The New TV App Economy: The Buzz Meets the Bottom Line

RELATED: View Along the TV App Landscape

Ask Erik Flannigan, executive VP of digital media for the MTV Networks Entertainment Group, about the importance of apps, and he comes back with a quip that could easily become a Comedy Central routine.

“We joke about our researchers going into the homes of young men and finding iPads loaded with apps, but no spoons in the kitchen,” he says with a laugh. “But it really shows how important these things have become to their lives. The tablet has been in the market less than a year and a half, but for our audiences it already has the importance of the Xbox or PlayStation—devices that these guys were basically weaned on—and apps are an enormous part of that.”

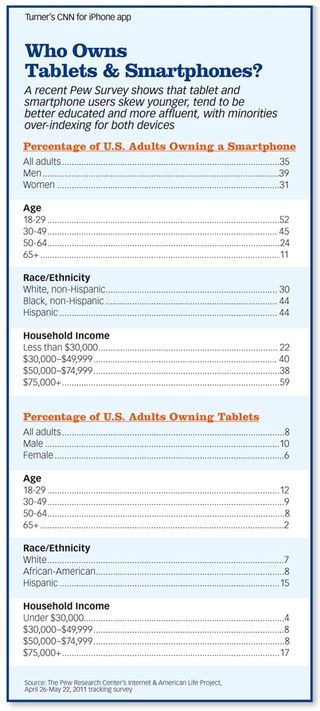

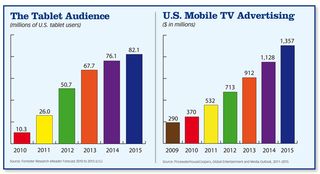

So important that some of the numbers surrounding the app craze are simply mind-boggling. With Forrester Research predicting that 26 million Americans will own a tablet by the end of 2011 and SNL Kagan estimating that another 122.2 million will own a smartphone by year’s end, tech research company Gartner expects that there will be some 17.7 billion app downloads worldwide by the end of this year, more than double the 8.2 billion cumulative downloads at the end of 2010.

By 2015, Gartner is predicting some 185 billion app downloads, or about 26 apps for every one of the planet’s 7 billion residents.

Unfortunately, however, dollars haven't proliferated as rapidly as downloads. “People love apps and are using them like crazy but the revenue hasn’t quite followed,” says John Fletcher, the lead analyst on SNL Kagan’s 2011 edition of the Economics of Mobile Programming report, which details mobile video revenue for approximately 30 TV companies and content owners. “This is a very promising area, but we are still in the early days.”

Gartner is predicting global mobile app revenue in downloads and advertising will hit $15 billion in 2011. But SNL Kagan’s data shows that U.S. TV players are likely to get only a tiny fraction of that cash and uncertainty over the industry’s development can be seen in the fact that other researchers are serving up much lower numbers.

The Yankee Group believes the U.S. app sector only brought in $1.6 billion in 2010, a figure that will grow to $11 billion in 2014. IHS Screen Digest predicts that the four major app stores that account for most of the business will produce only $3.8 billion in global revenue in 2011, growing to $8.3 billion in 2014.

Mobile advertising, which is particularly important for TV-related apps, also remains small. PricewaterhouseCoopers puts the U.S. mobile TV ad spend at $532 million in 2011, expanding to nearly $1.4 billion in 2015; considerable growth, but still a rounding error in the total U.S. TV business.

Among the 25-plus analysts, programmers, researchers, producers, broadcasters and top media executives interviewed by B&C on the emerging app economy, some players like ESPN, Disney/ABC Television Group, CNN and the Weather Channel are already producing significant revenue from their mobile efforts, and even those who are just getting started see apps as an essential part of their future.

“We see a tremendous opportunity in sports both with the browser experience for mobile Websites and with the explosion of apps,” says John Kosner, senior VP/general manager, ESPN Digital and Print Media, which has about 40 people working in the mobile area.

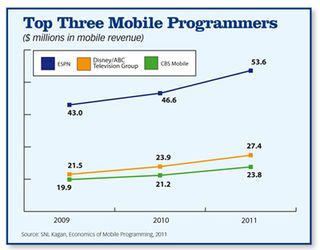

SNL Kagan ranks ESPN at the top of its list of mobile video programmers and projects that ESPN’s mobile revenue will hit $53.6 million in 2011, up from $36.7 million in 2008.

But even the most successful companies also stress that they face significant challenges, not least of which is the fact that the TV app economy— which only really began to take off when Apple launched its App Store in July, 2008—is changing at lightning speed.

“You can have an innovative app in the marketplace and six months later it can feel completely out of date,” says Flannigan at MTVN, which has released 168 apps.

Left to Their Own Devices

One example of the rapid change is the proliferation of devices. Most programmers are still concentrating on Apple’s platform, which dominates the app business and will account for about 76% of the app store revenue in 2011, according to IHS Screen Digest estimates.

But Google’s Android has now surpassed the iPhone as the dominant operating smartphone system with 36% of the U.S. market in the February-April, 2011 period, the most recent data available, versus 26% for Apple’s iOS and 23% for RIM, according to Nielsen.

Meanwhile, more than 75 new tablets were announced at CES this year and a new study from Strategy Analytics indicates that Android tablets grabbed 30% of the tablet marketplace in the second quarter of 2011.

While this proliferation reflects the huge demand for video-centric tablets and mobile devices, many of these machines use incompatible operating systems, which can signi! cantly add to app development costs.

The Weather Channel, for example, has more than 500 devices running in its labs at any one time to make sure all the different devices and operating systems work well with its apps, which have been downloaded some 53 million times.

Costs also vary widely but can be considerable. “To do a complete app at our scale that is designed to handle 20 million to 40 million uniques a month, you are talking about seven-figure development costs at least,” says Cameron Clayton, executive VP of digital product, the Weather Channel Companies. “You can go to a third-party developer and from $30,000 to $60,000 get a starter iPhone app that is very good for a single show. But if you are trying to do a large app for a whole series of TV shows or a network or cable channel app, you are de! nitely talking six figures.”

Big upfront investments make sense for companies like the Weather Channel, which racks up some 100,000 app downloads a day. But they can be a significant barrier for smaller producers or station groups that are trying to compete with national brands in the weather and news space.

Looking for the Right Model

Business models are also fluid. At the moment, most companies are offering a mix of free ad-supported apps and paid apps, with paid apps tending to involve games or premium content.

Nickelodeon, for example, has released more than 40 games that have been downloaded some 25 million times. “Our primary focus has been on games, which are paid, but as we expand our content apps, the focus will be more on free and ad supported,” says Steve Youngwood, executive VP and general manager, digital, Nickelodeon Kids and Family Group.

Likewise, History channel went the paid route for its Civil War Today iPad app, which was launched on the 150th anniversary of the conflict, says Dan Surratt, executive VP of digital media at A+E Networks, who says they are looking at a mix of free, paid and subscription apps going forward.

Generally, broadcasters, cable programmers and producers have free, ad-supported products for apps that are tied to programming in the hopes of reaching the widest possible audience for sponsors or promotions.

The ABC Player app and the ABC app for Grey’s Anatomy, for example, were both ad-supported, says Albert Cheng, executive VP of digital media, Disney/ABC Television Group.

But Cheng also sees opportunities for a mix of ad-supported and paid apps, a route the company took with its Oscars’ app, which had free elements and a pay wall for additional premium content.

Others have switched from pay to free. After experimenting with paid apps, CNN moved last year to free apps, which has dramatically expanded the reach, with downloads passing the 10-million mark this July. “Ultimately we came to the conclusion that CNN is a brand that people expect to be everywhere and our strategy has been to get it in as many people’s hands as possible,” says KC Estenson, general manager of CNN Digital.

Many of these free apps are likely to be expanded in the 2011-12 season, as they play an increasingly important role in the promotion of the new fall slates, note executives at ABC, CBS and NBC.

“You are only going to see our investment in social and tablet mobile oriented apps increase,” says Zander Lurie, senior VP of strategic development at CBS, which launched the Star Trek PADD app in July that reached the No. 1 paid spot in the entertainment category of the App Store in 11 countries worldwide. “There is no doubt that apps have become a fundamental ingredient in engaging with fans of our shows.”

But measurement of mobile usage is still in its infancy and solutions to the problem seem at least a year or more away. “We have to be able to better measure usage,” CBS’s Lurie says, if the mobile sector wants to move beyond ad app experiments into a more mature business.

Another major issue is windowing. Lurie and others note that they need to be careful in terms of how they make content available so that it doesn’t hurt their much larger TV businesses.

“We have to construct a business model around apps that keeps the existing ecosystem healthy but provides a driver of new revenue,” he says, comparing their decisions making content available on apps to some of the decisions they’ve made about other digital distribution platforms. “Licensing current content to Netflix didn’t work for us, so you’ve seen us license a single-digit percentage of our library content to them for what we think is a good price.”

Answer Could Be Everywhere

One potential solution to the shaky business models of the current app economy is TV Everywhere products.

These apps require users to log in and prove that they are subscribers of a multichannel provider who has agreement for multi-platform distribution. Currently, Comcast’s TV Everywhere online product has 8 million authenticated users who have access to about 185,000 pieces of content from 100 networks, says Matt Strauss, senior VP/general manager of Comcast Interactive Media.

Migrating that scale to the app world will take time. Comcast’s Apple and Android apps for tablets and smart phones boast a much more limited number, with about 7,000 pieces of content, but Strauss notes that the amount of content continues to grow rapidly and that the app has been downloaded about 2.5 million times. “We think customers should be able to watch more content on these devices and authenticated apps are a great way to do that,” Strauss says.

These apps are attractive for programmers because they can be bundled into existing agreements with multichannel operators, preserving or perhaps even increasing their license fees and ad revenue because Nielsen is now providing combined TV, online, DVR and VOD ratings.

Among programmers, early examples of TV Everywhere apps include ESPN Watch, offering four live network feeds that includes most of the networks’ programming; and HBO Go, which has been downloaded nearly 4 million times since it was launched in February, and is now offered by operators that serve about 80% of HBO subscribers. Time Warner Cable and Cablevision are the only two major operators not to offer the option, which carries all of the pay services’ current programming.

In July, CNN also upgraded its free app to an authenticated version that provides live feeds of CNN and HLN to subscribers of multichannel providers reaching about 50 million homes, a number that should grow to around 70 million in upcoming months.

Turner is also planning authenticated apps for its entertainment nets that will feature extensive offerings of long-form on-demand content, reports Jeremy Legg, VP of business development of Turner Broadcasting.

“We are basically migrating our app strategy from a focus on shortform content to authenticated long-form content,” Legg says.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Window Into Strategy

These apps also raise a number of windowing issues. To promote both its programming and the HBO Go app, HBO recently made the second episode of True Blood available on HBO Go the day after the second season premiere, which meant the app users didn’t have to wait until the following week for the linear TV airing.

Generally, however, programmers seem to be following the pattern set by VOD windows, offering new episodes within 24 hours after the linear schedule. Now that Nielsen is offering bundled C3 ratings of TV, online, VOD and DVRs, they have an even greater incentive to make new episodes available online or via a TV Everywhere app as soon as possible.

Over time, the new TV Everywhere apps could, however, have a significant impact on windowing of free online content. On Aug. 15, Fox will change the way viewers can access its new episodes online. Episodes that had previously been available the following day for free on Hulu.com and Fox.com will become available all of eight days after their airing—unless the viewer is a subscriber to one of the multichannel providers that has inked TV Everywhere deals with the programmer, or a subscriber to the Hulu Plus premium service.

Dish Network is the first to have signed up for the new window and Fox is currently negotiating with others. If these talks end up producing additional revenue, other companies may consider changing the windowing of online content.

Beyond TV Everywhere apps, programmers are also increasingly looking at second-screen or coviewing apps as a potential way to offer interactive services and advertising. These apps allow a viewer to use a second screen—a tablet or a smart phone— that could access interactive features, chat, social media, additional information and other enhancements to the TV programming.

MTV Networks, NBC, ESPN, the Weather Channel and Disney/ABC are among the programmers that are experimenting with such apps. Two of these apps—ABC’s Oscar Backstage Pass app (which was part of the Oscar Digital Experience) and the Grey’s Anatomy Sync App for iPad—were recently nominated for Emmys in the outstanding creative achievement in interactive media category.

ABC’s Cheng argues that “the iPad could very well transform the way we think about interactivity and could finally provide interactive TV with a platform that works for consumers.”

But he adds a note of caution that these apps, when done right, require a great deal of work, which adds costs. The sentiment can be applied to the app industry as a whole, as it searches for the right way to make it all work.

“The big question is really scale,” Cheng says. “We really are in the process of ! guring out a business model that will allow us to scale this and build an interactive platform for advertisers.”

E-mail comments to gpwin@oregoncoast.com