Original Programming Costs Raise Concern

The new golden age of television may be enriching viewers, but some Wall Street analysts are concerned it might leave the industry with less green in its pockets. More original programming— especially premium scripted fare— is showing up in more places. On broadcast networks in the summer. On cable networks most people have never heard of. Online with Yahoo, Sony’s Crackle and others. And particularly on streaming video services such as Amazon Prime, Hulu Plus and Netflix, which this month picked up a Golden Globe for its House of Cards star Robin Wright.

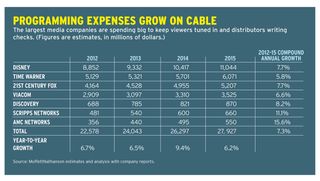

It is simple economics: When demand goes up, price goes up. It’s true for pork bellies and it’s true for programming. Analysts, who loathe rising costs as much as Homer Simpson’s billionaire boss Montgomery Burns does are worrying that earnings could be impacted and profit margins could narrow, making media companies less attractive investments.

In recent years, original programming has been a great investment, helping cable nets build brands, add distribution and attract advertisers. Just ask AMC what Mad Men, Breaking Bad and The Walking Dead have done for its business. If the industry is approaching a point of diminishing returns on programming, a new strategy is needed, to say the least.

Industry executives acknowledge that their world is becoming more competitive, but rather than focus on cost, they say there are also more ways than ever to monetize high-quality content, so they’re not panicking. At least not yet.

In a Jan. 8 report, MoffettNathanson Research analyst Michael Nathanson surveyed a landscape in which measured viewing was flat, creating a zero-sum game in which one channel’s audience gain came out of some other network’s Nielsens.

“We are witnessing an arms race in original content,” Nathanson wrote. “The hunger for ratings growth will lead to increased programming/marketing costs in 2014 (including some healthy step-ups in new sports contracts) and great audience volatility which could pressure network margins.”

Nathanson added that, “the drive to source more original content will help TV studios near-term, but raises questions about longer-term, back-end values.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

A day later, Todd Juenger, senior analyst at Sanford C. Bernstein, sent out a report headlined: “U.S. Media: The Golden Age of TV? Quantity of Original Content Is Skyrocketing (But So Are Programming Costs).”

In his report, Juenger said that 9,165 hours of original grown-up content was available to U.S. basic cable subscribers in primetime from the programming companies in his coverage universe, plus NBC broadcast, from January to November 2013, up 565 hours or 6.5% from the prior year.

“The competition to attract TV audiences is more intense than ever, and growing,” Juenger wrote, explaining the leap in original programming.

“Reruns rarely work anymore (with the peculiar exception of The Big Bang Theory) in a world that includes hundreds of linear networks, DVRs, VOD, SVOD and online video (not to mention gaming, social media, streaming music and other entertainment options). Broadcast networks have all moved to yearround original, scripted programming. Cable nets have moved from primarily relying on off-network syndication, to primarily relying on originals of their own (and less reruns of their own originals),” Juenger wrote.

The climate might create new financial consequences. “While there is evidence this increased investment is starting to pressure margins of the networks, it is not yet negatively impacting absolute profitability,” Juenger said. “Broadcast networks recoup their investment from syndication (SVOD and international). Cable networks recoup their investment from market share gains (domestic and international). But not everybody can win forever,” he concluded.

TV executives confirm that programming is becoming a bigger expense. “Our costs have already been expensive, but I’d say that the rising costs to a large degree have not just been due to competition but consumer expectations,” said Kevin Reilly, chairman of Fox Entertainment. “That’s been a slow creep for a long time, particularly on the drama front with the level of quality and execution that’s expected.”

Reilly thinks costs have risen more steeply for shows on cable, which used to have lower production budgets than broadcast. “Right now, it is a great time to be a supplier with these various outlets to supply,” he said. On the other hand, he added, “It is a challenging time for any network, not only broadcast, to run a linear service.”

Last year, according to Fox, the series the network ordered for the 2013-14 season represented the biggest investment in programming and marketing in its history, and it will invest $150 million more this year, primarily to acquire and support new series as it aims to air original programming nearly all year long.

Reilly said the more intense competition drove costs higher. “There’s no question on the drama front this year, this was the first time where demand was outstripping supply,” he said. “This fall, with the amount of dramas that were being produced, between cable, broadcast and SVOD subscription services, if you could push a pen, you were employed.”

The SVOD players also aren’t putting away their checkbooks. Netflix said it plans to double its original programming spending in 2014 from an estimated $150 million in 2013. Hulu acknowledged it plans to double the 20 originals it launched in 2013 over the next few years.

During the TCA Winter Press Tour on Jan. 15, CBS Entertainment president Nina Tassler stressed the upside of investing in originals. “It is building an economic model about a title, around a title, something that has value, and creating a financial structure that allows you to produce that kind of programming. And ultimately, it’s good for all of us to have more original programming on the air.”

It’s not only viewers who prefer networks with original programming. Cable operators and other distributors pay for it with higher subscriber fees, and advertisers respond by backing networks that add original content and paying higher rates.

“There’s no question original programming at some point becomes more expensive than acquired product and the old movie library and there’s a question of valuation of how it fits into your overall portfolio,” said David Levy, president of Turner Broadcasting.

Levy noted that the price for quality acquired offnet programming has gone up, as have sports rights, a big part of programming budgets for networks that decide to enter that arena.

“Each network is different and unique, but I will say this: With original programming comes new opportunities as well to monetize this content,” Levy said.

Networks can produce shows themselves or structure a deal with a studio, giving them opportunities to collect revenue generated by programming beyond selling spots to advertisers. There’s money in digital distribution, international distribution and SVOD.

Golden Goose Chase

The competition for original shows also puts a premium on having strong personnel. “We’re all out there looking for unscripted, we’re all out there looking for originals, and hopefully we get to the golden goose maybe faster than the next guy,” Levy said.

In order to control programming costs and cash in on the back-end revenue that the shows on their schedules generate, the broadcast networks started buying an increasing share of their programming from studios owned by their parent companies.

Some cable networks have also set up studios to produce programming, most recently A+E Networks.

“What I have been asked to do is help us evolve our overall content strategy,” said Bob DeBitetto, president, brand strategy, business development and A+E Studios. “What you really need to worry about is an environment where costs are going up and performance is going down. What we are trying to do is manage both ends to the extent that we can.”

DeBitetto said one of A+E’s key objectives with the studio is to own and control more of the premium scripted content that it airs.

A+E’s History scored with historical drama Vikings and A&E Network renewed the Psycho prequel series Bates Hotel. “These kinds of shows are critical to our brands and to our business. And with the growth of non-linear consumption across all these platforms, and how well these shows work on those platforms, that’s only going to be more true down the road, not less true,” DeBitetto said. “Programming costs do continue to rise, although the rate of increase seems to be leveling off a little bit.”

Most of the programming aired by A+E’s networks is of the nonscripted variety. “Nonfiction is obviously very much in demand,” DeBitetto said. “I think we see cost escalation, but manageable cost escalation.”

One way A+E is looking to manage costs is through joint ventures and other partnerships.

“On the scripted side of things, it’s a very different dynamic and yes, there are all kinds of pressures that are at play because there has recently been a real escalating demand for premium scripted content,” DeBitetto said.

Granted, owning content requires more of an investment upfront, but, said DeBitetto, “What we have found—and maybe Wall Street can take some solace in it—is that at the end of the day we actually think the economics are better for us. We actually expect, over time, earnings to improve, if you’re looking at our original scripted offerings versus the old license model.

“We think this is a great response to a concern about rising costs because it might require some marginal upfront investments, but we think it will actually contribute to our margin in scripted over time,” DeBitetto said.

Tapping other revenue sources is crucial at a time when on-demand viewing is eating into ratings and ad revenue.

“The biggest challenge I think we face is lost ad sales revenue,” John Landgraf, president of FX Networks and FX Productions, said last week at the Television Critics Association Press Tour. Landgraf said that because of DVR use and commercial skipping, FX loses about 40% of the ad revenue potential for a show such as Sons of Anarchy, which is watched by 5 million viewers, only 2 million of whom watch the commercials. “That’s a lot of lost revenue for a show that’s very expensive to make,” he said. FX hopes to makes up some of those losses with its non-linear service FXNow.

An Eye on the Back-End

In addition to worrying about the cost of programming, Nathanson expresses concern about the future value of content’s back-end.

“Given the robust demand for original content, it would be safe to say that this is a great time to be in the TV studios and production business,” he said. “However, we are witnessing an increasingly complicated TV studio profit cycle where near-term profitability might be boosted by the demand for more original fare but longer-term questions arise given the untested waters of the syndication value impact after selling to SVOD players.”

Nathanson also said the value of the back-end could shift as current buyers, such as basic cable networks, increasingly program their own originals. That could leave an increasingly picky Netflix as the sole buyer. “History has shown that there is limited buyer interest from existing cable networks in competitor’s product. Again, Netflix appears to be in the pole position,” he said.

But Ken Werner, president, Warner Bros Domestic Television Distribution said content has a longer lifespan in the new environment. “It may sound counterintuitive because the press writes so much about original programming, but the evidence is quite clear that every distribution model needs pre-existing successful content to work,” Werner said. These shows may not draw the huge audiences they did when they were new, but there are enough viewers to build a small business.

“It’s not surprising that with more choice and everything everywhere that one’s ability to attract large numbers of people is more challenged,” Werner said. “It’s healthy for the ecosystem, but certainly creates pressure and other opportunities.”

Media stocks scored big-time in 2013, with all the larger ones outperforming the Standard & Poor’s 500, Nathanson noted. In October, when he joined MoffettNathanson, he rated the industry “neutral” as an investment, noting concerns over its overdependence on SVOD dollars, weaker syndication pipelines, negative Pay TV household formation and changing TV consumption patterns. Since then, he says, the media sector has been treading water, with only four of the eight traditional media stocks he follows beating the S&P 500.

“We believe that investors in 2014 will begin to be more focused on the sustainable drivers of media models and will narrow their interest to companies that have reinvested for long-term growth (such as Disney) and away from models that are overly reliant on domestic advertising dollars and domestic SVOD/traditional syndication sales,” Nathanson said.

Of course, concern over programming costs is not the only view on Wall Street.

“I don’t have this empirical data that shows broadly that programming expenses are really ramping across the industry,” said David Bank, managing director at RBC Capital Markets. “I think we’re seeing things that are somewhat anecdotal and somewhat specific.”

He points to CBS’ summer programming as an example. While the network’s spending on programming is up, CBS made deals with Amazon and international distributors that ensured last summer’s hit Under the Dome was profitable even before it aired. When it turned out to be a hit, CBS posted huge earnings for the third quarter. “The bigger issue to me in this new golden age of media is the content monetization opportunities are greater,” Bank said.

“So yes, you could argue that the cost of content is going up. And oh, by the way, there’s only so many people in Hollywood that can do this stuff. There are more distribution outlets trying to do it and that’s putting pressure on costs,” he added. “But if I can distribute it internationally, if I can distribute it through traditional syndication, cable, broadcast, if I can sell it to SVOD distribution, if I could distribute it in all these fashions, there is the ability to drive real operating leverage in a positive way and make the investment pay off.”

The Hours Are Up, The Margins Are Down

Time Warner, Scripps exceptions to trend

Nearly all of the big media companies significantly increased the number of original program hours they aired in 2013, according to Todd Juenger, analyst at Sanford C. Bernstein.

The biggest increase in original programming hours came at AMC Networks, home of top-rated The Walking Dead, and Discovery Communications. AMC was up 22%, with most of the increase at its flagship network. Similarly, Discovery was up 17%, with Discovery Channel showing a 31% gain.

The exceptions were Viacom and Scripps Networks Interactive.

Scripps had fewer original hours at HGTV, but appeared to be trying to bolster its Food and Travel channels by pumping up new programming.

Among the broadcasters, CBS was up 11%, NBC rose 8% and ABC was up 4%. Original programming hours dropped 4% at Fox and 3% at the CW.

Original programming hours also dropped at the kids’ networks.

Juenger said that at companies where original programming hours rose, network margins decreased. Margins dropped at AMC, Discovery, Walt Disney Co. and CBS.

Time Warner was the only network owner to have a significant increase in original hours—excluding kids— while increasing margins.

On the other side of the coin, Scripps Networks’ margins went down even as original hours declined.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.