The Early Word on 2016 Upfront Volume: It Will Be Up

You read it here first. Next year’s upfront is going to be up after two years of decline. Yes, the 2015-16 television season has barely begun. And the ink is still wet on the deals negotiated during the weak 2015 upfront market. In fact, reports continue to come in estimating just how much volume shrunk, whether it was high-single-digits or low-single-digits.

Yet with Halloween a month away, ad people are already talking about the 2016 upfront. And if that’s not spooky enough, the smart money has numbers to share.

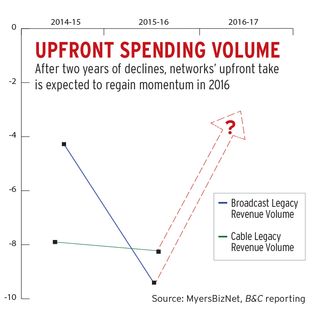

Volume for the 2016-17 upfront will rise 3% to 5%, they say. And prices on a cost-per-thousand-viewer basis will increase by high-single-digits.

That would be a big difference from the 2015-16 market. According to a recent report from Jack Myers, who has been doing this for a while, broadcast volume was down 8.4% on the back of a 7.9% drop in the 2014-15 upfront. Pricing for broadcast prime was up 3.5%. For cable, Myers estimates that volume slumped 10% in the 2015-16 market, piling on top of a 4.8% spill in 2014-15.

The weak upfront has contributed to media companies reporting lower ad revenue for several quarters this year.

So why would next year be different? Take a look at the scatter market.

For most of the past year, the scatter market has been sluggish in terms of volume and with mainly flat prices.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

But during a recent round of investor conferences, senior media companies all attested to an improvement in what had been a sluggish market for advertising. “The advertising market right now is very good,” said Steve Burke, CEO of NBCUniversal. Tom Staggs, COO of Walt Disney Co., also said scatter was doing fi ne: “The healthy trends bode well for what we’re going to see for a scatter market as we get into the fall season, and I’m feeling optimistic about that.” And CBS Corp. CEO Les Moonves said third-quarter scatter has been terrific: “Best quarter of the year.”

Viacom CEO Philippe Dauman was even talking about reducing the number of commercials the company’s cable networks run during primetime.

Ad sales executives say that a number of big marketers made a couple of big bets in the 2015-16 upfront that backfired. That’s helping to drive scatter and will make the 2016-17 market appear more attractive.

The first bet was that by holding money out of the upfront, the market would soften and price increases would be smaller. That worked. But now that advertisers need to spend the remainder of their budgets, they are finding the significantly higher pricing in the scatter market is costing them money. That’s partly because inventory is scarce with networks still paying off under-delivery from last season, due in part to increased demand. Getting burned in scatter will drive those advertisers and their ad dollars back into the upfront.

The second bet was moving money that would have been spent on TV in the upfront to digital advertising. Several major marketers including Procter & Gamble, Mondelez and Kraft embraced digital, banking on the ability to more precisely target ads and get a better read on return on investment. But the romance soured because of issues including click fraud and viewability, which means marketers weren’t always getting what they paid for. Worse than that, spending on digital didn’t make the cash register ring loudly enough.

Those companies will be back in the upfront market come May. Just remember where you read this first.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.