A Divide That's Not As Deep As You Think

Predicting what's next for television is never easy. But in recent years, the rhetoric surrounding the industry's future has been particularly heated.

Travel to Hollywood and you'll find legions of studio and network executives who would argue this is a new Golden Age of Television, with record levels of viewing, advertising sales and multichannel TV subscriptions.

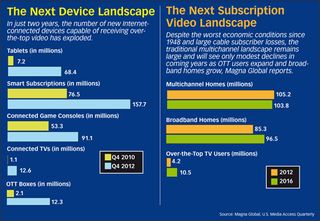

But take the freeway a few hundred miles to the north and you'll find plenty of Silicon Valley professionals ready to explain why studio execs really do live in La-La Land. Don't they know that digital media already wrecked the big record companies and the newspaper industry? With 184 million U.S. Internet users watching nearly 37 billion online videos each month, it's only a matter of time before broadcasters and cable operators fall off the same cliff, they'll argue.

"I look at the debate over the end of TV or the threat of digital as very similar to the polarization of American politics, where both arguments are to the extreme and the truth is somewhere in between," Albert Cheng, executive VP and chief product officer of digital media at Disney/ABC Television Group, said when asked by B&C about the subject during a keynote at the Banff Media Festival in June.

Some encouraging signs suggest, however, that TV and Silicon Valley players are working to overcome that divide, with companies such as Comcast setting up major operations in Silicon Valley and others like Microsoft working hard to collaborate with major operators and programmers on content deals.

But serious tensions still persist, illustrating the importance of finding a middle ground between traditional TV models and the revolutionary technologies.

In recent years, very different attitudes toward consumer habits and technology trends have translated into heated battles over Stop Online Piracy Act (SOPA) and Protect IP Act (PIPA) legislation, legal issues, copyright rules, regulations and business models that have hurt both Hollywood and Silicon Valley. (See Washington Watch for a closer look at these regulatory and legal issues.)

The fallout from these battles is particularly evident on the tech side of the divide, where companies such as Apple and Google struggle to realize their ambitions of becoming major TV players.

"The problem is that the tech companies have trouble understanding content," argued Bruce Leichtman, president and principal analyst at the Leichtman Research Group. "Apple has the highest market cap of any company ever, but they were never successful in video. And I think the core reason is that they don't understand the content model."

Lack of close ties with tech companies has also produced plenty of pain for the TV industry. For example, broadcasters trying to launch live broadcasts to mobile devices have struggled to get consumer electronics manufacturers to create phones and tablets capable of receiving them.

Worse, efforts to expand TV Everywhere offerings to make more content available on tablet and mobile devices have been significantly slowed by lack of ratings and the difficulties of putting metering systems into Apple's iPads and iPhones.

"We don't have measurement on critical Internet-connected devices like tablets," noted Coleman Breland, COO of Turner Network Sales. "For companies to make content available on all screens, the measurement needs to be there so we have ad models to fund that content."

Crossing the Great Gulf

But such problems are, fortunately, pushing players on both sides closer together. "You have this great divide, where one side has the ideal technology and the other side has the ideal content," said James McQuivey, a media technology analyst at Forrester.

By working within existing business models, Microsoft has been particularly successful in forging TV Everywhere deals for its Xbox gaming console with operators including Comcast, AT&T and Verizon and programmers such as ESPN, Fox and HBO, McQuivey noted.

Microsoft currently has more than 500 content deals worldwide and more than 75 deals for apps, added Blair Westlake, corporate VP of the Media & Entertainment Group at Microsoft. "What we share in common is the goal of reaching as many homes as possible," Westlake said.

Very notably, Xbox has also worked with Nielsen to set up a system for measuring usage on the units. That effort played a key role in convincing Viacom and other programmers to make their content available on the consoles via authenticated apps.

Samsung, Roku and others have also been forging extensive content alliances.

Eric Anderson, Samsung VP of content and product solutions, noted that "we now have around 25,000 developers in our community globally and somewhere north of 1,400 applications."

One particular focus of late has been second-screen applications designed to complement the live TV feed and TV Everywhere applications that make programming available on connected devices as part of larger multichannel subscriptions, Anderson added.

Roku has also been heavily focused on content, reported Roku founder and CEO Anthony Wood.

As part of that effort, Roku became the first over-the-top box to get the HBO Go authenticated app on its platform. This summer, the company cut a deal with Dish Network to partner on streaming international content. "The traditional incumbent [operators] realize Internet distribution is important, and it is important for us because content drives usage," Wood said.

Meanwhile, the major media companies and studios have moved aggressively into over-the-top video and digital media.

So far this year, Roku has attracted a $45 million investment from News Corp. and the U.K.'s largest multichannel provider, BSkyB; Discovery has purchased online content provider Revision3 and Turner has taken a 10% stake in Funny or Die.

Everybody Gets Into the Act

A number of so-called old media operations also boast very extensive new media holdings. CBS Interactive is now "a top-10 Internet property" with around 400 million users per month globally, reported Jim Lanzone, president of CBS Interactive.

Lanzone added that "the criticism that Hollywood or media companies have been slow to evolve is really too harsh. We have been careful to preserve our business models, but there has just been exponential growth in how much content is available today on all the different devices. Almost 90% of our primetime lineup is available on CBS.com for streaming."

Most notably, the TV Everywhere efforts that have been the focus of a number of recent TV/Silicon Valley alliances have been making considerable progress.

The HBO Go authenticated app has been downloaded more than 6 million times and is available to 98% of the company's subscribers, while Turner has TV Everywhere deals that put its content on multiple platforms with operators serving 77 million homes.

"When we started two years ago, a lot of people were wondering how this would work," noted Bernadette Aulestia, senior VP of domestic network distribution at HBO, who added that TV Everywhere applications have become a major focus of the company's talks with tech firms. "All the major brands have embraced the benefits of TV Everywhere and have seen what it can mean for them and the devices they can sell."

That progress was most evident during this summer's London Games, when NBCUniversal made much of the Olympics action available to multichannel subscribers as part of TV Everywhere deals.

Matt Strauss, senior VP of digital and emerging platforms for Comcast Cable, notes that the 2010 Vancouver Games produced about 3 million multiplatform views for VOD on television and online. In contrast, Comcast had about 50 million for the London Games, with about half coming from PCs, tablets and phones and the rest from video-on-demand. "It was a watershed moment in usage that marked the first time many people had tried these platforms," Strauss said.

The spread of TV Everywhere offerings are also part of much larger investments operators have made to boost broadband speeds and their capacity to deliver IP video.

Verizon has spent some $23 billion to bring FiOS fiber to 17 million homes, according to IHS Screen Digest, and cable operators have invested around $185 billion since 1996 on their networks, according the National Cable Television Association. By the end of 2011, cable operators had rolled out DOCSIS 3.0, a standard that is capable of delivering speeds of more than 100Mbps, in 77% of the cable broadband footprint.

Strauss also noted that Comcast opened an office in Silicon Valley to help speed up the pace of new product rollouts and to establish closer ties with tech companies. "We are clearly focused on building a bridge with Silicon Valley," he said. "The growth of TV Everywhere requires both collaboration between distributors and programmers and between operators and CE manufacturers that are supplying the devices that make it possible."

Over time, this will also be important in TV viewing. As operators move toward an IP infrastructure, they will be able to deploy a number of new features that can already be seen on AT&T's all-IP U-verse service.

"Being 100% IP allows us to do things very differently" in terms of offering interactive features, social media, apps and multiplatform content delivery, said G.W. Shaw, assistant VP of product management at U-verse.

Tensions Persist

But the embrace of digital media doesn't mean all the tensions have disappeared.

Mike Hopkins, Fox Networks president of distribution, grants that television's relationships with tech companies have improved and that they have become a valuable partner in making Fox's authenticated content available on devices such as iPads and Xbox.

"But when an industry creates a lot of products that seek to disrupt another, there is always conflict," Hopkins said. "If you want to work with us to enhance the consumer proposition in a way that supports our business models, that is fantastic. But if you start creating products that seek to undermine advertising, subscription, copyright and the way we can afford to make content, then there will be friction."

The ongoing shift in consumption of Internet or IP video also continues to put some pressure on business models.

"We are at an awkward point right now because consumer behavior on the face of it hasn't changed that much," noted Forrester's McQuivey. "Because people still watch a lot of linear TV, I don't think this industry understands how vulnerable they are to new business models."

One potential flash point continues to be over-the-top video. The rise of Netflix and the willingness by some programmers to make their content available online prompted widespread concerns a few years ago that the traditional relationship between programmers and multichannel operators would fray.

Those concerns have been muted by the rise of TV Everywhere. "The key impact of TV Everywhere has been to strengthen the ties between multichannel service providers and programmers," by providing a "financial model within the existing multichannel business to fund digital distribution, according to Ian Olgeirson, senior analyst at SNL Kagan.

The movement of high-pro" le TV content into OTT players such as Netflix or Amazon has also tended to simply create a new window for library content, according to Tom Gorke, Viacom Media Networks senior VP of content distribution and marketing. "We've approached it as complementary to the large businesses we've created on the traditional TV ecosystem," Gorke said.

But the rising popularity of OTT video could create new rifts. "We should not get suckered into the idea that there aren't tensions in the business model," said Howard Horowitz, president of consumer research firm Horowitz Associates. "These universes [for alternative video distribution and OTT video] are now big enough that they are important to the future of the business and are capable of introducing tensions in the business model."

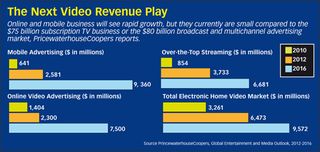

One important development is the rising investment in original online content. Here, the most high-profile effort is Google's decision to pump more than $100 million worth of funding into content for its YouTube channels. But companies such as Netflix, Hulu and Sony's Crackle are also increasing their investments in original online video.

"There is a lot of activity in that space," noted Eric Berger, executive VP of digital networks at Sony Pictures Television, which has been investing in a number of online originals. These include Jerry Seinfeld's Web series, Comedians in Cars Getting Coffee.

Funding for such content remains tiny compared to the bucks spent on traditional TV fare. But if online video advertising hits $7.5 billion in 2016 and the over-the-top streaming market grows to $6.7 billion that year, as PricewaterhouseCoopers is projecting, balances could shift.

That potential growth has already attracted some major new investments in OTT video. Above and beyond pure OTT players such as Netflix, Hulu, Google and Amazon, Comcast has launched Xfinity Streampix, Dish is bundling its services with the Blockbuster streaming service, Amazon continues to expand its Amazon Prime and Verizon is planning to launch an OTT service with Redbox.

"There is a meaningful market for OTT content distribution that is supplementary and complementary," said Terry Denson, VP of content strategy and acquisition at Verizon.

Denson believes Verizon's OTT service will allow the company to expand its footprint nationally and attract consumers who might not want a full package.

But as the OTT space grows, analysts wonder if some companies might try to set up "virtual MSOs," offering a bundle of channels over a broadband connection. "We are talking to a number of players who want to do that, and I think you will see some of them within a year," said Wood of Roku.

Getting enough content to have a competitive offering might be difficult today, but increased OTT revenue could change that landscape. "The TV industry has moved successfully past round X, but round Y is coming up," Olgeirson said. "They are not going to be able to rest on their past successes, because there are going to be continued challenges."

One immediate challenge is getting better measurement. Nielsen first announced that it planned to offer combined ratings for TV, online and other digital media in 2006 but rapid technological changes have complicated the effort.

Last year, the company added online viewing to its measurement system for linear TV, VOD and DVR viewing. But mobile devices have proved harder to chronicle, in part because Apple's proprietary platform doesn't currently allow Nielsen to put technology on the devices that could measure the audio codes used to track viewing.

Currently, Nielsen is working with Comcast, Cablevision, ESPN and Turner on a solution to the problem for measuring iPads, according to Brian Fuhrer, senior VP product leadership at Nielsen.

Initially, Nielsen is likely to work with developers to put some metering code into their apps, Fuhrer notes. He makes a very conservative estimate that this will allow them to begin to produce analytical data that is comparable with existing ratings by the second or third quarter of 2013.

This would be important because measurement for mobile is currently very different than TV ratings, making it a challenge to compare the viewing reported by TV channels with the video usage reported by over-the-top providers such as Netflix.

But this data won't initially be integrated into the C3 ratings used to sell TV advertising. To do that, Nielsen will set up a panel or method of sampling the tablet viewing data that is compatible with existing panels and is acceptable to both programmers and advertisers.

As a result, Fuhrer says integrating tablet measurement into the C3 ratings might not occur until early 2014. But he is hopeful it could be accomplished much sooner, and he stresses that a solution for smartphones could come shortly after the tablet measurement is established.

For the moment, tablet viewing is relatively small, researchers note. A survey conducted this summer by Horowitz Associates found that only 11.6% of respondents were viewing TV programming each week on a tablet. Even in the younger, more tech-savvy 18-34 demo, only 14.9% were watching TV programs on a tablet each week.

But several programmers stressed the importance of getting better measurement. "We are heavily dependent on advertising and want to grow the advertising model," said Viacom's Gorke. "Measurement has been a critical hurdle that the industry has to resolve if we want to make more content available on these devices."

Another critical issue will be the impact of TV Everywhere on the business models for over-the-top players. While Netflix and a number of other OTT providers offer subscription services, Sony's Crackle is ad supported and Hulu has playing with several business models.

In addition to its free ad-supported content, Hulu has launched the subscription service Hulu Plus. But two of the owners of Hulu, Fox and ABC, have also moved over the last year toward TV Everywhere models for making their content available online, with subscribers to multichannel providers getting faster access to shows.

Fox's Hopkins notes that they are currently making network content available one day after a show airs on broadcast to subscribers of operators that have cut TV Everywhere deals with the programmer.

As a result of that effort, Fox has deals in place with four operators that allow for authenticated subscribers to go to Hulu and access network content the day after a broadcast airing. Others viewers have to wait eight days.

"We would like to find a great way for pay-TV operators to participate in Hulu and we have several distributors that are now authenticating," Hopkins said.

"As a partner in that venture we would like to see Hulu evolve into a TV Everywhere business," he added. "We like TV Everywhere and we like Hulu and we think it would be great if they could coexist. But I think the jury is still out on whether the market will accept that."

Models in Flux

Business models for significantly expanding over-the-top content are also in flux. Google is investing $500 million in building a broadband fiber system in Kansas City that has reportedly attracted enough potential subscriber interest to convince the company to wire 89% of the city's "fiberhoods" by the fall of 2013.

But Google has also had trouble signing up major programmers for the service and it isn't clear if Google or anyone else could afford to expand the service nationwide, given the cost of wiring a market that is the 31st ranked DMA, and has only 939,740 TV homes according to Nielsen, less than 1% of the country's multichannel homes.

"Google gets a lot of attention but that is just a test that is not going to go anywhere beyond Kansas City," argued Leichtman. "You can have the best fiber system in the world but if it doesn't have half of the key content people expect, you are going to lose."

Roku's Wood argues that programmers are not going to unbundle their channels from traditional pay-TV operators and move to competitors like Google for "at least the next ten years. But I think that there will be fraying of the bundle with less bundling and different bundling options. Operators will try to use those to reach customers they are not reaching currently."

Growing investments in original OTT content could be important in some of these newer bundles.

Alex Carlos, head of entertainment at Google's YouTube, noted in an email to B&C that, "a few decades ago, there were a handful of broadcast networks that commanded 100% of the viewing audience. Then cable TV arrived, heralding a new phase in entertainment, and changing the economics of video forever. Cable created instant audiences for general interest areas like sports, music and news. Fast-forwarding to the present, we are now witnessing the next phase of video consumption, with the arrival of thousands of channels delivered by the Internet to any connect screen, with the potential to transform video once more. This new content will not compete with cable, but rather will complement it, offering thousands of channels built around niche interests with global audiences. Whether you're a creator, an advertiser or a viewer, it's a great time to be in this space."

Stay tuned.

E-mail comments to gpwin@oregoncoast.com and follow him on Twitter: @GeorgeWinslow

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below