Local TV Ad Spending Seen 5% Lower Because of COVID-19

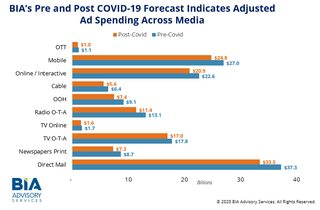

Ad spending on local over-the-air television will be 5% lower this year than previously expected because of the COVID-19 pandemic, according to a new forecast from BIA Advisory Services.

BIA had been forecasting $17.8 billion in local TV spending for 2020 and now sees spending topping off at $17 billion.

BIA Said local TV and radio were being impacted by decreased ad spend by leisure and entertainment companies, restaurants and retailers, as well as sports cancellations.

The local cable forecast has been reduced to $5.6 billion from $6.4 billion. Live sports disappearing has affected their viewing and subtracted inventory usually bought by local advertisers.

TV online spending was trimmed to $1.6 billion from 1.5 billion and over-the-top reduced to $1 billion from $1.1 billion.

“To formulate the update to our local advertising estimates, we considered all the different angles of the economic impact of COVID-19 on the economy, including unemployment, local market specific factors, and the declining ad spend of key business verticals,” said Mark Fratrik, senior VP and chief economist at BIA Advisory Services. “A realistic view of the virus is that it will continue to have a negative impact on the second quarter, with some continuation into the third quarter. We have assumed that there will be a strong rebound in the latter part of the year, but we will have to re-evaluate as the on-going economic impact becomes clearer.”

Overall, BIA reduced its U.S. local revenue forecast by 10.6% to $1.443 billion due to the impact of the Coronavirus.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“As this situation unfolds, we are continually running our forecast models to make sure our estimates reflect economic conditions,” said Thomas Buono, CEO and founder, BIA Advisory Services. “This unprecedented moment is greatly affecting our clients’ revenue opportunities, and we believe businesses can use solid data and insights to take steps to minimize their losses and take steps to plan for the recovery.”

Buono said he has been advising client companies in the media industry to take several steps now to keep their companies going and then preparing for the economic rebound in three key areas: preserving liquidity; emphasize and manage relationships; and, think forward as a team.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.