News

Latest News

Brooke Shields Stars in Netflix Film ‘Mother of the Bride’

By Michael Malone published

Critics describe movie as ‘mush’, ‘respectable’ and ‘not particularly bad’

NBC Sends Leslie Jones to Paris for Offbeat Olympics Coverage

By Michael Malone published

Comedian reprises her role from PyeongChang and Rio Games

NBC Affiliates To Get Cut-Ins During Olympic Coverage To Promote Local News

By Jon Lafayette published

90-second cut-ins will come before early-evening newscasts

LG Ad Solutions Integrating Trade Desk’s Unified ID 2.0

By Jon Lafayette published

Brands will be able to use first-party data to target ads

Fubo Grabs Viewer Attention, According to TVision Study

By Jon Lafayette published

One advertiser saw 67% more attention for ads on Fubo compared to other connected TV apps

Nexstar Reports Higher Net Income in First Quarter

By Jon Lafayette published

Losses at The CW reduced by $50 million

Warner Bros. Discovery Reports $966 Million First-Quarter Loss

By Jon Lafayette published

Direct-to-consumer business adds 2 million subs, with EBITDA up 72%

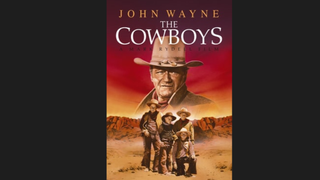

Future Today Adds Movies From Warner Bros Discovery to Fawesome

By Jon Lafayette published

Titles include ‘The Big Sky,’ ‘The Cowboys,’ ‘The Outriders’

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below