Big News Audiences Drawing More Advertising Spending

WHY THIS MATTERS: With most TV ad sales mainly flat to down, news represents a growth area for many of the big network programming companies.

In these crazy times, advertisers are tuning into the news. News offers advertisers the kind of live, engaged viewing that encourages recall, and news ratings are more stable than most traditional TV programming, which has been eroding at a double-digit pace.

And with the midterm elections coming up in November, ad sales executives at the cable news networks are looking for big ratings numbers and big bucks in the upfront.

“The more I look at the way primetime and entertainment is going, I think we’re going to see a flood of money,” Marianne Gambelli, president for ad sales at Fox News Channel, said.

Read More:Finding Better Bang for the Cable News Buck

Gambelli said the money would flow toward news because that’s where the eyeballs are. News and sports are both live and have similar audiences, but news is cheaper on a cost-per-thousand-viewers basis. “So I think there’s going to be a lot of opportunity for news in general.”

Shining by Comparison

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

News ratings used to rise and fall based on campaigns, rising during election years — with presidential years doing best — and falling during odd-numbered years. The first year of the Trump administration created a bit of an anomaly. So far this year, ratings for all TV news programming is down 7% based on Nielsen data, according to Pivotal Research Group senior analyst Brian Wieser. But the ratings are up 7% from two years ago (before the election).

Related: Fox News Channel Recaptures Weekly Primetime Ratings Crown

This year’s decline is still much smaller than the double-digit declines being rung up by entertainment programming.

The cable news networks had record ratings last year, and so far this season they are racking up big increases in advertising revenue.

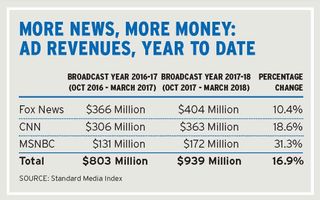

The three networks have generated $939 million in ad revenue this season, from Oct. 1 through the end of March. That’s up 16.9%.

The biggest network, Fox News, is up 10.4% in ad sales. CNN is up 18.67% and MSNBC has jumped 31.3%.

“CNN has historically been a must-buy for advertisers during presidential election cycles,” said Donna Speciale, president of ad sales at Turner, CNN’s parent. “We anticipate a number of advertisers to secure their position as an election partner early during the upcoming upfront cycle.”

Related: Speciale Sees Industry Turning to Data-Driven Audience Future

News from the Trump administration has given MSNBC in particular a big boost.

“The great news is that the scale of the audience isn’t hurting the quality of the audience,” said Mark Miller, senior VP at NBCUniversal and head of sales for its news group. The bigger ratings numbers haven’t diluted MSNBC metrics for engagement or brand awareness.

Miller said news in general offers immediate impact from live viewing and the ability to help marketers reach their ratings goals when they need to. “The news category is kind of defying gravity right now and is one of the few places where you can actually see audience growth,” he said.

NBCU’s news offering, he said, is unique because it spans broadcast, cable and digital properties. Recently, MSNBC did a show called Revolution featuring an interview with Apple CEO Tim Cook. Content from the show wound up on NBC Nightly News and Today, and it was used by other parts of the organization, Miller said.

Allstate sponsored it on MSNBC but NBCU didn’t have time to build a crossplatform package for Revolution. It could for other programs, if it’s appropriate for the advertisers, Miller said. “It’s about where can we do the most effective job against that audience, and that’s the combination of properties that they buy.”

News Grows On Digital

Miller said NBC News’s digital assets are growing, such as the Stay Tuned program it’s doing with Snapchat and the digital-only content created by NBC Left Field.

Read More: B&C's Commplete Coverage of the Upfronts

Many NBCU clients are buying across the company’s entire portfolio of broadcast and cable networks and digital properties. These days, news is a growing part of that portfolio.

“There’s no question that you’re seeing more advertisers and more categories looking at news and coming into news,” Miller said. “Absolutely people are starting to lean in because of the immediacy, the growth that we’re experiencing across the news genre.”

That growth will be accentuated by the midterm elections.

“We do expect this to be a very strong year. I think the interest in politics continues to grow,” he said. The network is working out the details of election news packages it will be making available to sponsors, Miller said.

Gambelli said Fox News is also working on its election coverage packages, but notes that the midterms usually don’t generate as much national spending as presidential years.

Though both are part of 21st Century Fox (pending the sale of some assets to The Walt Disney Co.), Fox News is separate from the Fox Networks Group. Specific advertisers have asked that Fox News be included in their bigger Fox deals, though, so the two groups will be coordinating on a case-by-case basis.

“We’re not going to market together, but on certain clients we’re targeting and working closely together,” Gambelli said.

During its upfront presentation, Fox News will be emphasizing that news is hot and making noise at the watercooler. And while advertisers are increasing their news spending across the board, Gambelli said Fox News is the leader for a reason.

“I think the one that we can prove is that if you watch Fox News you probably don’t watch any other news outlet, where we believe if you watch a CNN or an MSNBC you’re probably skipping around,” Gambelli said. “I don’t think you’re going to get that audience anyplace else, so it makes it unique. Ours is very passionate, very loyal. And we sell a lot of products.”

CNN’s upfront theme is that people have a need to know, particularly in this unprecedented time, said Donna Speciale, president of ad sales for Turner, CNN’s parent company. “We’re underpinning the value of reliable and accurate news to our culture, and the halo effect this trust creates for our brand partners.

“Brands that advertise on CNN are more trusted than those that advertise on our news competitors, and 70% of digital news consumers’ conversations about brands are positive,” Speciale said.

“We’re also doubling down on how advertisers can leverage our powerful cross-platform content, live environments and cutting-edge technology to own cultural moments in a big way,” she added, noting that last year CNN introduced live ads as a new product and executed big programs that aligned with both the eclipse and New Year’s Eve. The results were phenomenal with consumers overwhelmingly preferring the live ad experience to traditional commercial spots.

Speciale said CNN’s primetime, general news and original programming slate are an important part of Turner’s portfolio sales, along with its data-driven sales based on targeting audiences that are likely to buy specific products.

While Turner does not break out CNN’s share of the company’s revenue, Speciale said 2017 was a record year for Turner in terms of audience and ad sales.

“This is especially impressive, as we were coming off an historic election year. With news remaining a necessary — even, arguably, a more important — part of our culture, we anticipate this momentum to continue in this year’s upfront,” she said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.