Moonves Touts Sports Betting As Hot Ad Category for CBS

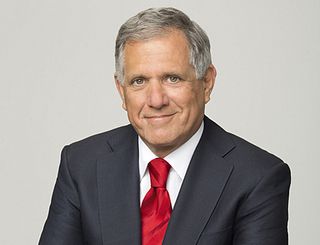

CBS CEO Les Moonves sees sports gambling driving powering big gains in advertising revenue.

Despite questions about his future, Moonves was upbeat during CBS’s second quarter earning call with analysts Thursday, and said that CBS’s relatively new over-the-top service CBS Sports HQ and its Sportline website stand to benefit from gambling ads.

The Supreme Court ruling that ended the ban on sport betting will “create a whole new ad category as well as drive demand across our sports-related content,” he said.

CBS has been reducing how much of its revenue comes from advertising. With the growth of businesses like over-the-top, advertising now accounts for about 38% of CBS’s revenue. But advertising is a growing business, Moonves said, pointing to the recently upfront.

“We had another terrific upfront with healthy demand in daytime, news, primetime and late night. CPMs were up high single to low double digits across dayparts and volume grew as well,” Moonves said.

“Our programming was well received and we sold a number of units for the Super Bowl and the Grammys which we have on back-to-back weekends in the first quarter of 2019,” he said.

“This is also the first time we went into the upfront marketplace with our integrated broadcast and digital sales teams, and the results were significant,” Moonves said. “Digital volume was up nearly 40% and we continue to leverage the power of targeted digital advertising with the huge reach of broadcast TV.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

In the third quarter, scatter market ad price are up more than 20%, he said.

In response to questions from analysts, Moonves said that it was likely that sports betting would start as a local phenomenon. With sports bets being accepted in New Jersey, CBS will see revenue at its Philadelphia station first, then New York.

He noted that the NBA recently made a deal with MGM for gambling and reminded the analysts of the fortune in advertising that Fan Duel and Draft King spent on advertising to popularize their services.

“So we think it’s a category that has an unbelievable upside,” Moonves said. “What that is I don’t know, but because of our local marketplace we’re ready there. The good news is this is also going to help the ratings on all our sports events, so that’s a positive to us.”

He did not provide a figure for how much revenue advertising for sports betting could generate. In a recent report analyst Ben Swinburne of Morgan Stanley estimated that sports betting could generate $1 billion in paid media by 2023, with TV taking in about 75% of that.

CBS could see a 1.5% to 3.1% lift in ad revenue, Swinburne said.

Moonves was asked about possible gambling oriented shoulder programming.

As long as sports better remains local, obviously it will be better to surround it with sports programming and we have such a ton of that between the network and our cable network as well as HQ. So that’s our plan,” he said. “To tell you the truth, we’re not that far down the line in terms shoulder programming or sports betting, but we’re looking forward to it.”

Analysts were told not to ask questions about the published sexual harassment allegations against Moonves and other CBS executives. The CBS board has hired a law firm to investigate the charges.

Nor did they ask about legal action against the Redstone family or a potential combination with Viacom.

It would have been strange not having Moonves on the call signaling he was still running the company. But hearing him on the call also reminded analysts of the odd position the company is in.

“CBS reported 2018 results which were generally unsurprising, if relatively unimportant in light of reporting last week on CEO Les Moonves and the company’s news division,” Brian Wieser of Pivotal Research said in a note Thursday.

“While there are important questions within the industry and among investors related to management succession, how the company is addressing workplace safety, the profitability of CBS News and concerns some advertisers will have, each was unaddressed,” Wieser said.

Wieser criticized CBS’s board for failing to investigate the charges against Moonves before they were published in the New Yorker.

Michael Nathanson of MoffettNathanson Research added that most analysts were no longer focused on CBS’s financial performance.

“The combination of recent sexual harassment charges leveled against CEO Les Moonves and the Board’s ongoing battle vs. National Amusement for control of the company have created overhangs of epic proportions. So, while CBS continues to execute and, in some cases, exceed its strategic plan established during its March 2016 investor day, most investors are not paying attention to the numbers.”

Related: Delaware Judge Shoots Down CBS Request for NAI Restraining Order

Nathanson called CBS “uninvestable.”

“If these accusations are correct, it would be impossible for Les Moonves to continue running the company. It is patently obvious that if Moonves is forced out by the CBS Board on the back of sexual harassment, CBS will be materially weakened by the loss of an irreplaceable programming executive…and the stock should fall further,” Nathanson said.

“It is also clear that the current CBS Board will be wounded if, indeed, a CEO is removed from their watch right after they declared open war on National Amusements’ controlling interest. And, if that happens, there is a chance that National Amusements will start to change the Board, as they did with Viacom’s, with minimal independent shareholder complaint,” Nathanson said.

“Love him or hate him, the common theme here is that Les Moonves has been critically important to both the success of the CBS Network and the CBS Corporation and losing him . . . would be a major negative to the stock. For very different reasons, we have not recommended buying CBS stock in a while and, despite the obvious attractive valuation, see the current trade as dangerous. If we have had an ‘Avoid’ recommendation, we’d use it until the smoke on these two fronts clears.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.