Taking a Free Ride With OTT

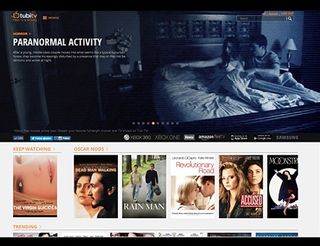

Netflix, Amazon and Hulu continue to gain subscribers for their over-the-top subscription video services, but other big players are starting to gain traction. Free, ad-supported services, including ones backed by the nation’s top studios, are freeing up more content for digital distribution and gaining viewers. Sony’s Crackle has been a leading video-on-demand light on the advertising front, offering a mix of licensed content and originals such as The Art of More, and Tubi TV, a service that debuted in 2014, also has been racking up viewers and studio deals.

Though subscription VOD services continue to gain steam, they are also subject to market saturation, as consumers tend to pick just one or two of them. That provides a big opportunity for free OTT services, Tubi TV CEO Farhad Massoudi said.

SUBSCRIBER SATURATION

“When we look at the landscape, and even the current viewership of OTT, most consumers only have one SVOD app,” he said. “I don’t see consumers signing up for more and more packages,” Massoudi added, noting that a combo of Netflix, HBO Now and Sling TV, plus $50 for the underlying Internet connection, puts the total monthly nut in the neighborhood of $100.

That will open the door to growth for ad-supported offerings, Massoudi noted, adding that programmers and studios continue to boost their digital spending. “But they want to make sure it’s premium, and they want to make sure it’s delivered in a safe environment,” he said.

Though Tubi TV is an on-demand service, usage patterns tend to mimic that of a traditional TV channel, peaking between 6 p.m. and 9 p.m.

“We’re very much like a TV property,” Massoudi said. “We’re a TV network, but in a medium that has flexibility and functionality that goes beyond the traditional TV network.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

San Francisco-based Tubi TV is privately held, so it doesn’t divulge financial data, but claims its audience has been growing by 30% on a month-over-month basis.

The service attracts “millions of monthly visitors,” Massoudi said, noting that the average user session on a connected TV device is more than an hour, though typically much shorter in length on mobile devices.

Where Tubi TV claims to stand apart is in the audience it attracts: Coveted millennials and a growing group of cord-cutters, the company said, as well as consumers who don’t subscribe to a traditional pay TV package.

Massoudi said Tubi TV has managed to sell out its inventory (Massoudi’s AdRise division has its own programmatic OTT ad platform that implements real- time bidding), but acknowledges that the company is not yet in the black.

“We tripled the size of the team in the past six months,” he said. “If we had not done that, we would be profitable now. We’re focused on growth right now, not so much on profitability.”

What Tubi TV also isn’t focused on, at least not yet, is the development of original programs and series — something that has become a strategic cog in the engines of other OTT providers, including Crackle, Hulu, Netflix and Amazon.

Tubi TV likens its trajectory to the early days of Turner Broadcasting System.

“They started out by buying top quality movies and TV shows,” before the programmer developed its own original content, Massoudi said.

HISTORY REPEATING

“Turner took advantage of the cable evolution; we’re taking advantage of the OTT market,” he said. “Our focus is on getting partnerships and proven content, as opposed to trying to produce content.”

That strategy appears to be resonating, as Tubi TV has managed to score digital distribution deals with several big name studios, including Metro-Goldwyn Mayer Studios and Lionsgate (which are also investors in Tubi TV), netting the OTT service access to “hundreds” of library titles, including Midnight Cowboy, The Hurt Locker, Fargo and American Psycho.

Of recent note, Tubi TV has also scored licensing agreements with Paramount Pictures (Top Gun, Basic Instinct, The Hunt for Red October) and Starz Digital (After Life, Mad Money, Pure). With all content factored in Tubi TV now claims to have a library of more than 40,000 titles — all delivered under its ad model.

Tubi TV is also looking into developing a library of content in the 4K format and expects to reach more platforms later this year. The service is currently offered on Web browsers, iOS and Android mobile devices, Amazon Fire TV, Roku players and Roku TVs, the Xbox One and Xbox 360, and Samsung smart TVs.