Buying Into the Buzz

winslowbc@gmail.com | @GeorgeWinslow

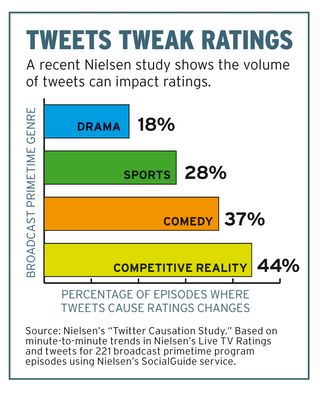

Nielsen’s recent finding that Twitter activity has a statistically significant impact on the ratings of many primetime episodes confirmed what many observers had long believed—social media activity needs to be a crucial component of any successful TV programming or advertising strategy.

But as social media assumes a more central place in the promotion of new shows, the process of tracking and understanding the activity remains a complex, often laborintensive endeavor.

"Social media measurement is very complex," says Trendrr CEO and founder Mark Ghuneim. "Each show, genre and audience has its own behavioral type."

Some of that complexity reflects demographic differences between various platforms. Public Twitter feeds are widely used by social media measurement companies. But that data can skew younger than other social media platforms such as Facebook, and exclusive reliance on Twitter feeds can lead to missing a lot of other social media activity, researchers say.

During a recent TCA presentation, CBS chief research officer Dave Poltrack cited a May 2013 Trendrr study that found the social media activity around broadcast programs was actually seven times greater on Facebook than Twitter.

It's Complicated

Those issues are further complicated by the growing use of visual media--such as photos, GIF files and video on platforms like Instagram and Tumblr--and the difficulties of analyzing particular words, adds Ben Carlson, president and cocreator at Fizziology. "It is not a problem that can be solved with a single computer program," he says.

Systems that simply add up mentions of the word "House," for example, would have a hard time determining if the mentions referred to the TV show, a home or a real estate ad.

To help overcome some of these problems, social media and research firms have been ramping up their capabilities, both with acquisitions and alliances. Within the last year, Nielsen has acquired the Social Guide measurement service and announced a partnership with Twitter to create a Nielsen Twitter TV Rating this fall. Nielsen also has a long-standing alliance with Facebook, which supplies demographic data for its Online Campaign Ratings service.

This year, Twitter has also acquired social media analytics firm BlueFin Labs; Shazam has launched new tools to measure engagement across platforms; Facebook is working closer with Trendrr to collect data on the social media conversations about TV shows; and companies like TRA are planning to expand their capabilities.

Facebook has been particularly active in strengthening the data it is providing to TV partners and advertisers as the amount of social media activity relating to TV programs takes place on its platform. There were, for example, around 10 million interactions relating to Discovery's recent Shark Week stunt on Facebook.

Such efforts are particularly important because "today as an industry we don't even know the total numbers" for social media interactions for TV programming, explains Daniel Slotwiner, head of ecosystem measurement at Facebook.

"Quantifying the amount of conversation across those social media platforms accurately is of paramount importance," he says.

As part of Facebook's efforts to provide better measurement, the company has been working on research that would show the importance of its the platform versus its competitors, and data that would prove Facebook-user value for TV companies.

That commitment explains its expanded working relationship with Trendrr, which will see Facebook supplying data on mentions of TV programs from public and non-public activity on its platform. Facebook will, however, compile the data based on keywords supplied by Trendrr, which will not see the posts. Some age and demographic information may also be supplied.

The ability to provide more information about users is one key advantage to using the Facebook data. "Twitter has a very open data platform but there is no way to really know the reach of a post or the engagement of a post," says Evan Krauss, president of the second-screen firm GetGlue. "With Facebook, users log in and you know how many saw a Facebook post."

The size of Facebook's audience is also important, with some 88 million to 100 million users logging into Facebook each night during primetime hours in the U.S.

But as the company pushes to better monetize its audiences, it will have to further improve the social media data it is supplying to advertisers and partners.

Pointing to widespread reports that Facebook is likely to start selling video ads for $1 million to $2.5 million per day, George Musi, head of cross-media analytics for multiscreen ad management company DG say,s "if they go that route and try to take money from the $75 billion TV ad business, then they are going to have to be much more open about providing data....If you want to make brand advertisers comfortable with their platform they will have to prove the effectiveness of the concept and be very open."

All About the Data

Better data is also a key component of Shazam's second-screen efforts. In June, the company launched a "Shazam Engagement Rate" metric to measure social engagement with TV ad campaigns, explains David Jones, Shazam's executive VP of marketing.

"We're sitting on a goldmine of data that can help clients know what part of their TV ad campaign is resonating," he says.

This can help with media buying plans in the future by showing which networks and shows are more effective in producing social engagement, and could also help tweak ad campaigns during their run, he argues. "If it is a long three- or four-month campaign, we can help them better understand how they might move around some of their TV ad spend to make it more effective," he adds.

Over time, such data will also be increasingly important to programmers looking to better promote their fare, says Elizabeth Breese, senior content and digital marketing strategist at the social media analytics firm Crimson Hexagon.

"In the future, I think you will see a much tighter relationship between social media and the programming and marketing departments, where they will be paying much closer attention to the engagement on social media," she says.

But Breese cautions that companies need to look closely at the data and the systems producing it. J.J. Abrams' new show, Believe, will be particularly challenging, "because it is such a tough word to analyze on social media," she says. "It is used in so many different contexts and you have to have an effective way to filter out all the irrelevant conversation. If you are just relying on key words or predefined rules, it will be almost impossible to understand the conversation."

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below