Tech Pay Dirt or Fool's Gold?

RELATED: Swimming With the Giants: Venture Capital's Top Media Targets

Happy days aren’t yet here again, but these are certainly better times than the media sector has enjoyed for several years. Stocks have hit all-time highs, tracking the record-setting Dow Jones Industrial Average. And in just the first two months of 2013, more than $100 billion in mergers and acquisitions have closed in the media, tech and telecom space, according to Dealogic. This includes signal deals for the television business, such as Comcast spending $16.7 billion on a fast-tracked buyout of the rest of NBCUniversal.

And yet, under the relentless scrutiny of Wall Street, the pressure has never been greater for media companies to continue to innovate and stay competitive with the forces of social media, gaming and mobile technology. Historically, Big Media has tried to buy its way into those worlds (Hello, AOL and MySpace!), but the emphasis in recent years has actually been on small investments and relationships that can add up over time. By ponying up less than $25 million, many big TV and multichannel players have made the reasonable bet that these deals will have an outsized impact on the future of TV. And by taking small stakes in emerging technologies, broadcasters, major programmers, studios and multichannel providers hope to acquire the technologies and skills they need to transform their businesses so they can better capitalize on the rapidly changing landscape.

“I tell my team that we are the Lewis & Clark and the Magellan of Comcast,” says Amy Banse, managing director and head of funds at Comcast Ventures, which has taken stakes in about 10 start-ups since early 2012. “We are exploring cutting-edge technologies, interesting innovations, disruptive trends and the entrepreneurs who are bringing those technologies to life.”

Investment targets vary widely depending on the company’s business, but are frequently focused on efforts to distribute more content to more devices and develop new advanced advertising systems. These would include consumer-focused startups focusing on social media, second screens and original online video, as well as pure technology plays for things like advanced advertising platforms to better target users, improved search and discovery, social media analytics, multiplatform video distribution and compression and cloud-based technologies.

Once an investment has been made, companies such as Comcast, Time Warner, Hearst and Disney will introduce the start-ups to their operating units, which often deploy their technologies. These deals provide the initial gains, much-needed revenue and credibility, which in turn boosts the value of the venture fund’s investment and gives its parent company access to new developments and efficiencies.

Rachel Lam, senior VP and group managing director, Time Warner Investments, notes that about three-fourths of the companies TWI has invested in have been “successful in striking up partnerships with our operational units.”

“We are in a marketplace where technology is aggressively changing everything about how consumers experience our product,” notes Thomas Gewecke, president of Warner Bros. Digital Distribution. “It is really valuable to us to be more involved in how that change occurs and be directly involved in making some of those companies a success.”

Funding the Future

Most analysts applaud the trend as a way of adapting to the rapidly changing technological landscape. “We’re living at a time when three months is five years,” says Debra Sharon Davis, president and CEO of the Davis Group, who has worked on a number of strategic alliances between big media companies and tech start-ups. “For major media conglomerates, not taking risks [in new technologies] is a greater risk.”

To capitalize on those changes, Comcast, Disney, Hearst and Time Warner have all had venture capital units for a decade or more, though the pace of their investments has picked up considerably in the last two years.

Meanwhile, a number of media giants have also acquired large online and digital operations. CBS Interactive, for one, is now “a top-10 Internet company with over 400 million monthly users” across 25 Internet properties, notes company president Jim Lanzone.

Over time, the deals have also brought with them a supplementary “heap of tech and native Internet talent” that has been very important in building up the network’s digital and social media efforts, Lanzone adds. “Our experience in social media has definitely played a part in driving tune-in of the shows,” he says.

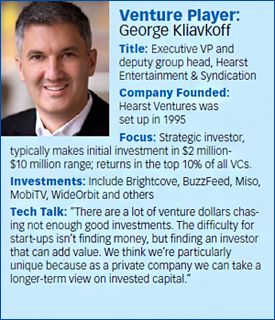

In terms of financial returns, while none of the media-backed venture funds release specific numbers, all cite industry-beating returns. “We have had tremendous financial returns, and would be in the top 10% of all VC [venture capital] firms if you just measure the financial return,” says George Kliavkoff, executive VP and deputy group head of Hearst Entertainment and Syndication and leader of Hearst Ventures.

Gauging the impact on their operations is even harder. Many start-ups fail, and picking next-generation technologies in a rapidly changing consumer electronics landscape is tricky. Nor is it clear how well these start-ups will fit into the needs of large media companies or how fast these giants can pivot their operations to take advantage of their innovations.

James McQuivey, a principal analyst at Forrester and author of the book Digital Disruption: Unleashing the Next Wave of Innovation, recently published via Amazon, hails these investments as an effort by big media companies to embrace change. But he also cautions that by virtue of their corporate DNA, they “can shape the [process of] innovation in a way that would inhibit promising entrepreneurs. Some of these venture funds have been around for a long time, and it isn’t clear if it has given them an edge.”

The Innovator’s Dilemma

To address these obvious risks while pursuing the larger goal of speeding up the pace of innovation, companies have adopted a wide range of strategies for working with tech start-ups.

Some companies—notably Comcast, Disney, Hearst, Time Warner and Time Warner Cable—have set up separate venture capital units for making these investments. Others, such as Discovery and News Corp., have not taken the step to formalize such efforts into separate venture units. A number of companies, including Fox and Viacom, tend to work with start-ups on specific deployments without taking equity stakes.

All of the major media companies continue to invest huge sums in their own internal technical infrastructure. “By far our largest investment in technology is internal, where we probably spend half a billion a year on technology that really powers the content across all of our operations,” says Wade Davis, chief financial officer at Viacom. “That dwarfs the external investments.”

Davis notes that Viacom has not set up a venture fund and that cash investments that have been made in companies such as social media provider Zeebox are only a small part of the equation.

“We haven’t set up a venture business because we’re entertainment companies, not a venture capitalist,” Davis says. “First and most importantly, we’re looking to partner with companies that will help our business flourish….Yes, we made a cash investment in Zeebox, but cash investment pales in comparison to the other operational resources we offer in that partnership.”

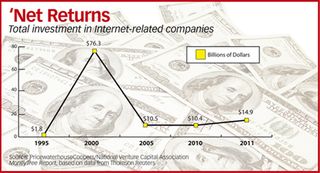

Generally, these investments tend to be small and are targeted to achieve specific objectives. This is a major change from the 2000s, when companies tended to make larger acquisitions, like News Corp.’s disastrous $580 million acquisition of MySpace as a way of buying its way into a promising sector. News Corp. eventually sold MySpace for only $35 million. Time Warner’s Jeff Bewkes wound up using Bebo as a rueful punch line in the aftermath of the ill-fated, $850-million purchase in 2008 of the Euro-centric social media platform.

“There is much less elephant-hunting going on,” says JB Perrette, Discovery Communications chief digital officer. While Discovery has not set up a separate venture unit, it has created a small team in its emerging business unit to scout for investments and technologies.

As part of that effort, Discovery acquired online video creator Revision3 last May and took a stake in the online mental fitness game provider Lumosity during its Series D round of funding last August.

Both deals complement the company’s existing focus on nonfiction programming and “the knowledge space,” while providing Discovery with expertise that will help expand its online and digital operations, Perrette explains.

Similar sentiments can be found at Turner Broadcasting System, which has also been investing in online video producers, taking a stake in Funny or Die in May 2012 and spending around $175 million last August to acquire Bleacher Report, a provider of sports websites.

“In the U.S., the primary investment strategy is around building and complementing the digital scale that we have,” says Trey Turner, senior VP of finance for mergers and acquisitions and investments at Turner Broadcasting System.

For example, the stake in Funny or Die will expand the digital presence of Turner’s entertainment brands TNT, TBS and Adult Swim. And as part of that deal, Turner will be handling ad sales for Funny or Die. “It pairs the digital traffic they can bring with the access we can provide to large advertisers,” Turner says.

Media Camp Expands

Turner has also launched an innovative program to work with very early stage start-ups called Media Camp. As part of the Media Camp program, the company takes a small stake in start-ups that are then given extensive access to Turner executives over a 12-week period.

This year, the program was expanded to include Warner Bros., which will run its own Media Camp with start-ups and studio executives in Hollywood, notes Darcy Antonellis, president and CTO of Warner Bros. Technical Operations. While they make a small investment in the companies, the main goal is to help their executives work better with the new companies and speed the process of innovation. “We are the glue between the start-ups and the media world, to help the start-ups understand the media world and where they can help us,” says Balaji Gopinath, VP of emerging technology, Turner Broadcasting System.

A number of executives see direct equity investments as lower priority, however. While News Corp. has a long history of investing in tech companies and Fox spends a great deal of time meeting with start-ups, the network prefers to work with a wide range of companies without taking equity stakes.

David Wertheimer, president of digital, Fox Broadcasting, notes that start-ups have access to many sources of venture capital funding, reducing the need for Fox to help them along financially.

“We do talk about taking equity, and have occasionally done it,” Wertheimer says. “But we believe that it is better to find the right technology and the right company and work with them, rather than being locked into one company just because we have made an investment in them.”

E-mail comments to gpwin@oregoncoast.com and follow him on Twitter: @GeorgeWinslow

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below