fare. Viacom plans to launch Spike TV programming on Channel 5 in the spring.

“We saw significant opportunities and we decided to do it,” Bakish said, “but you shouldn’t interpret that as a sea change in our strategy.”

That also holds true for the most-active buyer in the space, Discovery.

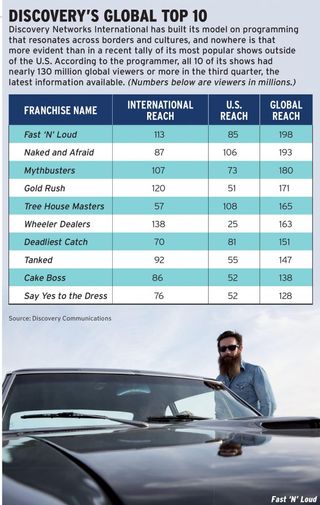

Discovery Networks International president JB Perrette said his company is a little different than other international players in that it has been in the market for more than two decades. Discovery is expected to continue to be aggressive on the M&A front, but it isn’t buying scale. For Discovery, acquisitions are focused on building on the scale the company already has.

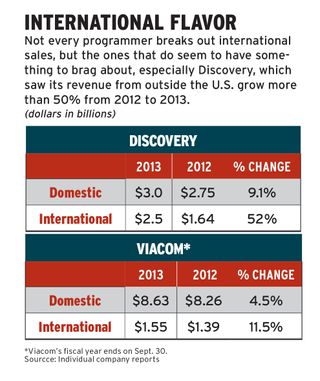

It has a lot of scale. Company-wide, international revenue now makes up the majority of Discovery’s sales, with Morgan Stanley media analyst Ben Swinburne estimating 2014 international revenue of $3.3 billion and domestic sales of about $3 billion. Swinburne expects that gap to widen in 2015, with international revenue topping $3.9 billion while domestic sales reach $3.2 billion.

“This has been a 25-year journey of building channels and asset value and reinvesting the money that originally got created out of the U.S. business, and deciding early on, well before most of our peers, [to own] broadcast and television assets outside of the United States,” Perrette said in an interview. “That made us different.

Now, he said, with add-on deals and other acquisitions, “we used that fantastic local infrastructure, the teams and resources in markets, to be able to competitively differentiate ourselves when we get into acquisitions conversations.”

Perrette called Eurosport a prime example of that strategy. Previously it was a largely pan-European sports brand that was heavily skewed toward its home country of France; Discovery is making moves to refocus the channels on sports popular in specific regions.

For example, ski jumping is wildly popular in Poland, Perrette said. Hockey draws huge audiences in Sweden, and in Spain, handball and basketball attract crowds.

By buying rights for those sports in particular regions and promoting them there, Discovery is in essence transforming Eurosport into several different regional sports networks.

“The regional sports network analogy is a good one, albeit on a multinational scale,” Perrette said. “Being able to tailor the product to better meet the appetite of the viewers and consumers in those markets and how they differ, versus having peanut butter spreading across the entire region, where you get pockets of popularity depending on which sport you’re taking about. We like that companion of a multinational pan-regional network and then an RSN model at the local level.”

Discovery’s Local Accent

Similarly, with other networks, Discovery has added local celebrities to narrate foreign versions of U.S. shows and built programming around local people of note.

One of TLC U.K.’s highest-rated shows ever was My Fat Story, a recent two-part documentary that depicts former reality star Katie Hopkins gaining and attempting to lose 56 pounds (4 stone, in British measurements) in six months to show, in her words, how easy it is to lose weight.

According to trade website Broadcast Now U.K., the first episode of My Fat Story garnered about 257,000 viewers on Jan. 5, smashing TLC’s previous U.K. record of 140,000 viewers for Jodie Marsh on … Plastic Surgery in October 2013.

Discovery’s ID channel—one of the fastest-growing cable channels in the U.S.—is available in about 100 million homes in 157 countries and will expand to 200 countries later this year.

Across the board, content providers are beginning to see rising viewership—and bigger profits—as they launch new networks and programming outside of the U.S. The sluggish stateside advertising market is a strong incentive to expand overseas. For companies such as Discovery and Viacom, the growth is coming in areas outside of traditional markets like Western Europe and Latin America.

Bakish said Viacom:

● Launched Arabic-language version of Nickelodeon and Nick Jr. in the Middle East on Jan. 9;

● Formed joint ventures in India—Viacom 18, which launched the popular general-entertainment network Colors—to develop programming;

● And will launch a version of its U.S. network BET in South Africa later this year.

“International is a higher priority than it ever was,” the Viacom executive said. “We see a significant opportunity in serving eyeballs outside of the U.S.”

Bakish wouldn’t estimate just how much growth will be, but Viacom International’s revenue has been growing at a steady clip over the past few years, even as its domestic networks face declines due to ratings sluggishness and a depressed advertising market.

International revenue made up about 14% of total revenue in fiscal 2014, about even with the prior year. CEO Philippe Dauman has said publicly that he sees the international networks as a “driver of significant growth for Viacom for many, many years to come.”

U.S. media firms like 21st Century Fox, The Walt Disney Co., Time Warner Inc. and Scripps Networks all are expected to see at least some increases in affiliate fees and ad revenue internationally in the coming years.

RBC Capital Markets media analyst David Bank has estimated that Time Warner’s Turner International networks will see the biggest increase in affiliate fees—growing them by double digits through 2018—and is optimistic about growth potential for the entire sector.

“We believe international networks still represent a secular growth story, with management teams citing an improvement in Europe while growth in emerging markets is still secular in nature, with affiliate and ad revenue growth a function of increased pay-TV penetration,” Bank wrote in a recent report.

Evercore ISI media analysts Vijay Jayant and David Joyce said they think Time Warner will grow international ad revenue by 2% in the fourth quarter (outpacing domestic ad growth of 1.6%), while 21st Century Fox will boost ad revenue outside the U.S by 4% in the fiscal second quarter ended Dec. 31.

Jayant and Joyce are even more optimistic for Discovery, predicting fourth-quarter international affiliate fees will grow 30% while ad revenue outside the U.S. will rise 9.5%.

Even the new entrants see a long runway of growth ahead. The 2014 purchase of Chellomedia by AMC Networks—parent of U.S. cable channels AMC, WE tv, IFC and Sundance TV—raised some eyebrows, but the programmer has already made some significant moves to beef up the channels which are available in about 390 million homes in 138 countries in Europe, Asia and Latin America. AMC rebranded Chellomedia as AMC Networks International in July, and in August announced plans to rename its MGM Channel as AMC in Europe, Latin America, Asia, Africa and the Middle East.

AMC Footprint Grows

That same month, AMC Networks expanded Sundance Channel into six new territories in Latin America and by October had bought rights to Formula One motor races for the Sport1 and Sport2 channels in the Czech Republic and Slovakia. In November, AMC Networks International had doubled its household numbers in Mexico.

AMC Networks chief operating officer Ed Carroll described a two-pronged strategy internationally: Put high-profile series on the acquired channels and enhance strong existing regional networks.

Rebranding the MGM Channel to AMC is a big step forward in taking care of the first prong. Already AMC-owned shows like Halt and Catch Fire and Rectify are gaining audiences outside of the U.S.

Some of AMC’s most iconic originals—Mad Men, Breaking Bad and The Walking Dead—may take a while longer to find their way onto the Chello channels, mainly because of rights issues. Mad Men is owned by Lionsgate Entertainment and Breaking Bad by Sony; both have licensed the shows to other networks.

While AMC owns The Walking Dead, it is currently distributed overseas by Fox International Channels. Carroll didn’t want to talk about specific shows, but he said in general the company would like that “more of the original content be seen on channels we control more often.”

As far as Chello’s regional networks, Carroll said the plan is to “strengthen those channels and commit more to the local platform.” That could include coproduction deals or using format rights to create localized versions of shows. “As our footprint continues to grow, those are conversations we will engage in.”