Facebook’s Video Move May Aid Nielsen, comScore

Facebook’s efforts to get into the video programming business might create even more competition for the traditional TV networks and further erode the need for pay TV subscriptions.

Hardly anyone in the traditional TV business benefits, according to analyst Brian Wieser of Pivotal Research, except one group: the companies that are supposed to keep track of who is watching. Nielsen and comScore, two unbiased observers in the digital ratings race, will likely gain the most from this move, maybe even more than Facebook itself.

Facebook, along with Google, has dominated that growing world of digital advertising. But advertisers are becoming increasingly wary of the viewership numbers coming from the digital giants. Huge marketers such as Procter & Gamble are calling for digital advertising to be more transparent and meet measurement standards.

In August, Google’s parent, Alphabet, issued refunds for ads that ran on websites with fake traffic, according to The Wall Street Journal. Other advertisers cut back their advertising on Google YouTube because of concerns their ads could run next to objectionable videos.

Facebook has also had trouble with the numbers it has been providing to advertisers and media buyers that have inflated its reach.

Those problems could become more pronounced as Facebook and other digital companies, including Apple and Google, get into the premium video business and look to steal ad dollars from the TV networks.

Sophisticated advertisers want more than large numbers of users looking at what friends are posting, Wieser noted.

“Merely reaching a large number of people was always going to be insufficient to reach [Facebook’s] goals, as TV advertisers generally want reach paired with video ad units while also borrowing the brand equity associated with premium content,” Wieser said in a research note. “Unsurprisingly, this reality has required Facebook to change its approach.”

Facebook Unwinds Its Watch

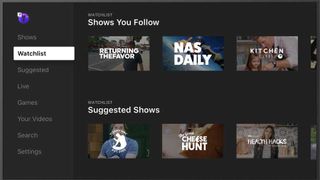

In the past few weeks, Facebook has introduced its Watch tab and has enlisted TV companies including Discovery Communications, A+E Networks and Univision Commuications to create “premium mid-form shows” for the new platform. Facebook also made a $610 million bid for the video rights to India’s Premier League cricket, but was outbid by Fox’s Star.

Because Facebook will be spending big bucks on premium content, Wieser said, margin for the ad sales on that content will generate lower ad revenues than might have been expected. At the same time, those ads will be more closely scrutinized by advertisers used to television’s viewer metrics.

“Measurement issues at Facebook have been top of mind for many of those same marketers over the past year, given revelations around overstated average video viewing time, video viewing completions, miscalculations of organic page reach and other data which impacts how budgets are planned,” he said. “And then last week, Australian trade publication AdNews discovered that Facebook claims to reach 1.7 million more 16-to-39-yearolds in Australia than exist in the country, according to its census bureau.”

Wieser found a similar situation in the U.S., where Facebook claims a potential reach of 41 million 18-to-24-year-olds, 60 million 25-to-34-year-olds and 61 million 35-to-49-yearolds — all exceeding U.S. Census figures.

“We think that awareness of general measurement issues causes larger advertisers to require the use of third-party measurement services, including Nielsen’s Digital Ad Ratings and comScore’s validated Campaign Essentials (vCE), to provide the basis against which Facebook is paid,” Wieser said. “As these products generate revenue on a campaign basis (versus traditional TV measurement, which has fixed fees), growth in Facebook, YouTube and other digital media will continue to provide growth support for third-party measurement companies.”

The bottom line for Wieser: “We think the primary winner of Facebook’s expansion in video will be third-party measurement firms, including Nielsen and comScore.”

Nielsen naturally faces some challenges as video viewing becomes more complicated to measure and consumption takes place on more platforms and more digital devices, including smartphones.

Nielsen’s U.S. national and local TV ratings businesses generate about 20% of the company’s revenue and a larger share of cash flow, according to Wieser.

“The most realistic threat to Nielsen would occur if the company is unable to maintain consensus among buyers and sellers about the superior quality-cost trade-off associated with Nielsen’s services versus alternatives, given ongoing changes in how video-based advertising is being consumed and transacted,” he said.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.