News

Latest News

AMC Networks Earnings Drop To $48.5 Million in Q1

By Jon Lafayette published

Streaming revenues increase 3%; ad sales down 13%

KXAS Dallas-Fort Worth, WTVF Nashville Pick Up Peabody Awards

By Michael Malone published

Two stations among the 34 winners for ‘most compelling and empowering stories’ in U.S.

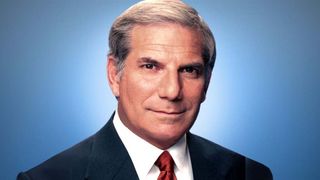

Harry Pappas, Station Group Founder, Has Died

By Michael Malone published

He grew Pappas Telecasting to largest privately-held group in the U.S.

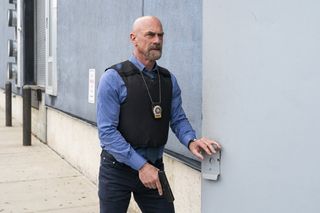

‘Law & Order: Organized Crime’ Moves to Peacock

By Michael Malone published

Four seasons on NBC for Dick Wolf show

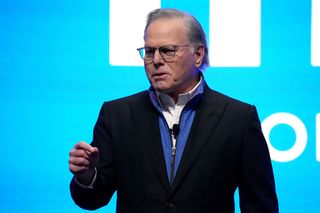

Streaming? No Thanks, Says Nexstar CEO Perry Sook

By Jon Lafayette published

Rebundling is taking the industry back to basic cable in costly fashion

Andrea Robinson Joins WCMH Columbus as Weekend Anchor

By Michael Malone published

Departs KPLC Lake Charles for her hometown market

‘Good Morning Football’ To Air on Fox Television Stations

By Paige Albiniak published

Football-focused panel talker slated to debut on TV stations Sept. 2

Allen Media Group Reaches Expanded Carriage Deal With Hawaiian Telcom

By Jon Lafayette published

Distributor will launch cable networks TheGrio and HBCU Go

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below