Multicasting Goes Multicultural

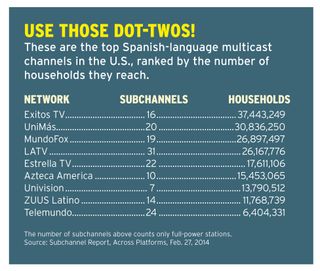

Just as niche cable channels sprung up in the wake of a maturing broadcast network landscape decades ago, a burgeoning batch of Spanish-language multicast networks are taking root as the likes of their big, broad network counterparts, Univision and Telemundo, entrench themselves in the American mainstream.

The array of digital networks, from general entertainment to religious to music, often counterprogram the major nets and provide Hispanic viewers—and the marketers intent on reaching them—with more content than ever. “We’ve never had this many choices, and choice is always good,” says Lia Silkworth, executive VP and managing director at Tapestry/Starcom Mediavest Group, noting how much easier it is for clients to send the right message to the right viewer amid the narrow-casting landscape.

The growth of Spanish-language multicast options is substantial, with Estrella TV and MundoFox among the high-profile nets finding distribution partners to air their slick programming at a healthy clip. There were 164 individual multicast signals distributing Spanishlanguage programming in 2011, according to BIA/Kelsey, and it jumped to 365 in 2013—led by V-me (93 signals nationwide), Enlace Spanish (33) and Estrella TV and LATV (26), along with network giants such as Telemundo, which appears on 44 broadcast subchannels.

The non-Spanish-language diginet fold includes increasingly well-established entertainment brands such as Me-TV, Cozi TV, This TV, Antenna TV and Bounce TV. Estimates have the total multicast revenue pie at around $110 million—and they are hardfought dollars. Michael Kokernak, founder and president of multicasting consulting firm AllPlatforms, says there’s actually been a downturn in general audience diginet signups after the initial gold rush. “Everybody came out of the box and got their Me-TV, Antenna TV, etc.,” Kokernak says. “There’s been a deployment slowdown since, and it’s still challenging on the revenue front.”

A Whole New ‘Mundo’

The Hispanic population in the U.S. was 53 million as of July 2012, according to the U.S. Census Bureau, representing 17% of the total population. As the number grows, there remains vast opportunity in the Spanish-language multicast space. The growth is not so much from immigration anymore, says Tapestry’s Silkworth, but the babies born here. The bebés are attractive to one substantial set of advertisers, and they will draw attention from other marketers—telecommunications, automobiles, etc.—at each stage of their lives in America.

The networks—and agencies—are happy to pair them up. “Without a doubt, we’ve seen the [Hispanic TV] marketplace respond to the growth in population,” says Silkworth.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Ibra Morales, former president of the Telemundo station group, saw enough opportunity in the multicast space that he left his position as VP of national marketing at Katz Television Group to head up MundoFox, which Fox launched in 2012 with Colombian giant RCN Television. Morales says he jumped at the chance to be part of a “young network with a tremendous amount of future.”

“I’m always up for a good opportunity,” Morales says. “This is a chance to win, a chance to do something exciting.”

MundoFox has had a somewhat sluggish start out of the blocks as it finds the right mix of programming and affiliate partners. Principals are working with Time Warner Cable to get vital carriage in New York—the network's distribution model includes both broadcast and cable partners, primary channels and subchannels—and move Mundo closer to 70% U.S. clearance and beyond.

“Our goal is to be 100%,” says Morales, whose résumé also includes a senior VP of sales stint at Hearst-Argyle.

Star of the Subchannels

MundoFox will present its programming slate at an upfront presentation May 14. Estrella TV, growing on the backs of Hearst TV stations, among others—including 10 ownedand- operated outlets—takes its turn May 12. Estrella has a unique proposition in that its programming is 80%-90% original, says Lenard Liberman, executive VP. Estrella owns its production facility and keeps costs down by shooting multiple episodes of its stripped shows at once. “Usually it’s renting that kills you,” Liberman says. “We’re very efficient in what we do.”

LATV is scheduled to unveil its lineup and strategy May 1 in New York, playing up its bilingual, bicultural viewers’ 18-49 chops. “We are Latino Alternative— we counterprogram the big networks,” says Luca Bentivoglio, LATV chief operating officer.

More competitors for Hispanic viewers on broadcast and cable makes it a harder fight for eyeballs and ad dollars. Entertainment channel El Rey, backed by Univision and Comcast, made a splashy debut last December. Univision and ABC joined up on the news network Fusion, which launched last October and is filling a niche as CNN pulls the plug on year-old CNN Latino.

Notably, Univision’s subchannels feature English-language networks Bounce TV and vintage film newcomer getTV, suggesting the multicast outlets are counterprogramming the major sister networks.

Telemundo, meanwhile, airs classic telenovelas on the diginet Exitos.

Más Noticias

While they are defined by entertainment fare, the prominent Spanish-language multicast networks are intent on increasing their news offerings. Estrella airs 5:30 p.m. and 10:30 p.m. news, while MundoFox is live at 5 and 10:30. Both hope to add more news; Liberman speaks of debuting local news in the Estrella strongholds of Houston and Dallas, and Morales mentions expanding into weekend early evenings. “As we grow our entertainment and distribution, we will grow news as well,” Morales says. “I think you should give viewers news seven days a week.”

LATV does not do news, but does believe it covers a niche. Launching way back in 2007, the network’s principals, pointing proudly to LATV’s 45 affiliates, have seen other competitors in the multicast world come and go. “We are established in our niche and have a track record,” says Francis Wilkinson, executive VP of distribution. “We’re comfortable in our position.”

Michael Malone, senior content producer at B+C/Multichannel News, covers network programming, including entertainment, news and sports on broadcast, cable and streaming; and local broadcast television. He hosts the podcasts Busted Pilot, about what’s new in television, and Series Business, a chat with the creator of a new program, and writes the column “The Watchman.” He joined B+C in 2005. His journalism has also appeared in The New York Times, The Philadelphia Inquirer, Playboy and New York magazine.