Cross-Catalog Search a ‘Must-Do’ for Pay TV Providers

Cross-Catalog Search — a capability that enables access to traditional linear TV as well as sources of over-the-top content — has become a growing desire of consumers, TiVo found in a new study that spotlights online video and pay TV trends.

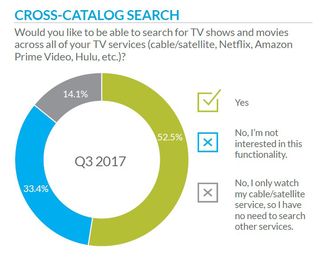

More than half (52.5%) of respondents would enjoy being able to conduct such searches, making them a “must-do” feature, TiVo noted in its Q3 2017 Online Video and Pay-TV Trends Report. The report tabulated results from more than 3,000 adults in the U.S. and Canada.

TiVo’s data also showed that respondents aged 23-25 had the highest interest level (73.1%) in this area, while 66.9% in the 18-50 group were interest in searching across multiple video offerings.

“With more than half of respondents already interested and with the rise of TV apps for smart TVs, pay TV providers may eventually have no choice but to incorporate cross-catalog functionality,” TiVo said.

Pay TV providers are responding to this trend. Comcast, Layer3 TV and Dish Network, for instance, have integrated select OTT TV services onto their respective set-top box platforms. TiVo has been championing the idea for years, as it already provides access to a range of streaming services alongside digital cable services on its leased and retail devices.

On the other side of it, multichannel video programming distributors are also building streaming apps for their pay TV services that can tie into retail products such as Roku players.

TiVo’s study once again highlighted the growing cord-cutting trend, finding that of those without any pay TV plan, 20.2% cut service in the past year. Regarding future churn, 5.4% said they plan to cut their pay TV service, while 7.7% said they intend to switch to another provider. Almost 6% said they intended to switch to an online service or app for their video needs.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Price, at 85%, is still far and away the main reason for cord-cutting. Of the nearly 83% of respondents who get pay TV service, nearly half (48.7%) said they pay between $51 to $100 per month for it.

The silver lining is that 31.7% of consumers said they are “very satisfied” with their cable or satellite TV service, up 7.7% year-over-year, while 17.5% said they are “unsatisfied,” down 3.5%.

Some 58.4% of respondents also said that access to an a la carte model or skinny channel bundle would convince them to stay with their current provider, making it the No. 1 feature that would keep them in place.

The average price U.S. consumers said they’d pay for a self-selected channel lineup is $34.45 per month, or $1.44 per channel, per month. On average, 24 channels represented the composition of their “ideal” lineup.

Of those without pay TV service, 45.9% said they use an antenna to watch local broadcast TV.