It's Primetime for Media Stocks

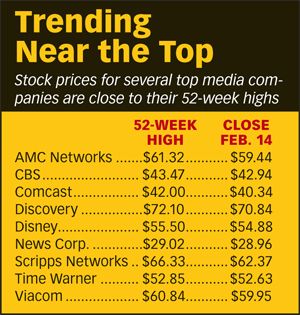

As the stock market flirts with its all-time high of 14,164.53 on the Dow Jones Industrial Average, most media stocks have been climbing even faster than the Dow and are approaching record territory.

In an improving economy, the conventional wisdom is that companies that depend on advertising would outperform, said Brian Wieser, analyst at Pivotal Research. That was true in the opposite direction when the economic crisis hit, and media stocks nose-dived and recovered only slowly.

Last year was a great one for media stocks, with shares of Discovery and Comcast leading the way with gains of more than 60%. Going forward, media stocks “can outperform the market, they sure can. ‘Will they’ is another question,” Wieser said.

So far this year, they continue to rise. Discovery and Viacom have jumped more than 12%, CBS is up almost 12%, News Corp. and Time Warner have gained 11%, Disney 10%, Comcast 9% and Scripps Networks is plus almost 7%. Overall, the Dow is up 6%.

Rising stock prices are obviously important to investors. They are also important to top executives who have significant holdings and are granted stock and options as part of their annual compensation. Wieser also notes that rising stock prices create enthusiasm and momentum that can boost the interest of vendors and customers, such as programmers and advertisers, to work with the company.

The gains by media stocks did not abate with the perception that ad revenue growth slowed in the fourth quarter. “For the most part, this earnings season has supported the view that the media business models may have a greater ability to drive margins higher than many have anticipated,” John Janedis of UBS said in a recent research note. “For the fourth quarter, earnings have come in better across the board on weaker than expected revenue from advertising and film. The good news is that ad growth will accelerate somewhat from 4Q driven by greater volume and marginally higher pricing exiting the quarter.”

Janedis’ top picks in the sector are Time Warner and CBS.

Todd Juenger of research firm Sanford C. Bernstein is also bullish. “Generally we believe 2013 ought to be another good year for the sector,” Juenger said in a recent report. “The same business drivers that propelled 2012 are still in place. Affiliate fees are safe and contracted, and cord-cutting remains a hypothesis rather than a reality. We are cautiously optimistic on advertising demand.”

Despite that optimism about advertising, Juenger favors companies poised to benefit the most from increases in affiliate fees and international growth, and those that have the best programming cost structure.

“Frankly, the most important item this quarter— and every other quarter—for media companies is: What is the state of TV advertising? How is the demand environment holding up? What visibility do we have? Should we be worried? It seems like over the past year the intensity of those questions has been stronger than ever, given the high level of uncertainty about the macro environment combined with the unprecedented volatility of ratings,” he said.

Bernstein currently rates Disney, News Corp. and Discovery as “outperform” companies, CBS and Time Warner as “market perform” and Viacom as “underperform.”

Earlier this month, Scripps Networks reported slower than expected advertising revenue, and its stock took a quick dive. But after a reassuring conference call, some analysts thought the sell-off was an overreaction. In a note called “Less Heartburn Than We First Thought,” Michael Nathanson of Nomura Securities said that he was leaving his target price for Scripps Network share unchanged at $58.

Increased dividends and share buybacks have been as big a factor in media stock gains as advancing revenue and operational efficiency, noted Anthony DiClemente of Barclays Capital. “With certain media companies generating incremental cash through the divestiture of non-core businesses, we believe return of capital trends could improve from here,” Di- Clemente said. “Importantly, high-priced/dilutive acquisitions have been scarce, an indication of more disciplined management teams.”

Pivotal’s Wieser notes that with lots of cash on their balance sheets and low interest rates, media companies don’t need to rely on the high price of their stock to make acquisitions.

And though media companies are squeezing costs to boost profit margins, “If it’s a company that views itself as having great growth prospects, then retaining cash and plowing it into the businesses is the focus,” Wieser said.

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.