How This Can Still Be A Breakout Season

The annual rite of American Idol promotions ramping

up on Fox means the broadcast networks are starting

to turn their sights to January, a second chance

to launch a television season. And after the networks collectively

failed to birth a new breakout hit this fall, midseason

can’t come soon enough.

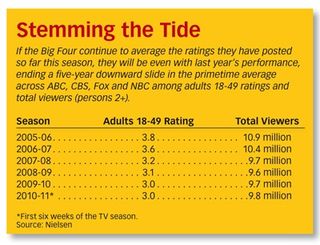

But the news hasn’t remotely been all bad for broadcast, which has

seen only minimal drop-offs year-over-year in primetime ratings, both

in the coveted 18-49 demo and total viewers (see chart on opposite

page). These days, stemming the tide is good news, especially with

primetime broadcast ratings in a collective free fall for years. But this

year’s numbers have held up despite some serious road bumps, especially

at Fox, where the prized rookie of all the networks, Lone Star,

tanked and a short Giants-Rangers World Series didn’t help matters.

“That [the networks are] not off to a great start is always disappointing,”

says Bill Carroll, VP/director of programming at Katz

Television Group. “But the whole dynamic changes after the first of the year at midseason, when AmericanIdol becomes

part of the overall schedule.”

And while the networks won’t have prized

midseason assets like Lost and 24 to help

launch other new shows, there is plenty about

the upcoming midseason to watch out for.

Obviously all eyes will be on the new look

of American Idol without Simon Cowell, but

there are several factors that will decide the fate of a television season

whose story is still yet to be defined.

THE IDOL FACTOR

It may be entering double-digits in age, but when it comes to midseason,

it’s still all about American Idol. “A lot of what’s riding on how

the broadcast networks will do is based on what happens—or doesn’t

happen—with the newly reconfigured, Simon-free American Idol,” says

Shari Anne Brill, an independent media industry analyst.

As the show (finally) has started to show its age with falling ratings,

and now with a new judging panel of Randy Jackson, Jennifer Lopez and Stephen Tyler, everyone is waiting to see what will happen. “It’s

strange to say that [Idol is] the wildcard, but I think it is because you

have two things going against it: it’s in its 10th season, and Simon’s

gone,” says Brad Adgate, senior VP of research at Horizon Media. “The

question is how dominant are they going to be, and that will determine

how well Fox will do in adults 18-49 for the season.”

And Fox’s rivals may be ready to pounce. While the final Idol

schedule has not been announced, it’s possible that Paula Abdul’s new

CBS show Live to Dance, slated for Wednesdays at 8 p.m. starting in

January, may go up against her former series, at least in the beginning.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“The other networks will be looking to see if there’s any vulnerability

in American Idol, and at that point they might go counter-program

against that,” says Carroll.

CBS insists that scheduling Live to Dance on Wednesdays is not a

stab at Idol, but rather a bridge show for Survivor. In fact, CBS execs

say—in an opinion mirrored by other networks—that while they don’t know how the Death Star will fare with its new casting, they

wouldn’t dare expect a massive falloff.

While Idol will be down one acerbic British judge, it is adding music

industry executive Jimmy Iovine as a mentor; Brill thinks Iovine

could re-insert that missing element. “He also is bold and brash and

doesn’t mince words, and will dish out that brutal honesty that everyone

loved Simon for,” Brill says.

And Simon or not, Fox remains con! dent that the show will survive

this year’s road bumps. Network execs have long maintained the

contestants are the real key to Idol, not the judges.

“I don’t think any network could have handled Idol as well as we’ve

handled Idol. We know it inside, outside, upside-down—we know it,”

says Preston Beckman, Fox executive VP, strategic program planning

and research.

Even if Idol continues to drop off, that decline is still relative, and

no one doubts that it won’t still be the most-watched show on television.

“American Idol will decline, but even if it loses 10% of its viewership,

it’s still going to be probably the top show among adults 18-49,”

says Brill. “It would have to be universally panned for that show to

be in trouble.”

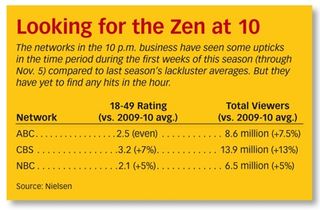

CAN THE NETWORKS WAKE UP 10 P.M.?

Despite last year’s promising entry The Good Wife, a dominant 10

p.m. drama continues to elude the networks in a time slot where

NYPD Blue and ER once dominated. Good Wife has failed to greatly

build its audience from last season like Glee and Modern Family, and

two of this fall’s five casualties so far—NBC’s Outlaw and ABC’s The

Whole Truth—were 10 p.m. occupants.

Compared to this same time last year, CBS’ ratings are down 6% in

the 10-11 p.m. hour, and ABC’s have dropped 14%. NBC has managed

to climb 24% from last year’s failed Jay Leno experiment, though

its ratings still trail the other two nets with lackluster performers like

Chase and The Apprentice. “They haven’t been able to make signi! cant

inroads in the 10 o’clock time period, and I think that’s where the race

is going to be impacted the most,” says Carroll.

Perhaps the most likely midseason show with the potential to reverse

the trend is ABC’s Off the Map, the latest medical drama from

creator Shonda Rhimes, which will fill Truth’s time slot Wednesdays

at 10 p.m.

The network, seeing room for a big hit at the hour, hopes it is an aggressive move, says Jeff Bader, ABC executive VP, planning, scheduling

and distribution. “The 10 p.m. time period is a really interesting

time period right now because nothing has really broken out and

there is room for a big hit on Tuesdays and Wednesdays,” he says.

IS THERE A DIAMOND IN THE ROUGH?

In the absence of any breakouts this fall, the question remains

if any rookie show can break through the clutter in midseason and

emerge as a hit.

“There are a lot of midseason shows—maybe there’s some gem in

there on some network that even they’re not aware of,” Beckman says.

A midseason launch provides networks the opportunity to promote

the show in the fall, when TV usage is higher than the summer, and

possibly put it in a more strategic time period with the knowledge of

how the season has unfolded—a strategy that made hits like Grey’s

Anatomy and House. “There’s been a pretty good track record of shows

that have debuted in the middle of the season and have had successful

runs on television,” says Adgate.

This year Fox is throwing its weight behind midseason entry The

Chicago Code, using the Super Bowl to launch the new cop drama the

following night in the troublesome 9 p.m. time slot. “We’re hoping to

get that going and get our Monday night back on track,” says Beckman.

“We stumbled out of the gate with Lone Star. We put Lie to Me

there, which at least helped us get our circulation going. But we need

to try to create another asset for us, and we’re hoping The Chicago

Code will do that.”

Among other scripted hopefuls set to debut in midseason are ABC’s

Mr. Sunshine, CBS’ Mad Love and CriminalMinds: Suspect Behavior and

NBC’s Love Bites and The Cape.

FRESHMEN (ACTUALLY) GETTING

TIME TO BREATHE

After some swift cancellations (Fox’s Lone Star, ABC’s My Generation),

many of this year’s new entries are actually being allowed some

time to prove themselves. “If it’s anything, it’s going to be how patient

are the networks going to be with these shows that are right on the

cusp—will they hang onto them for a full year,” says Fox’s Beckman.

And in some cases not only are the networks giving them a chance,

they are actually actively trying to prop them up.

That is ABC’s plan for the Michael Chiklis drama No Ordinary Family,

which Bader notes is probably in “the most difficult time period on

the schedule” against The Biggest Loser, NCIS and Glee.

So ABC will move the series to 9 p.m. in December and run holiday

specials in front of it to try to pump a family audience into it. “We’re

hoping that come January with No Ordinary Family and then the return

of V, we have a block of programming that’s an alternative to the

very female programming that’s on the other networks,” Bader says.

Beckman names Raising Hope as the most important new show

on Fox’s schedule, one that has the potential to support a liveaction

comedy block in the future. “I think there’s a show there, and

if we nurture it and are patient with it, it can be the foundation for

a comedy block,” he says. “That’s been a tough nut for us to crack.

Glee allowed us a foundation;

we have to keep fanning the

" ames on Hope.”

The CW gave both its

freshmen, Hellcats and Nikita,

full-season orders despite

moderate ratings in hopes

their audiences will grow.

And CBS, which renewed all five of its fall rookies, had yet

to announce the bulk of its

midseason schedule at press

time, in favor of a wait-andsee

approach. “The success

of these shows has bought us

quite a bit of time to evaluate,”

says Kelly Kahl, senior

executive VP, CBS primetime. “We’re in the fortunate position of not

having to decide right now, so we’re going to take full advantage of it.”

AVOIDING THE SOPHOMORE SLUMPS

If this fall season lacks a breakout hit, perhaps it’s because last year’s

darlings are still holding onto the title. “You could say that the biggest

hits of this year, the programs that have gotten the biggest bounce upward,

are two-year shows like Glee and Modern Family,” says Adgate.

While Heroes was the most recent example that a big ! rst year does

not a hit make, the Fox and ABC critical and Emmy darlings are up

huge vs. last season. Glee has jumped 23% with adults 18-49 (4.4

to 5.4) and Modern Family has grown a whopping 45% (4.0 to 5.8).

Of the other big rookies from 2009-10, NCIS: LA is up 14% over

last season, while The Good Wife is up 7%. With the exception of the

franchised NCIS, all have benefitted from critical acclaim based on the

appearance of bringing something new and fresh to TV—something

this season’s rookies notably lacked. In a fall crop littered with spinoffs

(Law & Order: Los Angeles), remakes (Hawaii Five-0) and re-imaginings

(Outsourced, or The Office in India), the sophomores continue to attract

new fans.

“There’s still plenty to talk about on network TV—you just need

to take a little more of a risk,” says Brill. “When you play it safe, you

don’t win audiences that way.”

E-mail comments to anmora01@gmail.com

and follow her on Twitter: @andreamorabito