Slinging Away From the Pack

When Sling TV streamed onto the scene in February 2015, it was all alone, the first virtual multichannel video programming distributor to deliver a subscription package of live-TV channels that initially targeted cord-cutters and cord-nevers.

Fast-forward to today, and Sling TV’s got lots of company amid the launches of OTT rivals that include PlayStation Vue, YouTube TV, fuboTV, Hulu Live, DirecTV Now and likely more to come.

Though Dish Network no longer breaks out Sling TV subscribers, the OTT service remains in the lead among its peers. According to comScore, there were 3.1 million U.S. homes taking a skinny bundle as of April 2017, with more than 2 million on board with Sling TV.

So the challenge now is how to retain and perhaps extend that lead in an increasingly crowded market of vMVPDs.

Roger Lynch, Sling TV’s CEO, believes that his company’s a la carte style of packaging will help it stand apart from the pack. B&C contributing editor Jeff Baumgartner recently caught up with Lynch to reflect on what’s happened in the last 18 months and what else Sling TV has in store. An edited transcript follows.

Sling TV was the first virtual MVPD out of the gate when you launched in February 2015. What are the biggest lessons you’ve learned?

Even before that, we had almost three years of experience with the international channels with DishWorld [rebranded as Sling International in 2015]. There were a lot of lessons learned, certainly on the technology side.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

For the Game of Thrones [season seven] premiere on Sunday [July 16], we saw that a number of services melted down, some that have fewer subscribers than we have, and we had a great premiere for it. But when I go back two-and-a-half years ago, we had a problem with the Game of Thrones premiere. I think that’s evidence of a lesson learned. We’ve learned how to create a more stable and scalable service.

Two, I think back to when we launched, there was a big question in all of our minds: How big is the market opportunity? Were consumers really ready to go to live streaming? It was not obvious to consumers. It was very novel to stream a live television package. I think we caught people by surprise. I think that question has been answered pretty emphatically with the demand.

With respect to scalability and stability, what has changed to help you essentially cruise through the recent Game of Thrones season premiere?

I’m not claiming that we’re perfect. We still have things that come up from time to time. But we are hitting all of our metrics — customer satisfaction, net promoter score, churn, everything. We’ve seen a dramatic improvement in our service.

But you build it and you test it and it goes into the real world and you find things that you thought could handle a certain amount of volume and it can’t. With live streaming, there’s a lot of third parties that you rely on. It’s not like our [Dish Network] satellite system, where you build the satellite and you control the satellite and you control the set-top box and you have the spectrum — you have control of the end-to-end. You don’t in a live-streaming service.

Part of it is that you run over the open internet and part of it is you have to rely on a lot of third parties that are integral to your system. You also find that some of them have weaknesses in their architecture and they have to be sorted out. As we look back … the issues that we’ve had, probably half of them have been our own doing, and half of them have been third-party vendors that we work with.

From a demographic standpoint, how is your customer base breaking down compared to the early launch days and how has that changed in the last year or so?

That’s actually played out pretty much how we thought it would. When we launched, we would attract early adopters, which would include cord-nevers and some cord-cutters. When you look at your target market, it doesn’t mean you don’t go after customers outside of that; it means you focus your efforts on that strategic target market.

At launch, it was basically males who were 25-35. They tend more likely to be early adopters and … they overindex in sports, and we have a lot of sports. When we launched it was about two-thirds, and maybe it was about 70%, male.

Over time, we started to see that the percentage of males started dropping somewhat. It was still a significant majority. As we started to add more content, [we’d get more] young families with kids. And once we started to have more serious competition launching, I think that opened the market for a different kind of category of customer, which is customers who are pay TV customers who are leaving pay TV to take an OTT service.

We weren’t seeing many customers beforehand who wanted that many of the add-ons, so we came out with that offer where you get the Lifestyle, Comedy, Kids and News Extras, which are $5 each and would be $20 when you put them all together, but you can get all four of those for $10 [with the promotion]. That has proven to be very popular.

You still lead with the Blue [$25 per month, which includes Fox and NBC locals and Fox and NBC regional sports nets in select markets] and Orange [$20 per month, with no local broadcast TV or regional sports nets] core packages. Do most of your customers take some sort of an add-on package?

The take rates continue to grow and grow and grow, partly because the four extras offer a really good deal. That’s core to our strategy of making our service a la carte, when you can choose. If you look at our packaging versus traditional pay TV — traditional pay TV has the big, bigger, biggest bundle. And they all, as we say in the industry, nest within each other — every channel that’s in the big bundle is in the bigger bundle, and every channel that’s in the bigger bundle is in the biggest bundle. We really broke that paradigm by saying, just because somebody wants some channels that are in the biggest bundle doesn’t mean they want to pay for all of the other channels.

As the OTT competitors started launching, they just replicated the traditional pay TV paradigm. It also fits into over-the-air. Everyone else who has launched makes you pay for the local channels. They are included in the bundle. There’s a large segment of the market, we think 25 million households, that are already getting those channels for free with a digital antenna.

How have discussions with all the broadcast groups evolved in the last six months, and is there any sense yet on when Sling TV will be able to provide uniform, national access to local broadcast TV?

Our discussions with the broadcasters are fine. I think the bigger issue is the broadcasters and the affiliates and sorting out a model between the two of them. The broadcasters never granted the affiliates the rights for streaming, so those two groups have to sort out their relationship for all the OTT operators. That’s starting to happen. You’re starting to see [OTT] launches of affiliate networks. But it’s still a work in progress.

So is your packaging and pricing model your biggest differentiator, or are there others that you’re going to focus on?

We have other differentiators — we’re on more devices than anyone else. But I’d say that the a la carte nature of our offer … is really the core differentiating factor for us. Once you start down the path that every other one of them has started, you can’t shift to what we have because the programming deals that you’ve done enshrine the structure of your packaging that you launched with.

What are your top priorities for the rest of 2017? Is it mostly a focus on subscriber acquisition at this point?

We’re always focused on subscriber acquisition. We’re coming into the best time of the year for that. When football season starts … that’s absolutely the strongest time of the year for us.

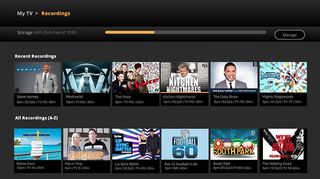

Our overarching focus is about continuous improvement in the service — platform, stability — but other areas of specific focus will be about being on more devices. There’s some more we can do. Adding new content will always be a theme for us; and more features. The [cloud] DVR feature has been quite popular.

How do emerging video formats like 4K and HDR fit into Sling TV’s roadmap?

For what we do with live channels and on-demand content that we offer, there’s virtually none of it available in 4K today. That will change, but right now you’d be chasing a feature that would have no consumer benefit because the content’s not there. And there are still many devices, like Apple TV, that don’t support 4K. It is something that we will launch at some point. But it’s not the highest priority now because the content’s not there yet.

With the recent activity around network neutrality rules and the ongoing deployment of usage-based pricing for broadband, have your thoughts on that changed much in terms of the threats they pose to your business?

With the FCC reviewing the net neutrality regulations, it does impose more risk, although I know that [chairman] Ajit Pai is very pro-consumer and I think he’s opposed to the way that the prior administration [imposed] them.

We want to see how this plays out, but I think now streaming has become so mainstream that if an ISP were to take what we’d call anti-competitive measures with regard to data caps or throttling or whatever they might want to do, I think they’d face a huge consumer backlash that ultimately will incite the regulatory backlash on them. I think that in some ways the risk declined over time just because it’s become so mainstream.

If you had electricity for 20 years and all of a sudden the electricity provider said, “we’re going to charge you more for the electrons to go to this brand of dishwasher versus that brand,” people would be up in arms about it.