Gateway to Growth

The NATPE confab’s move to Miami, signaling a renewed focus on the Latin American television market, comes at an opportune time.

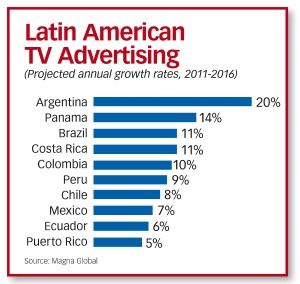

Latin America was less affected in 2009 by the global economic crisis than the U.S. or Europe, and since then it has rebounded much faster than other regions; TV advertising is expected to grow at doubledigit rates for the next five years, according to recent forecasts from Magna Global. “The Latin America TV business is the fastest-growing in the world, faster than Asia, though from a smaller base,” says Brian Wieser, executive VP, director of global forecasting at Magna Global.

In production and sales, the strong Latin economies are also producing “explosive growth,” adds Don Browne, president of Telemundo Communications Group. Since launching its Latin American production and sales efforts in 2005, the U.S. Hispanic network now has studios in Colombia and Miami and produces 1,040 hours of scripted programming a year. “In just five years,we’ve become the secondlargest distributor of Spanish-language content in the world,” Browne says.

This growing production is part of a major shift from imported content to local fare that has occurred over the last 15 years. “Latin America has gone from relying heavily on movies and series that they were bringing in from the States to much more locally produced fare,” says Alexander Marin, senior VP/distribution, Latin America and the Caribbean, at Sony Pictures Television. SPT has been working to capitalize on the trend by becoming a major producer of Spanish-language programming in the region.

Similarly, TV Azteca in Mexico has been expanding its already considerable telenovela production slate and is building new facilities that will allow it to produce some 1,170 new episodes of television programming this year, according to Marcel Vinay, director of international sales at TV Azteca.

Latin America remains one of the few broadcast markets around the world where theatrical films continue to do extremely well. “Movies remain a hot spot in Latin America and are still getting very good ratings,” in part because the pay TV market remains relatively small, says Elie Wahba, senior VP, Latin America at Twentieth Century Fox Television Distribution.

American series are generally a tougher sell, though Wahba reports that The Simpsons remains popular throughout the region.

For example, TV Azteca’s main Channel 13 airs telenovelas in prime time on weeknights, with Mexican and American films on the weekends, says Pedro Lascuráin, director of acquisitions at TV Azteca.

TV Azteca’s secondary channel, Channel 7, has, however, has done very well with a number of series from Disney, Sony and Fox and airs a number of theatrical films. “About 50% [of my acquisition] budget goes directly to movies,” Lascuráin notes.

By global standards, pay TV penetration remains low in Latin America, but pan-regional channels have become an increasingly important outlets for American and European distributors, according to Helen Jurado, VP of TV sales and distribution at BBC Worldwide Latin America, which has seen healthy sales growth in recent years with both natural history programming and dramas like Strike Back. “The major pay TV groups continue to launch new channels that have become important outlets,” Jurado says.

Coproductions, which were relatively rare a decade ago, are also increasingly important. Telenovelas are massive productions with 120 to 150 episodes that entail a serious “financial commitment from the production companies [that] can add up to millions of U.S. dollars,” explains Michal Nashiv, president and CEO of Dori Media Contenidos and president and CEO of Dori Media Distribution Argentina, which plans to be involved in about 400 hours of production in Latin American and Israel in 2011.

To help defray some of those risks and costs, “a lot of new coproductions” are being done,” Nashiv adds.

The U.S. studios are also increasingly involved in format sales or producing content in the region. In addition to Sony, which has been active in Spanishlanguage production for a number of years, Twentieth Century Fox has closed a deal in Chile for a local Spanish-language version of Dharma & Greg, and Disney has produced Spanish-language versions of Desperate Housewives. Disney also recently announced a deal with TV Azteca to create a Mexican version of Grey’s Anatomy.

“Being able to sell U.S. blockbuster movies and series and having the ability to talk to them about making a new show means that they can come to a single player for conversations they used to have with a lot of people,” says Sony’s Marin.

E-mail comments to gpwin@oregoncoast.com

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below