In the Nick of Time, Kids Market Gets Rolling

With market leader Nickelodeon apparently stable after bouncing back from a shocking plunge in 2011, kids’ networks head into the upfront looking for fresh ad dollars by targeting moms.

Nick’s ratings angst was still the focus of the market last year. But SpongeBob SquarePants and Dora the Explorer now seem rejuvenated, and buyers say the traditional kids business has steadied, with upfront spending ringing in at just under $900 million.

“I wouldn’t say there’s been any sweeping changes in terms of advertiser categories that are heavy in or pulling out,” says Darcy Bowe, VP, director, video at media agency Starcom. “Consistency has been the name of the game, year over year, in dollar demand, scatter activity and players in the marketplace.”

While kids increasingly turning to digital devices to entertain themselves has caused concern, this year most of the players in the kids market are also offering clients opportunities to follow kids viewing online, selling ads on websites and mobile apps.

But kids’ networks say they are seeing growth from advertisers looking for family viewing. “The kids market is really becoming a kids-and-family market,” says Jim Perry, head of sales for the Nickelodeon Group. “We continue to do business with folks that were not talking to kids in years past.”

Perry says retail business is up 20% and that Nick has 12 retailers on its roster, and not only Toys R Us and Target during the holidays. he adds Nick is doing business with five insurance companies and 12 automakers including Toyota, which has a SpongeBob car for the first time.

“We’re finding ourselves working with more and more people in traditionally adult categories,” Perry says.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Nick’s Knack

The company shook up management at the network, putting programming under Russell Hicks, ramping up spending and accelerating development.

Some rivals say Nickelodeon’s stumble led to a shift in kids ad dollars in the market.

“They had a little crack in their armor last year. We definitely saw a huge benefit in that,” says Donna Speciale, president for Turner entertainment & young adult ad sales.

While the non-commercial Disney Channel challenges Nick for most kids viewers, Nick was able to regain its dominant position in terms of kids gross ratings points for advertisers, and business is pretty much back to normal. “They were about as humble as they can be, which is not very,” one buyer says.

“I think overall, there was no significant shift at all,” says Nickelodeon’s Perry. “We’ve been doing business for so long and have such great relationships and partnerships that go beyond just ratings. They’re all about content, integrated marketing and licensing to a large extent. So it’s hard to know if there was some minor shifting going on. But for the most part we held our own, and everyone stuck by us.”

“They certainly have rebounded in terms of coming back from whatever it was that happened a couple of year ago,” says Bowe. “They’ve encouraged viewership with new episodes. They seem to be on the right track.”

Nickelodeon will hold its upfront presentation for advertisers in New York on March 13.

“It feels good to have a positive story to tell. All the moves we made throughout the year have really worked,” says Perry.

Some of Nick’s new shows have helped, but the network’s mainstays SpongeBob and Dora the Explorer have been refreshed and have bounced back. “Everybody loves them both,” Perry says. “We’re reinvigorating these properties. Dora and Friends is a new show we’re coming out with, and there’s a new SpongeBob movie coming out of Paramount in 2015.”

Nickelodeon’s message to advertisers will be simple: “What we’re going to continue to do is sell video across all of our screens,” Perry says. “Everyone is very interested in what’s going on in the media landscape for kids and how they can follow eyeballs. TV certainly remains king in that regard, but our apps have all done very well. We’ve got over 7 million downloads, and they’ve been really additive to the digital video we bring to the market.”

Disney Dynamic

For Disney, ratings have grown on the strength of new franchises, and the company has been able to cash in even though Disney Channel and Disney Jr. do not air commercials.

“We’ve been fortunate over the last couple of years that the growth in the sponsorship model on both Disney Channel and Disney Jr. has been outstanding,” says Rita Ferro, executive VP at Disney media sales and marketing. “Clients understand the value of those properties.”

Ferro says the key to Disney’s upfront is getting marketers to become sponsors of Disney Channel original movies. In the past, titles such as High School Musical and Teen Beach Movie have been big hits, and the network has three scheduled for the upcoming season: Zapped, How to Build a Better Boy and Descendants. “We already have partners signed up,” Ferro says.

Disney is also seeing business from nontraditional kids advertisers looking to reach moms and families. “We continue to talk to the categories that are always with us: toys, video games, movie studios, tablets. But what you’re starting to see is moms are spending a lot of time as the adult in charge of family entertainment in their household. And family time spent together—according to all the research we’re seeing—is what kids value the most, it’s what moms value the most and how they come together to really experience that,” Ferro says.

“We’re really focused on how do we break and expand other categories, and we’ve had some success this year in auto, retail, packaged goods and the hospitality area,” Ferro adds. Sponsors for Disney movies include Honda, Best Western, Subway and Nabi, a tablet for youngsters. Other non-traditional Disney sponsors include Johnson & Johnson, P&G Oral and tablet company Fuhu.

Another growing tentpole for Disney is its Radio Disney Awards, which this year has a TV home on Disney Channel. Sponsors already on board include Duck Tape, Embassy Suites, Geico and Arm & Hammer. Ferro says two more are on the way. Sponsorships such as Duck Tape’s tend to stick well as Disney integrates them into events. For example, one of Radio Disney’s DJs is expected to arrive on the event’s red carpet wearing a dress made of Duck Tape duct tape.

The sponsors do have an opportunity to run traditional spots on the various Watch apps, which are ad-supported and provide opportunities for integrations and gaming.

Disney also sells commercials on its Disney XD network, which will benefit from two prominent Disney acquisitions as the TV home for Marvel animation and the new series Star Wars Rebels.

Cartoon Changes

Last month, Turner Broadcasting announced changes it was making in its kids portfolio. Cartoon Network will stop airing at 8 p.m., leading into Adult Swim. And the classic cartoon channel Boomerang will become more commercial.

Cutting back doesn’t mean less of a commitment to the kids business. The network will be creating more original online content. “Cartoon Network does amazing in the digital space,” says Turner’s Speciale. “Kids’ behavior is skewing toward digital. It makes a lot of sense for us to combine [linear and digital] and look at a multiscreen approach.

“I think it’s a kids’ marketplace— holistic, digital, linear. It’s one holistic environment, and that’s how kids see it,” Speciale adds.

Boomerang will give Turner a better shot at monetizing family viewing. “Cartoon Network is an amazing network, and does it very well with boys,” Speciale says. “And there’s some co-viewing. But Boomerang—given the programming and the content that Boomerang has—does very well with family. So it’s now a much more well-rounded kids conversation that we can have with both of our brands.”

Turner will be experimenting with the commercial format on Boomerang. “We’ve all been complaining that the commercial load has been a little heavy. And sometimes we know it’s hard to go backwards,” Speciale says. “So the goal is now we have a fresh network that has never had it before, so we’re being very innovative with our partners in creating an experience.”

Speciale adds there will be 30-second spots on the network, but “it’s not going to be the traditional commercial load, that you might see long-form, you might see sponsorships, it’s not going to be one-size-fits-all. Movie studios may want to have creative be one way, toy companies might want to have their creative and their messaging be another way. We’re early enough in the stage of being able to really play with it. We have time to try to do it the right way.”

Last year, Cartoon Network opted not to do a big upfront presentation and instead held top-level individual meetings with its clients. It has begun doing that again this year.

“We’ve had some really great dialogues with our clients,” Speciale says. “The clients are really loving the direction we’re going to in the kids and young adults space.”

All in the Family

Sprout, launched in 2005 as a joint venture by Comcast, last year became wholly owned by NBCUniversal. “The company is really all in now. Now that we’re fully owned we really feel the embrace of the company,” says Sandy Wax, Sprout president. Sprout’s ads are being sold by NBCU’s lifestyle network ad sales group, headed by executive VP Laura Molen, which pitches networks including Bravo, E, Oxygen and Esquire all at once. “The idea is that if they’re talking to P&G about a deal with Oxygen, Sprout’s in that conversation too. It’s actually a much more integrated sales approach for Sprout,” says Wax. “You’re meeting with more clients and higher-caliber clients across the board and you can cover more bases with the team.”

With its preschool audience, Sprout aims advertising at parents. “Last year we rolled out a trade positioning: Sprout Is Made for Moms. That’s our little secret. We don’t tell the kids that,” Wax says. “What’s important is the mindset of moms. There are young women watching Bravo or Oxygen also. But when they’re watching Sprout, they’re in that ‘is that right for my kids and family’ mindset. You can reach women on multiple networks, but on Sprout they have that mom hat on.”

Another change at Sprout is a push for original programming. Sprout in January announced its first fully funded animated series, Little Nina, which looks at the childhood of the host of the network’s Good Night Show.

Another kids’ network, The Hub, owned by Discovery Communications and toy company Hasbro, said it was not ready to discuss its upfront plans.

SIGNS POINT TO SOLID MARKET

Sales execs at kids’ nets know it’s early, but the market looks strong.

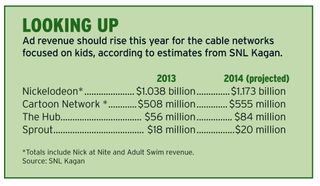

“I think it’s going to be somewhat steady and healthy,” says Donna Speciale, president of Turner entertainment & young adult ad sales. “The market tends to have a lot to do with where studios’ spend is, and if you recall 2013, there was a lot of success in the kids animation area. So I think we’re going to start seeing some increases in the animation and the family viewing studio business, which I think will help maintain the kids’ marketplace for 2014 and ‘15.”

“We had a great upfront last year. The scatter marketplace has been strong in the kids space, which is exciting to see. And we’re rounding up nicely for the upfronts,” says Rita Ferro, executive VP at Disney media sales and marketing.

“Let’s just say, we have a very high bar in this upfront,” says Sprout president Sandy Wax. Last year, ad revenue was up by double digits. “We got a lot of quality advertisers. There’s a bit more retain on Sprout, a lot of kids’ learning product. It’s really been successful.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.