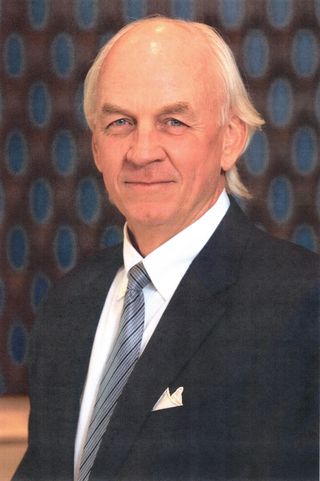

Brian Deevy

Brian Deevy’s career as a dealmaker can be summed up in just a few words: timing, luck and a little bit of yelling.

Welcome to the 28th Annual 'Broadcasting & Cable' Hall of Fame

The luck part started in 1981, when Deevy, working in Chicago as a VP at Continental Bank, got a call from a venture capital friend from Dartmouth’s Amos Tuck School of Business who said a cable broker in Denver, Daniels & Associates, was hiring. Deevy didn’t know much about the cable business, but after meeting founder and CEO Bill Daniels, he packed his bags and headed for the mountains.

“Working for Bill Daniels when I was 26 years old is the break that everybody wishes they had,” Deevy recalled.

Deevy joined Daniels in 1981, just about three years after graduating from the Tuck School. And though Tuck had a reputation for breeding media barons — former NBC chairman Bob Wright, former ATC chairman and CEO Trygve Myhren and former Time Warner Cable chairman and CEO Glenn Britt were all graduates — Deevy said that isn’t what drew him to the business.

Exciting Times

“There was a history there,” Deevy said of Tuck. “But the attraction was that it was a very fast-growing, very exciting time in the cable business, and Bill [Daniels] deserves his reputation. It was just the right time, right place.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Deevy said in his early days, John Saeman, who co-founded Daniels & Associates with Bill Daniels in 1958, ran most of Daniels’ businesses. But he did have an early brush with the cable legend.

“I had been there for just a couple of weeks, and if I sent you a note, I would initial it at the bottom, ‘BD,’ ” Deevy said. “After a couple of weeks, this shadow appeared at my door and Bill said, ‘Hey, just so you know, there already is one BD here, and it’s not you.’ I then went to [signing notes as] ‘BD2.’

“There was only one BD,” Deevy said, meaning Daniels. “He was a wonderful guy, a generous guy, he was the industry’s best salesman. Talk about an exciting time to arrive.”

Obviously going through all of the more than 2,000 deals, valued at over $185 billion, that Deevy had a hand in during his tenure at Daniels would be too wordy an exercise, although he jokingly offered to go through each one in excruciating detail.

A highlight reel, though, includes some landmarks. Putting together a consortium of five operators to purchase cable properties from Jack Kent Cooke in 1989 is one. Mediacom Communications’ purchase of Triax Midwest Associates in 1999 for $750 million and its purchase of AT&T Broadband properties in Iowa and the Midwest for about $2 billion in 2001 would also be there.

Mediacom chairman and CEO Rocco Commisso estimated that the Triax and AT&T deals alone make up about 70% of what is Mediacom’s business today. A longtime colleague and friend of Deevy’s, he remembers the former Daniels chief as a “topnotch person” with a unique sense of humor, a sense of fairness and a willingness to go toe-to-toe.

Taking Care of Clients

“He always did the right thing for me,” Commisso said of Deevy. “His primary job was to take care of the guy he was representing. We screamed a lot — don’t think everything was rosy — but we got it done. That was part of the culture, part of the game.”

Another longtime friend, former TCI president Leo J. Hindery Jr., took it a step further. “Who doesn’t like Brian Deevy?” Hindery asked. “Who doesn’t laugh at Brian Deevy jokes? Who wouldn’t go out of their way to be around him in business and as a friend?”

Hindery spent countless hours with Deevy during a busy period of cable business consolidation during the 1990s. Through the so-called “Summer of Love,” Hindery and TCI reshaped the cable landscape, completing dozens of system buys and swaps that tightly clustered the Denver-based cable operator and set the template for other operators, laying the groundwork for what would become the broadband business in the 2000s and beyond.

In an interview, Hindery said a lot of those deals involved system swaps which could be subject to difficult negotiations over their relative value.

“What can happen in these exchanges is it can be very reasonably done, or it can never get done,” Hindery said. “If I think my sister is inherently cuter than yours, there’s never an exchange.

“When Brian would walk in with me to Chuck [Dolan] or Jim [Dolan] or the Cox guys or Jim Robbins or Brian [Roberts], and he would say ‘Just do it, Leo says it’s a good deal, just do it,’ you knew he wasn’t lying to you,” Hindery continued. “Nobody walked away from a deal in which Brian [Deevy] was part of and thought they’d gotten screwed. Brian played the long game based on relationships and friendships, and he never played the short game based on transactions or deals.”

Deevy’s sense of timing kicked in again in 2006, when Daniels & Associates partnered with Canadian financial services firm RBC Capital Markets, about six years after Bill Daniels died. The partnership was initially called RBC Daniels, and later was absorbed into RBC Capital Markets and still operates today with offices in Denver and New York.

Deevy officially retired from RBC Capital in June 2015, taking a board of directors spot at Liberty Media offered to him by its chairman, John Malone.

“He [Malone] joked if I wanted to wait, there would probably be another [board spot] in 10 years,” Deevy said. “I obviously enjoyed working with him and the opportunity was terrific. I was thrilled to have been asked.”

Deevy was chosen to head the board’s Audit Committee, ensuring the company has strong internal financial controls. Being a board member doesn’t mean Deevy is taking a break — he said the pace at Liberty is still “a deal a minute,” and he wouldn’t have it any other way.

“Bill Daniels asked me at one point, was I happy doing what I was doing,” Deevy said. “Working for him was like you won the lottery, so I really wasn’t looking to do anything else. Now, getting to work with Malone and the Liberty board, I guess I won the lottery twice.”