23% of Subscribers Would Drop if Netflix Had Ads

Netflix subscribers aren’t chill with the idea of adding commercials to the streaming service.

In a new study from Hub Entertainment Research, 23% of current Netflix subscribers said they would definitely or probably drop the streaming service if ads were included for the same price they’re currently paying.

Just 41% said they would definitely or probably keep Netflix. The others were undecided.

There has been speculation that Netflix might eventually have to stream commercials because it is currently borrowing money to pay for its programming and it will be facing increased competition from The Walt Disney Co., NBCUniversal and other media companies planning to up their direct-to-consumer businesses.

Netflix would get a better reception for commercial if it lowers its price by $2 or $3 a month. At $2 less per month, 53% said they’d keep Netflix and 14% said they would drop.

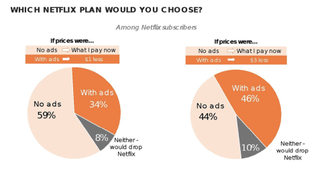

If Netflix added an option of an ad supported version at a price that was $1 lower per month, six in 10 subscribers would choose to stay ad-free, with one in three picking the ad supported product.

If the price was $3 lower, more people would choose ad supported than ad free.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“The success of any Netflix ad-supported plan—whether to replace or add to its current offering—will naturally depend on whether consumers feel they’re getting a sufficient price-break return on their ad-viewing investment,” said Peter Fondulas, principal at Hub and co-author of the study. “But one thing is clear from these results: after one increase already in 2019, any attempt by Netflix to use an ad-supported plan as a reason to hike its ad-free price again could seriously backfire.”

The data come from Hub’s Monetization of Video study, conducted among 1,765 U.S. consumers with broadband, who watch at least 1 hour of TV per week. The data was collected in June 2019.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.