Big Data Dream

When does Big Data become too much data?

For the first time this year, the Internet will break the Zettabyte Barrier--a total 1.1 zettabytes of data will course through the veins of the Internet by the end of 2016. The Library of Congress, the second-largest library in the world, holds 160 million items, including 24 million books. A zettabyte is the equivalent of three million Libraries of Congress.

Media and entertainment companies are at the forefront of efforts to harness the tidal wave of Big Data and turn it into a wealth of new insights, as the audience fragments into millions of individual pieces. "It's not just about viewership anymore, it's targeting, recommending models, personalizing engines, watching Hulu and Netflix, and having content suggestions," says Thomas Siegman of RSG Media, which advises content companies. "It's an air of personalization versus just figuring out what people are watching."

The secrets unlocked by Big Data open up new ways to engage emotionally with consumers at a deeper level, deal with their desires and anticipate their next wishes. "There's an opportunity to subtly influence the influence-able [and] actually create needs, wants and desires," says one expert.

This Big Data Insight report is the first of a series of four columns in Broadcasting & Cable and Multichannel News, sponsored by RSG Media. Its tools help content creators—cable and broadcast networks, production studios, cable systems, sports leagues, and videogame networks—make sense of the massive amounts of data spun off by the mobile boom.

Today's technology environment is a marketer's Big Data dream. There are now more than 2.6 billion smartphones worldwide. It's like having Little Brother in your pocket, tracking almost every move as people watch TV, interact with two million apps, a billion websites and link up with Facebook friends.

Solving a Mystery

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

This individualized data mother lode closes the gap between what consumers say they do and what they really do. Thus the black art of content creation and scheduling is morphing into an automated science of predictive analysis and data-driven decisions. In the 1980s, we were thrilled by the magic gut of the late Brandon Tartikoff at NBC. Today, aided by experts at RSG Media, networks are beginning to rely more on the latest in machine learning and artificial intelligence.

At RSG, the heart of this effort is the Big Knowledge Platform, an analytics engine that melds together more than 50 disparate data streams to form a bigger picture, smoothing the feeds and sifting for keener intelligence and new opportunities. The Big Knowledge analytics engine navigates mountains of information on Nielsen and Rentrak TV ratings, Crackle plays, Hulu streaming, Twitter trends, Facebook feeds, Experian credit-card activity, iTunes and Android downloads, ad views on the Doubleclick, and Freewheel platforms.

The Big Knowledge platform can define predictive models for viewer behavior, monitor cross-platform viewing habits, and cross-analyze viewing with purchase behavior and social media trends. It also shows them how to schedule programs to lower costs, rev up ratings, and build audience flow; single out the most impressionable viewers and engage them to watch more; target promotional spots to convert more viewers while consuming less airtime; and direct the right ads to the consumers most likely to respond.

One Big Knowledge app—a "machine-learning scheduling optimizer"—tracked historical ratings across a three-year span to learn year-over-year trends and seasonal consumption habits, then applied its smarts to an eight-week span, simulating various scenarios. The Optimizer crunched through options for airing 50 different half-hour episodes and 80 hour-long shows across six different genres to fill the 30 half-hour slots of primetime TV from 8–11 p.m. Monday to Friday. The resulting model yielded a 4% boost in viewership, which would bring in an extra $6 million a year. Better yet, the app runs on its own and can make these decisions hundreds of times a week.

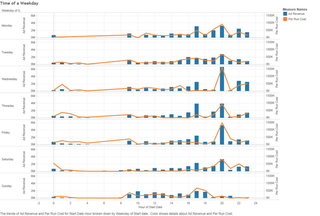

Another feature weighs ad revenue against the cost of airing an episode, aiming to push a deficit into the black. That yields some sharp contrasts.

For one cable network that prefers to go unidentified, ad revenue is highest in the 8 p.m. hour (at an average of $4 million), but so is the cost of airing an episode (nearly $1.5 million). Yet the 5 p.m. hour holds the highest profit potential—programs cost less than $500,000 to run, but ad sales are five times as much, at $2.5 million, nearly double the returns at 8 p.m.

Burying Billy Madison

For one movie, National Treasure, starring Nicolas Cage, a three-hour run at 7 p.m. on a September night costs no extra fee but gets ad revenue of $270,000. A run at 11 o'clock the night before, when the run cost was $300,000 and ads brought in just shy of $178,000, triggers a $122,000 loss. Under this app's lens, the man-child flick Billy Madison, however much you love the loopy comedy of Adam Sandler, is a money-loser in some time slots, no matter how many viewers it holds.

RSG's Advant ad platform automatically schedules ads to reach the right kind of viewers at the right time at the best cost. It also isolates how much more a network can charge for ads for premium brands, calculates a minimum price below which a network should refuse to go, and sets out how much inventory you should hold back for later. That's time that can be sold as advertising to generate extra revenue.

The bigger upside, though, is conversions—reaching those viewers who are most open to your come-on. "We're talking conversions, we don't just want you to see that promo, we want to make sure you watch that new show," says Shiv Sehgal, a solutions architect at RSG Media. "It's all about targeting the right promo to the right person at the right time to watch that show—that's the difference maker."

Dennis Kneale, a former anchor at CNBC and Fox after two decades at The Wall Street Journal and Forbes, is a media strategist in New York.

Related Stories:

The Big Data Gold Rush: Will Wall Street Be Left Behind?

How to Use Big Data to Get a 360 View of Your Customers

How ‘The Revenant’ — and Big Data — Will Change Movies Forever

Election Tech 2016: How Social Media and Big Data Changed Everything, a Q&A With Joe Trippi

GE Global Innovation Barometer 2016: 61% of Execs Using Big Data & Analytics to Improve Decisions