Master Station Consolidator Nexstar Aims to Live Large

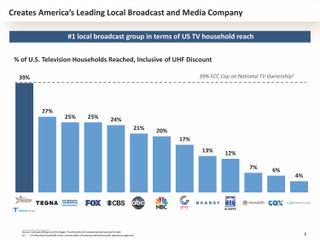

Consolidation of the local TV station market is on again with a vengeance following Nexstar Media Group’s agreement to buy Tribune Media for $6.4 billion, a deal that would create the largest U.S. broadcaster.

In 2017, Tribune agreed to be acquired by Sinclair Broadcast Group for $6 billion, but the government objected to Sinclair’s approach to complying with regulations — there is a public-interest standard that takes the review beyond the letter of the rules.

Though the government played hardball with Sinclair, the station business still sees consolidation as the best way to boost profits from local media operations when core, or nonpolitical, advertising revenues are not growing.

“This transaction highlights Nexstar’s role as the industry’s leading consolidator,” Nexstar chairman and CEO Perry Sook said during a conference call with analysts and investors after the deal was announced. “Our expanded scale, married to our commitment to localism, innovation and growth, has established Nexstar as one of the nation’s leading producers of trustworthy local news and other programming.”

The combined companies would have 216 stations in 118 markets and would generate about $4.6 billion in revenue.

$160M in Savings, Revenue

Nexstar calculates that it can create $160 million in reduced costs and added revenue in the first year after combining with Tribune. There would be a $20 million reduction in corporate overhead, $65 million in cost reductions at the station level and a gain of $75 million in net retransmision revenue as Nexstar applies its rates to Tribune stations. (For more about Tribune’s operations, see Station Group of the Year coverage on page 10.)

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

As part of its plan to comply with regulations, Nexstar expects to divest about $1 billion worth of assets. Of the 118 markets in which the companies have stations, there are overlaps in 15.

“We believe 13 will be subject to some amount of scrutiny,” Nexstar chief financial officer Tom Carter said. “There are two markets where we believe the regs allow us to own two stations outright.”

Fortunately for Nexstar, “we view the market for television divestiture sales as very healthy as we’ve seen private equity emerge in this space, as well as an increasing cast of strategic buyers,” Sook said.

After those sales, Nexstar could be on the prowl for more buys. Analysts asked if Nexstar would be interested in the Cox Media stations reportedly on the block. “If the national ownership cap were to open more we would be interested, but again it would have to be for the right kind of accretive acquisition,” Sook said.

Nexstar has a ready blueprint for trying to get the Tribune deal through the FCC and Justice Department, which is essentially to avoid the problems Sinclair ran into by pushing the envelope in how it chose to spin off its stations or retain them.

Sinclair tried to retain two of the top four stations in some markets, capitalizing on the FCC’s rule change to consider such combos on a case-by-case basis. But while it was within its rights to do so, the optics were bad.

A source familiar with the company’s thinking suggested that Sinclair did not see that as anything more than trying to use the rules on the books to its advantage. But Wall Street watchers scratched their heads over the company’s failure to respond to Justice Department concerns over concentration in ad markets and recraft the deal in a way that would pass muster. That was one of Tribune’s issues in suing Sinclair over the deal’s collapse.

Sinclair also chose to spin off some stations to owners with historic and problematic ties to the company — ties that drew national attention and eventually an FCC rebuke.

Importantly, Nexstar does not carry the political baggage that Sinclair brought with it, the conservative commentary that raised the hackles of opponents already suspicious of “bigger is better.”

Cap Concerns

Chris Ruddy, who runs conservative cable network Newsmax and was a big opponent of Sinclair-Tribune, was not firing at the new deal out of the gate, but signaled he has issues with Nexstar’s position that the FCC should eliminate the 39% cap on national ownership reach.

“We remain committed to the bipartisan consensus that Congress enacted the 39% national cap for good reason: to ensure diversity and competition in local broadcasting,” Ruddy said. “We will have more to say once we analyze this transaction.”

Nexstar will also face blowback from cable operators concerned about retransmission consent hikes due to the so-called after-acquired clauses in contracts that allow Nexstar to raise Tribune retrans fees to Nexstar rates within weeks of the deal closing.

Wall Street is betting Nexstar can close the deal.

“After nearly 19 months since the Sinclair-Tribune deal was announced, we’re confident that Nexstar can bring in these assets smoothly and on time,” Deutsche Bank analyst Clay Griffin said.