Q3 Pickup in Ad Sales No Sure Thing

After a sluggish second quarter, TV execs are counting on ad revenue to pick up in the second half, but early indications are that it might be tough to deliver on that optimistic outlook.

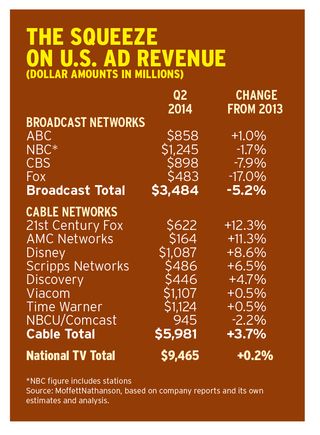

How tough was the second quarter? Analyst Michael Nathanson of MoffettNathanson Research estimates ad revenue growth was a paltry 0.2% —the lowest since the start of the recession.

Despite the grim numbers, earnings calls were garnished with expectations that a rebound was at hand. “You’ve heard recently about the challenges during Q2 in the advertising marketplace, which we saw as well. But we are now seeing pacing improve significantly here in Q3, both nationally and locally, and Q4 will be even better than Q3,” CBS CEO Leslie Moonves said in typically buoyant fashion.

But Nathanson notes ratings numbers were rough in July. Looking at the C3 measurement that media buys are based on, Nathanson says broadcast viewership was down 4% in July— topped by a 12% drop at Fox. The picture was even worse for cable, where primetime ratings were down 7% and total-day viewership was down 8%, with only AMC Networks’ collection of channels bucking the negative trend.

The ratings declines were in the double-digits in primetime for cable nets owned by NBCU, Time Warner and A+E Networks, a joint venture of Walt Disney Co. and Hearst. In daytime, the list of double-digit drops also included channels owned by Viacom and Discovery Communications, as well as independent networks.

A new report from Turner Broadcasting shows that this summer (May 26-Aug. 25), nine of the top 10 cable networks’ live-plusseven- day ratings were lower than last year. Only ESPN was up, and only FX avoided a drop in the double-digits.

Meanwhile, media buyers say the scatter market for ads remains tepid in the third quarter. “Things seem fairly consistent,” said one buyer. In fact, there are a few networks where there is little inventory available because of underdelivery liability that accumulated over the course of the year.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Those conditions make it hard for networks to increase ad sales, meaning hopes for growth lay at the end of the quarter. “Everyone in our industry on Wall Street is looking to hear about how September will end,” said Nathanson. “Without a very vibrant scatter market, which didn’t appear to be the case at the end of July, it’s going to be all about September and back to school and the NFL.”

With the summer over, media company executives are back to doing investor conferences. “In the next few weeks you’re going to hear a lot of people at conferences talking about third quarter,” Nathanson said. He expects to hear that the return of the NFL with its high ratings and CPMs will power a Q3 improvement over Q2’s run rate, especially with CBS adding a weekly NFL game in primetime on Thursday night. But he notes that, “We’ve been worrying about the ad numbers for the past nine months. The numbers have been coming in lower than we thought. And it’s been that way since [2013’s] fourth quarter.”

Of course, high ratings don’t translate into revenue unless marketers are spending their advertising dollars and allocating the traditional share to television.

Television issues have contributed to Interpublic Group of Companies’ Mediabrands division’s Magna Global cutting its ad spending forecasts for 2014, says Vincent Letang, director of global forecasting at Magna,

Magna is now expecting ad spending on the English-language broadcast networks to be down 4.8% in the third quarter and 3.4% in the fourth quarter, leaving the total for 2014 to be down 3.7%, compared with its prior estimate of a 1.7% decline (not including Olympics and political spending). Including the Olympics, the full year will finish flat.

For cable, Magna sees 4.3% growth, revised downward from 5.4%.

Letang says TV’s second-quarter weakness was partly circumstantial, partly structural. He says that demand will be slightly stronger in the second half, but that the pace of ad dollars shifting to digital—particularly online video—is accelerating.

“In the short term, we don’t expect a spectacular comeback for TV in the second half, but we think it’s going to be somewhat better than 2Q,” Letang said. Over the longer term, “we now expect digital media to out-pull television as a whole by 2017. Previously we had the two curves crossing in 2018.”

The second-quarter weakness contributed to lower than expected volume in the upfront. In both the first half and in the upfront, Letang says it’s possible that some advertisers decided to cut or freeze ad spending in response to a slower than expected economy. But there are signs the economy is picking up. “It’s possible they will unfreeze some of that money in Q3 and Q4,” he said.

While it’s early, one media buyer says that some upfront buys—know as “holds”—have been finalized to become “orders.” The buyer says there’s been no real “breakage” to speak of, meaning the advertisers haven’t cut their upfront orders. Some have added dollars to their upfront orders. “There’s probably more being added than cut overall, but nothing too different than what we’ve seen in the past,” the buyer said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.