PwC’s Tips for Dealing With Video Fragmentation

As the video world fragments, a new report from PwC identifies five consumer segments and offers recommendations for remaining relevant to them.

PwC found that cord-cutting continues, with only 67% of consumers subscribing to pay-TV, down from 73% in 2017 and 77% in 2916.

The cord-cutter are coming from all generations, with behavior of younger and older viewers converging. In its survey 28% of older consumer have cut the cord, up from 19% in 2017.

At the same time there a small but growing group of consumers that say their in a “committed relationship” with their pay-TV provider. Those consumer represent 19% of PwC’s respondents, up from 17% last year.

Navigation continues to be a problem as video services proliferate and the amount of content they offer mushrooms. Only 12% of those surveyed says they’re are able to find content on streaming platforms easily.

“Video consumption has never been more fragmented. Viewers can use a dizzying array of services to create their own consumption ‘nirvana,’” the report says. “However, there is bound to be an upper limit on both how many different services a consumer is willing to pay for, and how much time she has in the day to consume it. This leads some in the industry to believe the growth in content and platforms may not be sustainable over the long term.”

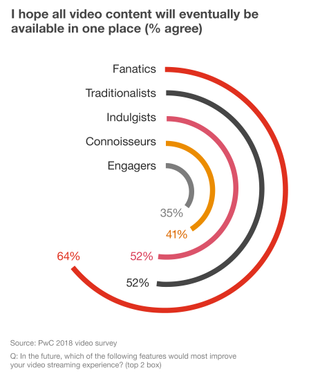

PwC broke down consumers into five segments. It said each segment spends between $18 billion and $24 billion on video. Ranked from biggest spenders on video to the smallest spenders, they are called Indulgists, Traditionalists, Engagers, Fanatics and Connoisseurs. Engagers and Connoisseurs have the highest annual household incomes.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Each group has its own set of preferences. For example, the Indulgists want the latest gadgets and premium content and are willing to pay for it.

Engagers are more likely to be gamers than satisfied by sitting back and being entertained. They look ahead to virtual reality experiences and like to post on social media about shows they watch.

Fanatics demand access to big libraries of content wherever and whenever they want it. They are more likely to be cord-cutter while subscribing to several streaming services at one time. They binge watch but hope someday they can get all their content in one place.

Connoisseurs are picking about what they watch and want to see more educational and diverse content.

Traditionalists spend the most on video content and want predictability, ease and comfort while watching. While this group is least likely to access video content online, PwC expects this group to shrink over time as content online and on app becomes more common.

For networks and other video providers to remain relevant, PwC offers eight recommendations:

- Know your audience and target intentionally.

- Personalize and target content for each segment.

- Don’t let search be a liability

- Deploy AI to improve recommendations

- Encourage second-screen engagement.

- Reinvent storytelling with branded content.

- Go Global and offer more foreign language programming.

- Develop immersive experiences.

PwC said it surveyed 2,016 American adults with annual household incomes of $40,000 or more in October 2018. It also conducted focus groups of consumers and industry insiders.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.