Hispanic Population Explodes—Will Ad Dollars Follow?

During the week of April 4, two of the nation’s largest media players, News Corp. and NBC Universal, separately announced their own initiatives to better serve the needs of marketers and advertisers trying to reach the U.S. Hispanic market. That Monday, News Corp.-owned Fox Networks announced with great fanfare the creation of Fox Hispanic Media (FHM), a media unit housing three Spanish-language cable networks, as a way for advertisers to reach a larger range of Latinos. The next day, NBC Universal touted its newly created “Hispanics at NBC,” a sales and marketing initiative aimed at connecting marketers with the nation’s 50.4 million Hispanic consumers.

News Corp.’s Fox and Comcast-owned NBC are two of the largest non-Hispanic networks that are vying to capture a higher share of advertising dollars in a market that is too large— and too important—to ignore: U.S. Hispanics represented an estimated purchasing power of $1 trillion in 2010, a figure that is expected to grow to $1.5 trillion in 2015.

This vital picture became clearer in late March, when the U.S. Census Bureau released its national findings, showing that U.S. Hispanics now represent the nation’s largest minority, surpassing the 50 million mark and growing at unprecedented rates (more than 100% over the last decade, in some markets), not only in those states that have traditionally attracted Latin American immigrants, but in seemingly unexpected places such as Vermont, Maryland, Tennessee and even Alaska.

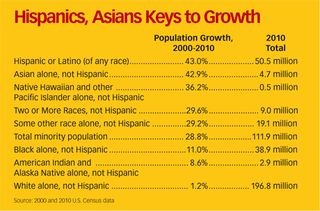

The census found that more than half of the growth in the total U.S. population between 2000 and 2010 was because of the increase in the Hispanic population, which grew by a whopping 43 percent, rising from a 2000 figure of 35.3 million. Today, Hispanics comprise 16 percent of the total U.S. population of 308.7 million.

The 2000 Census was, in fact, a wake-up call to Madison Avenue and marketers around the country that suddenly realized the importance of targeting U.S. Hispanics. While the 2010 census won’t exactly be a clarion call, it will mean the starting point of a bigger shift, one that will see advertising and marketing budgets better reflect the popular trends. And therein lies the challenge of properly reaching and influencing so huge and varied a group.

“With the 2010 Census, you are not going to have that ‘Aha! Holy cow!’ kind of moment,” Tom Maney, senior vp of advertising sales for newly created FHM, says about the 2010 results. “What you will see, though, are more marketers and advertisers going to the upfronts and planning for the coming year not with a general-market approach and then a Hispanic approach, but doing them together.”

Now What?

FHM is coming to its May 17 upfront at the New York City Public Library with not one but three networks (Fox Deportes, Utilísima and NatGeo Mundo), hoping to finally boost the budget allocated to Hispanic cable, currently at a mere $200 million a year. That’s a pittance when compared to the fast growth cable has experienced, not only among Hispanics but in the general market as a whole.

It is Maney’s “total market approach” that many broadcasters and cable programmers see as the only way to finally capture a bigger share of the ad dollars targeting Hispanics, or at the very least increase them to better reflect their share of the U.S. population.

According to the Census, the non-Hispanic population grew relatively slower over the decade, at about 5 percent. Within the non-Hispanic population, the number of people who reported their race as white alone grew even slower, at 1 percent.

Hispanics now represent 16% of the total U.S. population; by contrast, they account for a tiny 4% of the total advertising market.

“We want advertisers to come to us as a place that reaches 91% of Hispanics over the age of 18, in Spanish and English,” says Lauren Zalaznick, chairman of NBC Universal Entertainment & Digital Networks and Integrated Media, in announcing the launch of “Hispanics at NBC.” “We want to become the one-stop-shop for marketers wishing to reach this important demographic.”

NBC claims to be in a unique position to reach not only the Spanish- dominant audiences through Telemundo, but the more acculturated, younger ones with cable network mun2, and then everyone else, as NBC programming scores very high among Hispanics with networks including Oxygen, Bravo, E! and USA and online properties such as Fandango and iVillage.

Show Them the Money

For 800-pound gorilla Univision Communications, which stands as the largest Hispanic media company and attracts the largest chunk of the Hispanic- targeted advertising dollars, the 2010 Census did not come as a surprise, but it did come with a message: “This is a good moment to step back and ask yourselves: Are we allocating our spend in the right groups?” says Elizabeth Ellers, Univision executive vp of corporate research. Univision invests a good deal of time, money and resources in research, and through research it goes to market to tell advertisers to put their money where the eyeballs are. Univision consistently beats one or several English-language broadcast networks in primetime, and it is more often than not No. 1 in markets such as Los Angeles, the largest local television market with an estimated 2 million Hispanic TV households.

Univision expanded its commitment last week, saying it plans to launch two new Spanish-lanaguage cable channels by mid-2012.

But while Univision and Telemundo might be the largest—and on first blush, more obvious—places for reaching the U.S. Spanishspeaking audience, spend allocation is now more challenging than ever. While the 2000 Census unveiled the enormity of the Latino population as a whole, the figures highlight other fascinating trends, including geographical shifts, more multicultural households, growing bilingualism and an explosion of U.S.-born Latinos who are not only more mediasavvy but whose preferences are not as clear-cut as before, moving from one media to the other and toggling between languages.

“In 2000, it was all about ‘Wow! Look at this huge demographic,’” says Alain Groenendaal, president/CEO of Wing, a WPP-owned multicultural agency in New York. “Now, it is going to be going beyond language and going more into the culture. And that is exciting, but challenging at the same time.”

While media is still highly segregated between English and Spanish, Groenendaal thinks there is an enormous opportunity to embrace TV properties like ABC’s Modern Family, which shows a more accurate representation of mixed households. “People need to take a step back and think: ‘Where is the country really going?’” says Groenendaal.

Finding a Young, Diverse Nation

Given the numbers, the trend is moving more toward a time of ad dollars no longer being allocated simply in terms of language preferences. The message is getting clearer to the makers of English-language cable programming, where networks such as Nickelodeon and MTV consistently score high with Hispanic audiences.

MTV’s Jersey Shore, for instance, scored 7.6 million viewers overall with its March 24 finale—and had a lot to thank Latino viewers for its success. Per Nielsen, Jersey Shore consistently finished No. 1 among Hispanics tuned to English-language cable telecasts. In addition, the reality show managed to draw more Latinos than anything on Spanish— or English-language—cable on that night.

So, who is this demographic and how best to reach them? Jacqueline Hernandez, COO of Telemundo and former publisher of People en Español magazine, knows this demographic all too well. “These guys are young, they are Latinos and, yes, they are 100% American too!” she says. “Sounds confusing? No. These guys find it easy to toggle in and out of both the Hispanic and American cultures, and that de! nes who they are.”

It is with the bicultural, bilingual demographic in mind that Telemundo and sister cable network mun2 are shaping the programming strategy for the now Comcast-owned networks. “We want to reflect all of that in our telenovelas, our music shows and our reality shows,” says Hernandez.

Echoing that sentiment are the folks over at Si TV, which plans on capitalizing on 2010 Census results showing that bicultural Latinos constitute about 38 million (or 77%) of the roughly 50 million total Hispanic population. “We are talking about Latinos who live in a place where their friends are from all different ethnicities…. We need to be more inclusive than exclusive,” says Michael Schwimmer, CEO of SiTV, which will relaunch as nuvo TV on July 4, targeting English-speaking, bicultural Latinos.

Youth Will Be Served

Univision’s Ellers points out another interesting trend built into the latest census: That the U.S. Hispanic population is younger on average than non-Hispanic whites, which opens up opportunities for marketers and media outlets catering to families with babies and young children.

The census data also showed an increasing racial diversity among U.S. children, underscoring a shift that is likely to make whites a minority in the early 2040s. Of the entire Hispanic population, children make up about one-third, compared with one-fifth among whites. What is more: The total number of people under age 18 rose by nearly 2 million over the decade. At the same time, the number of white children fell, while the number of Hispanic children rose sharply.

These numbers are music to the ears of execs at Semillitas, a recent entrant to the Hispanic space that caters to Hispanic children up to 5 years old. “Hispanics might represent 16% of the total U.S. population, but they are 27% of the population 0-5 years,” says José Antonio Espinal, COO of Somos TV, the Venevision-owned network that operates Semillitas and movie channel Venemovies.

But while Semillitas and others in the Spanish-language kids space are betting on the explosion of Hispanic children, they will have to follow the trends closely. More and more U.S.-born Hispanic kids are spending time in the so-called general market channels, including Disney Channel and Nickelodeon. Nick’s 11-year-old hit Dora the Explorer became a smashing success not only among U.S. Hispanic children, but among non-Hispanic kids who see themselves living in a more diverse country.

“We don’t react to census numbers,” says Pete Danielsen, executive VP of programming for Nickelodeon, a highly popular network among Hispanic children. “Diversity is in our DNA. It is a very important part of our core business.” Danielsen oversaw the birth and evolution of Dora and spin-off Go, Diego, Go and continues to program—and cast—shows with a diverse audience in mind—not only Hispanic, but one that tries to reflect the whole color and ethnic spectrum.

Nickelodeon’s approach will soon be on everybody’s mind, and perhaps on their agendas, too. Beyond dollars and cents, the 2010 U.S. Census showed that the number of Americans who identified themselves as being of more than one race grew about 32% over the last decade. The number of people who identified as both white and black jumped an astounding 134%, and nearly 50% more children were identified as multiracial in this census, making that category the fastestgrowing youth demographic in the country.

Earlier this month, at the NBC breakfast announcing the Hispanic initiative, fashion model and cosmetics company entrepreneur Iman delivered a keynote and offered her own perspective on multicultural marketing. For many years, in the U.S., “the beauty next door was blond and blue-eyed,” Iman says. “The neighborhood has changed.”

And as the neighborhood changes, so do the perceptions of the people who live there.

“People are moving out of their traditional boxes; calling themselves multi-racial, and not living the way we expected them to live anymore,” says Wing’s Groenendaal. “The new generation is defying social conventions, and that is really cool.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below