New Ad Execs Create Advantage at Expanding Tennis Channel

WHY THIS MATTERS With a boost from owner Sinclair Broadcast Group, Tennis Channel is expanding its revenue-generating activities.

Once an independent junior, Tennis Channel has become a big league outfit.

Since it was acquired by powerful but controversial Sinclair Broadcast Group for $350 million two years ago, the network had increased its cable distribution from 30 million to 60 million homes. And it has added website tennis.com and Tennis magazine to a portfolio that also includes a strong TV everywhere and direct-to-consumer component.

Now, Tennis Channel is looking to monetize its viewership growth by adding senior people to its growing advertising sales department.

“We are at this moment,” Tennis Channel CEO Ken Solomon said. “There’s distribution. There’s ratings. There’s awareness. We’ve rolled up the rights.

“We’ve got all this stuff in place. We’ve got the platforms lined up. You know you’re doing well when you’re spending all your money hiring good salespeople, and they’re coming.”

Allison Bodenmann, head of ad sales at Tennis Channel, says her department has increased by more than 50% to 30 staffers in the last couple of years.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The network recently added Irv Schulman, an ABC veteran, as senior VP, national sales manager, and Marisusan Trout from Warner Bros. and Hallmark Channel, as senior VP, ad sales. It also hired Christina Tesauro from Disney/ABC as account executive, ad sales.

According to Bodenmann, Schulman will help manage the sales team and also aid in casting a wider net in terms of the clients Tennis Channel is pitching. “He’s a huge tennis fan, so he’s very excited,” she said.

Trout will manage Tennis Channel’s sales operations in Los Angeles, Bodenmann said, adding that the network is also in the process of bringing in a senior level digital salesperson.

Revenue Renewal

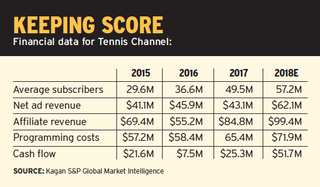

Advertising revenues for Tennis Channel were $45.9 million in 2016, according to media research company Kagan, a division of S&P Global Market Intelligence. Ad revenue slipped to $43.1 million in 2017, but Kagan expects to see a jump to $62.1 million in 2018.

“It is so difficult for an independently owned network to survive, let alone thrive,” Kagan senior analyst Derek Baine said. Since the acquisition, he said, Tennis Channel’s financials have dramatically turned around (see chart). “The massive retransmission leverage Sinclair has is definitely working wonders.”

With more distribution, the quality of the Tennis Channel viewer almost sells itself.

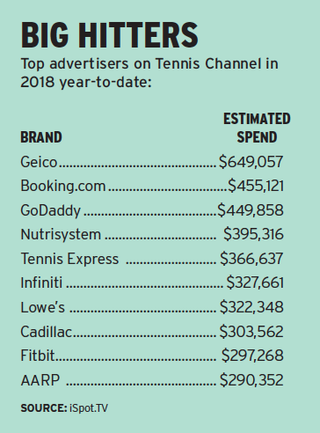

“The audience is just premium,” Bodenmann said. “They’re light TV viewers, they’re upscale, they spend a lot of money. It’s interesting that for a few years, we would actually have people say you guys are too upscale for us. But I think we’ve convinced people that our audience buys a lot of stuff. It really doesn’t have to be a $75,000 car. It could also be Colgate toothpaste.”

Live sports are attractive to advertisers as more viewing goes on-demand. And because of the nature of the game, tennis matches have room for the short commercial breaks that are becoming more and more popular.

All that will get discussed now that Tennis Channel has begun its upfront season. It held a cocktail party where clients and buyers could play pingpong in late February and is now in the process of holding about 70 smaller meetings with media agency account groups.

While it always discouraged clients from cherry-picking its Grand Slam events, Bodenmann said she’s rolling out a more formal tentpole strategy this season.

Seasonal Sales Approach

The network has broken up the year into seven seasons, such as clay court season including the French Open and tournaments leading up to it in April and May; grass court season, including Wimbledon in June and July; and hard court season, including the U.S. Open, July through September.

Grass court and clay court seasons — and the attendant stains that get on players’ clothes — attracted advertisers such as Clorox and washing machine maker Samsung. “We’ve done some fun things with that in terms of integrations and live reads,” Bodenmann said.

Tennis Channel also put together a “smile of the match” program during its recent coverage of the Indian Wells tournament for a new whitening toothpaste from Colgate. That campaign will be running throughout the year, Bodenmann said.

Starting this year, Tennis Channel will be selling the ads on its TV everywhere service — Tennis Everywhere — separately using dynamic ad insertion. And while the over-the-top streaming subscription service Tennis Channel Plus will remain commercial-free, a deal could be made to have an overarching sponsor for the service.

The network is also looking to put together more crossplatform packages for advertisers, including its digital and print assets.

“I think everyone’s really excited about selling across all those different platforms,” Bodenmann said. “It changes the kind of sale that we do. We’ve obviously focused on broadcast buyers, but if you’re selling multiplatform properties, you really need to get in front of clients and planning groups as well, and I think you need a bigger team to be able to get out and see all of those people. That’s what our new challenges are, but they’re all fun challenges.”

Managing the Scale Game

Solomon said Tennis Channel’s biggest challenge right now is “managing massive scaling, and I say this with humility.”

From its early days, Solomon said Tennis Channel wasn’t designed as just a cable network. That design has proved prescient as the TV business has changed, with the decline in traditional pay TV subscribers, the growth in over-the-top viewing and the rise in subscription services.

But as an independent, it was difficult for Tennis Channel to get the scale it needed to stay in the game.

Solomon forged a relationship with Sinclair when he was in his mid-20s with Paramount, selling stations syndicated shows such as Star Trek and Happy Days. “I’ve known them ever since,” he said, including a stretch when he was head of distribution for Fox and they fought over affiliate issues. “But we remained friends,” he said.

Needless to say, Sinclair has become better-known as it has grown. It has acquired its way into being the biggest owner of TV stations in the U.S. and has gained notoriety for the conservative “must-run” segments it airs on its newscasts.

With Tennis Channel, Solomon said, Sinclair was a uniquely good fit because it wasn’t in the national programming business but its size as a station group meant leverage with distributors. Sinclair has also been able to provide help by creating business models and by offering technology.

“What we went through was legendary,” Solomon said. “All we needed was to have the playing field leveled a little bit. And the only reason we didn’t die is because it was actually a great idea and there was this unique value proposition that the people at Sinclair saw.”

Sinclair’s stations also benefit from the connection. “Every town has a tennis court and its high school has a team,” Solomon noted. More to the point, when a tournament appears in a market, the local Sinclair station can take advantage. Some are airing or streaming a weekly segment called “Love 30.” During a recent tournament in Charleston, S.C., the Sinclair station plugged in, doing its morning show at the stadium with the network supplying players and commentators. In Washington, D.C., Sinclair’s WJLA simulcast the men’s and women’s finals of an area tournament. It goes without saying that there are local sponsorship opportunities for Tennis Channel advertisers, Solomon notes.

Growing Fan Base

As a sport, tennis has been growing more popular. According to a Nielsen survey 36% of Americans, or 117 million people, are interested in tennis, up 50% from 2012, when 75 million Americans said they were interested in the game.

But Solomon said that the nature of the sport meant only a fraction of its tournaments and matches could be seen by television viewers — until now, with the growth of digital and over-the-top streaming.

“We rolled up the sport: 95% of it wasn’t on television and we got that 95% and then we got the other 5% in some form, either live or immediately following live. We’ve got the rights to the real stuff all the time, not the leftovers,” Solomon said.

But at a time when some media companies are seekking content to launch direct-to-consumer streaming products, tennis provides a surplus of content.

“We needed second, third, fourth, fifth linearly programmed channels at certain times because in Paris there are over 20 courts going at the same time. The technology finally caught up with our sport,” he said.

Tennis Channel has been an early mover in terms of technology. For a tiny network it was one of the first to launch an HD feed. While the balls still appeared fuzzy, viewers were able to zero in on the players and their emotions as they played their kill-or-be killed matches.

It was also among the first TV everywhere networks, which meant fans weren’t stuck at home waiting for their favorite players’ matches to start or finish.

In January, the Tennis Channel app was re-launched and on March 8, during the Indian Wells tournament, it was the second-highest grossing sports app on Apple TV. The app was among the first to provide access to both the network’s TV everywhere service and Tennis Channel Plus, the $90-peryear subscription service.

Tennis Channel Plus added 20 tournaments in February after the network signed an expanded rights agreement with ATP. The network says revenue for Tennis Channel Plus was up 26% in March from a year ago.

While not providing precise numbers, Solomon said Tennis Channel Plus has subscribers in the tens of thousands. At that $90 a pop per year, he said, that’s “a nice business” when combined with the rest of the network’s platforms.

Solomon said that a specialty network such as Tennis Channel might be a better fit for the subscription model than a channel offering “all you can eat” of a bunch of different sports.

“People come here because they know exactly what they want and they want more,” he said. “And we’re able to show them Juan Martin del Potro in an early round and all of a sudden they go, ‘That guy’s amazing.’ And we go, great, get TC+ you can watch more of his matches because we’ve got to show you Rafael Nadal and Maria Sharapova right now.”

Going forward, Solomon said, Tennis Channel is working to activate its social media apparatus. It generated a billion social impressions during the recent Desert Smash pro-celebrity tournament. “So there’s some scale there. Now it’s time to monetize.”

The network is also thinking about commerce, from selling tennis equipment to working with players to serve up online lessons or other types of content. Booking travel is also an attractive opportunity because the network’s affluent viewers are frequent flyers.

“In a way, we really are just getting started and it’s almost unlimited because we know what we are and we know [tennis] is something that’s not going away,” Solomon said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.