News

Latest News

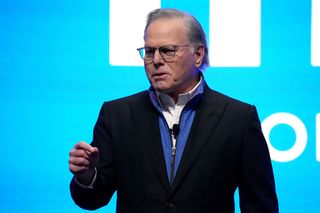

Warner Bros. Discovery CEO David Zaslav Got 27% Raise to $49.7 Million in 2023

By Jon Lafayette published

Other top WBD execs also saw their compensation increase

DAZN Weighs in With Content Ahead of Haney-Garcia Fight

By Jon Lafayette published

‘Run It Up’ is hosted by Rachel DeMita, Demetrious Johnson, Master Tesfatsion

Daytime Emmys Announce Some Nominations Early

By Paige Albiniak published

Entertainment magazines get early scoop in several categories

Fox Sports Hires Veteran Ad Sales Executives

By Jon Lafayette published

Jen Durda, Kathy Lydon named VPs

With Bears on the Clock, NBCU Local Chicago Plans Extensive NFL Draft Coverage

By Jon Lafayette published

Specials will air on NBC Chicago Sports, stream on NBC Chicago News

CBS Orders More ‘Elsbeth’

By Michael Malone published

Network green-lights a second season of Carrie Preston drama

DirecTV Stream To Carry Eight More The CW Affiliates

By Jon Lafayette published

More local stations in streaming lineup

Season 5 of ‘The Witcher’ Will Be Final One

By Michael Malone published

Production begins on season 4 of Netflix’s fantasy drama, with Liam Hemsworth on board

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below