OTT Closes Penetration Gap With Pay TV

Over-the-top video and traditional pay TV services are peers in more ways than one.

Offering a deeper view into how OTT is affecting the TV business, a new study from multiscreen-video technology company Clearleap found that the penetration of streaming services is “on par” with traditional cable TV service.

Some 78.5% of respondents to the July online survey of 1,111 U.S. consumers 18 or older said they subscribed to cable, while 71.37% said they currently use or had once used a streaming service.

Unsurprisingly, 70.32% of millennials surveyed used a streaming service, versus 64.41% who subscribed to cable. Just more than a quarter of the demographic (26.48%) has never subscribed to a pay TV service.

The study also looked at streaming services that are resonating with consumers, and found results that mirror subscription levels. About 83% of those surveyed said they’ve used Netflix, followed by Amazon Prime Instant Video (38%), Hulu (22%), HBO Now (7%), CBS All ccess (2%) and Sling TV (2%).

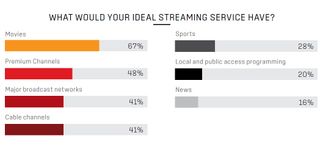

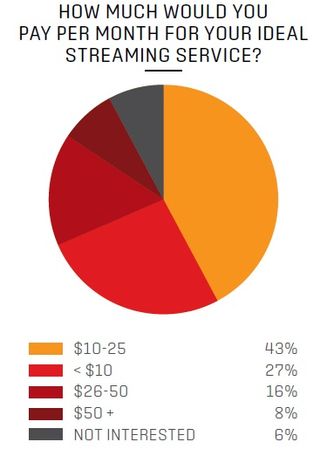

Clearleap’s survey also shed light on which content genres would make up a consumer’s “ideal” streaming service. Movies were tops, followed closely by premium channels, broadcast channels and cable channels. As for how much respondents woud be willing to pay for that ultimate streaming service, the sweet spot is in the range of $10 to $25 per month.

Those two areas — content and price — fit snugly with elements that are most important to consumers when picking a streaming service.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

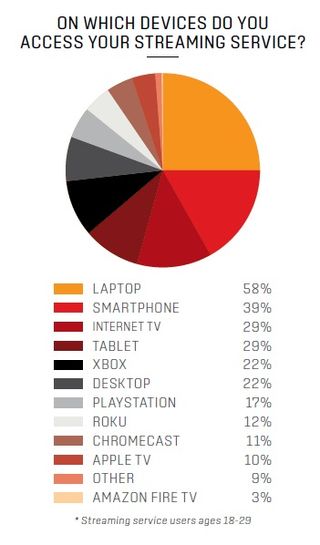

Among devices, laptops (58%) were the most popular platform used to receive a streaming service, followed by smartphones and a slew of TV-connected OTT platforms.

Given the “endless parade of streaming service announcements from incumbents and upstarts alike, OTT is changing the game,” Clearleap noted in the study. “Couple that with declining cable subscriptions and a growing preference for binge-watching, and 2015 will go down in history as a critical year for streaming service adoption.”