The 14 Names to Know in 2014

What always fascinates when we begin compiling our annual “Names to Know” list is the alchemic matter of timing: Who and what has seized a moment and will bring in viewers and/or bring about big industry change. Each of our choices—this year, from companies to corporate legends, from series to station execs, and from technologies to the land’s top court—must pass that test, but some choices may be more obvious than others. For instance, there’s no doubt FIFA will be in a league of its own in 2014, just as the somewhat ethereal Internet of Things will increasingly change the tech landscape now, and for years to come.

And in those years to come, we’re confident the 14 names mentioned here (in no particular order) will still be working their magic to shape the way content is created, viewed and distributed.

1. AMAZON

Jeff Bezos has had many breakout years in the two decades since founding Amazon. But 2013 was a particularly conspicuous time, with Amazon Prime’s first series launching (among them Alpha House, created by Garry Trudeau and starring John Goodman) and Bezos himself touting innovations such as drone delivery in an admiring 60 Minutes segment.

Still, why does Amazon belong on this list exactly? What makes it more than just another tech disruptor? In short: data. The rollout of Amazon’s first streaming series is certainly a milestone, and that content push will continue in 2014 and beyond under studios chief Roy Price. But what makes the company such a potent force capable of destabilizing the traditional media more than even Netflix has is the trove of customer insight it collects. Instead of merely driving apples-to-apples recommendation algorithms, the data is more multidimensional in the Amazon environment.

With a market cap of $164 billion, Amazon sells everything from appliances to orange juice to power tools. So the prospect of matching entertainment preferences to that purchase data has captured a lot of people’s attention. If it ramps up as many on Wall Street and in Hollywood anticipate, Duck Dynasty’s potency both on-air and in Walmart could seem almost quaint by comparison. —Dade Hayes

2. FIFA WORLD CUP

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

We call it soccer but for most of the world it is the real football, the sport everyone watches. More than 2.2 billion tuned in to at least 20 minutes of the 2010 FIFA World Cup, and the 2014 games in Brazil promise to be even bigger, both for the future of soccer in the U.S. and the Fédération Internationale de Football Association, or FIFA.

During the 2010 World Cup, viewing rose 19% in the U.S. versus 2006, the fastest growth of any measured market, with some 94.5 million watching at least 20 minutes of play. Results should be much better this time, given a better time zone (there is only a three-hour difference between the East Coast of the U.S. and Brazil, versus eight hours for 2010’s matches in South Africa) and rising interest in the sport.

That promises a big upside for ABC, ESPN and Univision, which have the rights to the 2014 tournament. But it poses no small challenges for Joseph “Sepp” Blatter, who began working at FIFA in 1975 and has been president since 1998. Critics have attacked FIFA for corruption, and the building of venues in Brazil has been riddled with problems. With FIFA presidential elections coming up in 2015, the reign of the one of the world’s most powerful sports execs is on the line. —George Winslow

3. MIKE HOPKINS | CEO, HULU

When Mike Hopkins was named chief executive of Hulu last year, the video streaming service’s owners left him a $750 million check to use to buy programming and build a business that wouldn’t hurt theirs.

Hopkins had been head of distribution for Fox Networks Group, part of 21st Century Fox, which is one of Hulu’s parents. Fox, along with Walt Disney Co. and silent partner Comcast, last July called off plans to sell Hulu, deciding instead to invest in the company, whose revenue reached $1 billion in 2013.

Picking someone with a distribution background appears to analysts to signal that Hulu’s strategy would be to work with distributors in streaming network content to consumers. Earlier this year, ABC started restricting next-day access to its primetime shows on Hulu to subscribers of Hulu Plus and pay-TV affiliates. Fox switched to that model in 2011.

Hulu has been using some of its new money to invest to buy library content. But a lot of its resources are earmarked for original content, making it even more of a potential rival to Netflix and Amazon as 2014 continues. “We launched more than 20 Hulu originals in 2013, and plan to double that number over the next few years. Shows like The Awesomes, Behind the Mask and The Wrong Mans performed extremely well on the service,” Hopkins said in a year-end blog post. —Jon Lafayette

4. THE INTERNET OF THINGS

The Internet of Things, or IoT, has become a growing buzz term in the tech industry. And now the idea of equipping almost everything with sensors so everyday objects can send data over the Internet to other devices is capturing the attention of major media companies. Many cable operators and telcos have already rolled out “smart home” services that allow consumers to use their mobile phones to control security systems and thermostats along with TVs and DVRs.

More is on the way, with consumer electronics manufacturers introducing Internet-connected refrigerators, washing machines, air conditioners and a host of “wearable technologies” that can monitor your health, fitness and everyday routine. By 2020, the research company Gartner predicts, the Internet of Things will grow to 26 billion units and that IoT products and service providers will produce more than $300 billion in revenue. The enormous amount of data collected by these devices could help channels better target ads and programs to a person’s lifestyle and physical state, perhaps pitching spa treatments or relaxing vacations when stress levels are high. But they also raise huge privacy issues and will require companies to make hefty investments in big data systems if they want to turn all that information into profitable apps and programming. —GW

5. GOLF ON FOX

Golf on television is often a painfully slowmoving, formulaic, stuffy enterprise that needs to sharpen its game with some fresh ideas. Fox Sports, which over the past 20 years has shaken up the way football, baseball and hockey are presented on TV, aims to have the same impact on golf beginning in 2015 through a new 12-year, reported $1.2-billion deal with the U.S. Golf Association for the sport’s prestigious U.S. Open and more than a dozen other pro and amateur events.

Last month, Fox tapped veteran producer Mark Loomis to lead its entry into the sport (Fox has never covered a golf tournament). The Emmy-winner produced telecasts of the sport’s major events for ABC and ESPN before spending the past two years at MLB Network as senior VP of production. (Loomis played golf at Vanderbilt University and still carries an enviable 2 handicap.)

Loomis will be in charge of building Fox’s golf crew and production style from scratch, much as David Hill built the net’s NFL presence in the mid-’90s. In keeping with technical

innovations like the FoxBox score graphic and the glowing puck in hockey, expect cameras and microphones on golf courses where they have never gone before, bringing viewers closer to the action. —Brian Moran

6. DAN LOVINGER| EXECUTIVE VP, ENTERTAINMENT ADVERTISING SALES GROUP, NBCU

As NBCUniversal continues to refine the way it sells its television networks as a portfolio of audiences, the executive with the trickiest assignment may be Dan Lovinger, executive VP, entertainment advertising sales group.

Last year, NBCU ad sales president Linda Yaccarino reorganized her team into content groups, with Lovinger’s unit overseeing the mass audience networks. That put the sputtering NBC broadcast network in the same bucket as top-rated cable channels such as USA Network and Syfy.

During last year’s upfront, USA was NBCU’s lightening rod, as Yaccarino pushed for broadcast level ad rates for off-network reruns of Modern Family. The sitcom so far has not drawn the kind of ratings that The Big Bang Theory has for Turner’s TBS, but so far NBCU has been able to keep media buyers and clients from squawking too much, with make-goods across its portfolio.

This year, USA will be selling Modern Family again, as well as a slate of new original comedies that launch in March.

Meanwhile, NBC is showing signs of ratings strength, although a lot of that has been due to NFL football. Still, armed with The Voice and The Blacklist, and the NBCU+ Powered by Comcast advanced advertising products, Lovinger should offer a good pitch for the Peacock. —JL

7. JOHN MALONE| CHAIRMAN, LIBERTY MEDIA

It’s not likely that John Malone will slink off the stage after a setback, even one that might be devastating to others.

After months of preaching the importance of scale and the virtues of consolidation in the cable business and offering up his pintsized Charter Communications as the vehicle to gobble up the much larger Time Warner Cable, Malone was caught flat-footed as Brian Roberts and Comcast swooped in and snatched TWC. The whipsaw leaves Malone in the awkward position of falling even further behind the industry leader in terms of clout and with few options of other cable operators to buy.

At 72, Malone has begun to plan what will happen to his holdings. But with stakes in companies including Charter, Liberty Media, Starz and Discovery, Malone remains a TV business force to be reckoned with. The man who coined the prescient notion of the 500-channel universe in the 1990s might yet be the first to spot a strategic opening to get back in the game. And given his reputation as a financial engineer, he might be able to find enough cash to close the deal. Failing that, Malone, the largest landowner in the country, has plenty of sunset to ride off into. —JL

8. SEAN MCLAUGHLIN| VP OF NEWS, E.W. SCRIPPS

The Scripps motto is, “Give light and the people will find their own way,” and the guy who will soon be holding the spotlight for the prestigious TV group is Sean McLaughlin. McLaughlin is departing his dual posts as executive news director and creative services director at KMOV St. Louis and will be tasked with pushing the Scripps stations—which include WCPO Cincinnati and WXYZ Detroit— to the next level of on-air and online content.

The high-energy news executive was a key player in taking KMOV from third to a tight race for first in über-competitive St. Louis, while bagging a National Murrow Award in 2011 for a documentary. Scripps senior VP of TV Brian Lawlor said McLaughlin brings “a ton of energy” and a knack for motivating people to bust their butts and win.

A key priority for McLaughlin, a former political reporter, is WCPO.com’s revolutionary paid-content model and the rollout of similar models at other Scripps stations. Stations will only get paid subscribers with truly standout content, and it’s McLaughlin’s job to make sure the Scripps news gatherers are producing stories that can’t be found elsewhere. It’s a big job at the growing station group. McLaughlin takes it on beginning March 6. —Michael Malone

9. @MIDNIGHT

It’s easy enough to sell this hot new Comedy Central series’ appeal on traditional merits: A game show from the folks at Funny Or Die, slotted seamlessly after The Daily Show and The Colbert Report, it possesses the same daily news-skewering sensibility of its lead-ins. Host Chris Hardwick (host of AMC’s Talking Dead) leads three comedian contestants as they cleverly crack wise on the Web news of the day. In the first three weeks for which data was available (last Oct. 21-Nov. 10), @midnight joined Daily Show and Colbert as the three most-watched series among men 18-34 and adults 18-24. Its median age is 32—the youngest of all late-night shows—and it returned in January with a 40-week pickup.

But it’s better to judge @Midnight by the only measure that counts, the LPM rating that’s older than Nielsen’s local people meter: laughs per minute. By that score, it kills, with hilariously caustic recurring themes and impulsive answers to news prompts (on the list of “Rejected Grammy Categories” was “Best New Gospel Album Even Though God Doesn’t Exist”). And when Adam Scott gives a serious read to a fake Amazon review of a product that’s sweetened with a chemical that may cause intestinal distress—well…you’ve been warned. And encouraged. —Robert Edelstein

10. THE NETWORK REALITY CHIEFS:LISA BERGER, ABC; CHRIS CASTALLO, CBS; SIMON ANDREAE, FOX; PAUL TELEGDY, NBC

Three of the Big Four broadcasters tapped new reality-programming chiefs last year. Those unscripted honchos will have plenty to do in 2014.

ABC’s Lisa Berger is busy prepping Rising Star, the network’s latest attempt to crack the music-competition field. The show’s realtime voting format will be a challenge to execute across four time zones, and Berger’s job wasn’t made easier when ABC entertainment group president Paul Lee set a June target for the premiere.

Chris Castallo of CBS must contend with the aging of franchises Survivor and Big Brother. His network, meanwhile, just ordered a Nigel Lythgoe-produced pilot of performance competition series In the Spotlight, adapted from a Turkish format.

So far this year, Fox’s Simon Andreae has picked up his first new series (Dutch import Utopia) and cleared The X Factor off his plate. But he still has to deal with American Idol’s ratings decline—the current season premiered Jan. 15 to a 4.7 live-plus-same-day Nielsen rating in adults 18-49, a series low for a premiere.

Meanwhile, the Big Four’s reality graybeard, NBC’s Paul Telegdy, looks to recover from the failure of The Million Second Quiz as he prepares to launch a new cycle of The Voice. He also has a little late-night transition to navigate. —Daniel Holloway

11. BRIAN ROLAPP| COO, NFL MEDIA

Brian Rolapp will become the NFL’s top media executive and president of its cable channel when longtime chief Steve Bornstein retires in May. Rolapp, a rising star at the league, has been active in quarterbacking advertising-supported digital and social media initiatives, including a recent content deal with Twitter’s Amplfy service, and with Verizon, Microsoft Xbox and other corporate sponsors on NFL Now, a personalized video network the league will kick off this summer.

Both programs represent big steps forward in mobile distribution for a league long highly protective of its digital rights. “The appetite for NFL content is borderline insatiable,” Rolapp said in announcing NFL Now before last month’s Super Bowl. Personalizing video highlights and news feeds for fans’ favorite teams and fantasy players, thus enhancing the content’s appeal for advertisers, is key to the NFL’s drive to grow mobile advertising revenue.

Rolapp, an 11-year NFL company veteran, also helmed the league’s recent negotiations to sell rights to eight early-season Thursday-night games from NFL Network. CBS won with a deal that reportedly will bring the league more than $250 million in new revenue next season. CBS got the Thursday package for one season as the league sorts out its long-range game plan for what Rolapp sees as a huge revenue-driver. —BM

12. THE SUPREME COURT OF THE UNITED STATES

The Supreme Court took the unusual step last fall of agreeing to take a case—Fox et. al vs. Aereo—where there was as yet no split in the federal circuits. The high court in 2008 declined to weigh in on the issue of remote access to content in the Cablevision case, saying it was not ripe for review.

It has ripened since then, and now the court could hold the fate of broadcasters, online video delivery, cloud storage and copyright law in its collective hands.

No matter which way the court rules, it will have major implications. The case is the decision of the Second Circuit Court of Appeals not to block Aereo. Theoretically, the court could simply rule narrowly on whether the Second Circuit Court had gotten that call right, rather than the underlying question of copyright protection. But it is more likely to weigh in on whether Aereo represents a performance subject to payment or not. If not, cable operators could adopt the model and bypass retrans payments. If so, it could threaten the cloud storage regime, though some say the court could rule more narrowly for broadcasters without dissolving “the cloud.”

Oral argument in the case is scheduled for April 22. —John Eggerton

13. LARRY WERT| BROADCAST MEDIA PRESIDENT, TRIBUNE

Larry Wert had been itching to run a station group for years. He recently got his wish—and then some. After Tribune closed on the biggest station deal of consolidation-crazy 2013—its $2.73 billion acquisition of Local TV—Wert went from having a big job to a Herculean one.

Entering his sophomore season with Trib, Wert—the former WMAQ Chicago GM and NBC owned group executive VP—oversees 39 stations reaching a whopping 44% of the U.S., including New York, Los Angeles and its home base of Chicago. And when Tribune spins off its newspaper group, which is expected to happen this summer, Wert should have the resources he needs to implement his strategy.

With the station group under his charge, Wert wields major clout with syndicators and net- works. Tribune is easily the largest CW station owner and is a Brobdingnagian Fox affiliate force as well. With those networks programming far fewer hours than the traditional Big Three, Wert has a vast canvas on which to showcase his programming innovation.

“Larry is a great marketer, salesperson, and content person—the triumvirate of things that matter in television,” said one TV veteran who knows him well. “And he gets how all three are related.” —MM

14. X1, COMCAST’S CLOUD-Y NEW INTERFACE

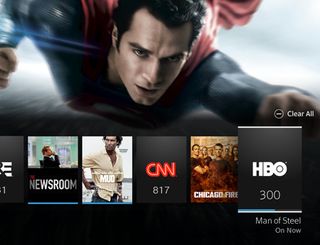

In the battle to preserve the pay-TV business from the twin threats of over-the-top content and cord-cutting, an important name to know in 2014 will be Comcast’s X1 platforms. Comcast rolled out the X1 cloud-based, IP-connected boxes and platform to most of its systems in 2013 and is now starting to make available the next generation of the system, which will offer significant improvements over the next year.

This newest iteration strengthens the traditional pay-TV bundle by offering consumers many of the benefits of the over-the-top IP world. It provides access to streaming content on the TV set; apps for social media, news, sports and weather; much-improved search capability; personalized recommendations; and a cloud-based DVR to stream live TV or recorded content to mobile devices and TVs in the home.

That could help the cable industry fend off challenges from companies such as Apple, Sony, Google or Amazon that might launch Internet-delivered bundles of subscription services and greatly speed up the pace of innovation. But it could also be good news for over-the-top services such as Netflix or Hulu Plus which could be streamed onto the TV via X1’s Internet connection. —GW