Clouds Are Clearing...Is the Sky the Limit?

With the economy slowly gathering steam, the television

business expects a brighter picture in the second half of the year.

There are good reasons for the rosier hue. Most of the fundamentals of the

industry continue to point up. The advertising market improved as the upfront

approached. Subscriber and retransmission fees continue to rise. And Netflix

and other streaming video-on-demand players are supplementing the traditional

syndication business.

Internationally, developing markets are creating opportunities for programmers,

and improved business conditions in more mature markets are making

contributions to the bottom lines of the major media companies.

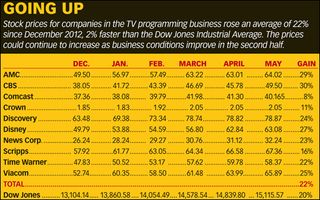

The stock market has noticed. As the Dow Jones Industrial Average has risen,

media stocks have skyrocketed, with many hitting all-time highs. Profits are

fueling higher dividends and share buybacks, making the stocks even more

attractive.

That said, there are reasons to temper the optimism. Advertising revenue growth

is not what anyone would call robust. After a 2012-13 TV season in which their

viewer numbers plummeted, the broadcast networks need to prove that they can

still produce hits, starting with this fall's schedule. The business model that

generates huge margins for cable programmers is under pressure from online

challengers and from a la carte advocates in Washington.

Meanwhile, technology and innovation marches on, and consumers can access video

on more devices from more sources seemingly every day. In only some of these

cases are programmers in control and able to cash in.

Here's a closer look at some of the key factors affecting the TV business in

the second half of 2013.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

It's The Economy, Stupid

Still coming back from the recession, media companies are finally operating

with a more large-scale macroeconomy that has shrugged off potential land mines

in the past year or so and could now be headed for smoother sailing.

"For the first time in a while, we're heading into a summer without a fiscal

cliff or a U.S. Treasury downgrade fear or concern that the next leg in the

economy is materially down," said David Bank, managing director of RBC Capital

Markets. "I feel like there's a pretty even-keeled view of the North American

economy."

"The economy is just gradually improving," added Brian Wieser, senior research

analyst at Pivotal Research Group. "Business has sort of shaken off the impact

of the attempts at austerity, the payroll tax increase and other factors that

could have retarded ad spending. It doesn't seem like that's going to be the

case."

Instead, the industry's performance has been improving sequentially. "The

year-to-year growth rates are looking better," Wieser said.

At a recent investment conference, Viacom CEO Philippe Dauman said the economy

looked to be strengthening for the next couple of years.

"We have a good dynamic going on right now. The macroeconomy is certainly

recovering in the U.S.," he said, adding, "Despite non-recovery yet in

Continental Europe, we're using this time period to build up our international

scope with continued strategic and tactical realignment and development there."

Better Days for Mad Men

The most economically sensitive part of the TV business is its advertising

revenue. Vincent Letang, executive VP and director of global forecasting for

media buyer Magna Global, said "We expect the economy [in the second] half to

be better than the first." Magna is predicting national TV ad revenue will be

up 2% on a full-year basis, with growth in the second half between 2.8% and 3%.

Magna's prediction is mostly based on economic forecasts, such as those

published by the Federal Reserve Bank in Philadelphia. The statistics that

correlate most closely to ad growth are personal consumption and industrial

production, Letang said. This has not been a great year so far for industrial

production, while personal consumption has been a bit more robust. Letang said

he expects both metrics to accelerate in 2014, contributing to a 4% growth in

national TV advertising dollars next year.

Till then, Magna sees broadcasters struggling in 2013, down 2% in revenue

growth in the first half and down 1% in the second half for a total drop of

1.7%. Cable, meanwhile, is expected to grow 4.2%.

For the broadcasters, the problems predictably start with lower audience levels.

"The big question is, is it just [last] season? Does it have something to do

with the quality of the shows? Or is it the beginning of an acceleration of a

real erosion of TV viewing among the youth?" Letang asked. "We think it might

be a bit of both."

Letang said that even though broadcast ratings are eroding faster than

expected-and might have to be factored into Magna's forecast in a few

months-spending and revenue won't fall nearly as far. "That's the big paradox,"

he said. "If there's a reduction of supply and demand gets stronger, you'll see

an acceleration of inflation in prices on a cost-per-thousand-viewers [CPM]

basis."

RBC Capital Markets' Bank said he would like to see a better performance from

the shows the broadcasters put on the schedule during their upfront

presentations in May. Bank added it's important for CBS to demonstrate that it

can continue to consistently generate the kind of high-quality content that

drives the syndication model. For Fox, an improved primetime schedule is needed

to stabilize the network's advertising revenue, although broadcasting isn't a

big driver overall for News Corp., where the bulk of profits come from cable.

Technology: Friend or Foe?

The business of TV is experiencing unprecedented change from consumers using

multiple devices to watch programming, and from new digital delivery systems.

Before the upfront presentations in May, a variety of Internet companies made

NewFront pitches telling advertisers that more desirable consumers are getting

entertainment, sports and news video via digital content. While online video

programming is currently the fastestgrowing form of digital media, ad spending

is expected to be $2.5 billion in 2013, according to Magna's Letang, which is

only 6.25% of the $40 billion spent on national television. "Even if the demand

for online video doubles, it's not going to change massively the outcome for

conventional TV," Letang said. That seems to be the case-for this year, at

least.

Nevertheless, digital players-in addition to writing checks for off-network and

library shows-are producing high-profile programming, such as Netflix's

resurrection of Fox's Arrested Development, and starting to soak up

viewers' time.

If this has worried executives running more traditional businesses, they are

not letting on. When Netflix let its deal to stream programming from Viacom

expire, Viacom was able to find another buyer in Amazon.

"There's never been a better time to be in the content business, at least for

the next three or four years," Discovery Communications CEO David Zaslav told

an investors' conference last month. "In the near term, what is happening here

is very beneficial for us. A lot more people want to buy our content, [there

are] new windows for our content, the U.S. is more pro"table than it's

ever been," he said.

At the same time, Discovery is buying digital video companies, including

Revision3. "People are spending time watching content on Netflix; they're

spending time watching content on YouTube. What does it all mean? We don't

really know what it means," Zaslav said. "So on the left side of our company,

we're making our channels stronger, growing our market share, monetizing it,

and we're optimistic about that great model we have. On the right side, we're

saying let's play around in this new space and see if we can get to know how

people consume content and make sure that one of our brands is in front of them

so we can learn from it and we can grow from it."

Aereo in the Air

Other media companies are also looking for ways to exploit the growth in

digital viewing. "We saw ABC roll out its Watch ABC [app]. I expect to see more

of that in the second half," said RBC's Bank. "And I want to see how the Aereo

lawsuits play out."

Aereo, backed by former TV exec turned CEO of interactiveoriented IAC Barry

Diller, has so far withstood legal challenges from the broadcast networks,

which have sued claiming that Aereo is misappropriating its signal for its

digital subscribers without paying retransmission fees the way cable operators

do. "I'm less concerned about the ad market than I am about those kinds of

things," Bank said. "The content's rich, the share shift in ratings, the

technological and legal forces at play-these are things that are going to play

out in the back half."

One clue to how digital will play out will come when a buyer is found for Hulu,

the video streaming website now being auctioned off by News Corp. and Walt

Disney Co. (A third owner, Comcast, is a silent partner under terms of a

consent decree issued when it acquired control of NBCUniversal.) Bank calls

Hulu "the best brand in online television."

Let's Not Make a Deal

Other deals are in motion that could affect the way the second half of the year

plays out. News Corp. is scheduled to split into two, separating its lagging

publishing assets from its TV and movie businesses, which will be owned by a

new public company controlled by Rupert Murdoch to be called 21th Century Fox.

Those TV assets will be undergoing a fair amount of change. News Corp. also will

be launching a new national sports channel, Fox Sports 1, a potential

challenger to Disney's dominant ESPN. It will be also launching FXX, the

younger-skewing component of FX Networks.

Other potential deals are in the wind. Sony's movie and television operations

could go into play; the ever-growing Scripps Networks Interactive could finally

complete a deal to acquire Tribune Co.'s stake in Food Network; and CBS has

been accumulating cable programming assets. One of the bigger players could

acquire one of the smaller players, further consolidating the industry.

"[On] the M&A landscape, one of these guys [might] do a big deal and we

think it's the wrong deal and our view of capital allocation could shift. That

could be a driver in the wrong direction," said Bank. "Our preferred capital

allocation tends to be return of capital to shareholders. And I think a

deviation from that, even for a good deal, could give some pause."

The Price Is Right

Wall Street likes the TV business. With the market rising in the first half of

the year, media stocks rose even further. Could that rise continue?

One thing investors like about media stocks is that revenue has become fairly

predictable, with affiliate fees and retransmission agreements being long-term

and most ad sales locked in on a year-long basis.

"There's so little that can change financial. Most ad spending is so

pre-planned and share shifts take many, many years. It's not likely we'll see a

rapid shift," said Pivotal's Wieser.

In the first half of the year, "the stock market performed really well, Wieser

said. "It remains to be seen whether or not stocks can keep up. Underlying

business performance will be OK with a pretty wide range of outcomes, depending

on which company, which sector."

In the last week the market, and media stocks in particular, pulled back. Todd

Juenger of Sanford C. Bernstein said the decline was the result of selling by

hedge funds and that there has not really been a significant change in business

conditions, despite slightly lower than expected upfront price increases for

the broadcast networks.

With the run-up of media stock in the past six months, some investors have been

waiting for an opportunity to buy, and the current dip may give them a chance.

Juenger specifically points to Discovery, which had the sharpest decline

despite its earnings being revised upward. "The question now, for all those who

said they wanted a better entry point, is: Will they still have the conviction

to buy? We believe the ‘buy on the pullback' case is very strong," Juenger

said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.