NBC AffiliatesSense a SeptemberTo Remember

The TV business is full of

wild mood swings, but few

general managers at NBC

stations would have believed

how dramatically their state

of mind could change in a

year’s time. Last summer, affiliate morale was famously in the dumps. But buoyed by well-funded,

well-received fall debutants—the taut political

thriller The Event and high-octane U.S. marshal

drama Chase chief among them—a number of

NBC affiliates believe the new season just might

mark the long-awaited awakening for NBC’s ailing

primetime, vastly helping stations’ late news

and overall revenue picture.

Talk about your “event” programming.

“It’s a great time to be an NBC affiliate, and

a year ago you just didn’t hear that,” says

Chris Mossman, VP/general manager of WITN

Greenville, N.C. “Nothing is guaranteed, but

I’ve got a feeling we’re right on the verge of a

turnaround.”

At that low ebb a year ago, NBC affiliates

were anxious about how the risky Jay Leno-inprime

experiment would play out. The network

was living by NBC Universal President/CEO Jeff

Zucker’s infamous “managing for margin” philosophy,

with primetime dominated by inexpensive

reality shows and its displaced Tonight

Show host each weeknight at 10.

“NBC was trying to do things more efficiently,”

says KOAA Colorado Springs President/

General Manager David Whitaker. “They’d gotten

away from what made them—and any network—

perform: quality dramas and sitcoms.”

But those who witnessed NBC’s upfront presentation

at New York’s Hilton in May say the

commitment from the network—which, of

course, has a proposed merger with Comcast

sitting before regulators in Washington—was

there in spades. While everyone concedes that a

snazzy trailer and subsequent buzz do not often

translate to a ratings-sustaining smash (oh, how

the critics loved Studio 60 on the Sunset Strip!),

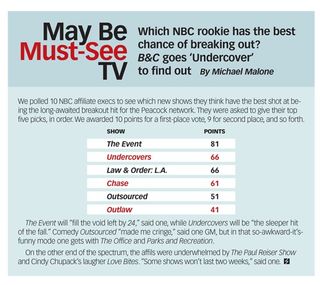

many say the programs, including sexy spy drama

Undercovers and offbeat laugher Outsourced,

look like the network’s best batch of rookies in

years.

“I give NBC a lot of credit for the speed with

which they committed money to development,”

says LIN Media Executive VP Scott Blumenthal.

“They realized they had issues, and they made

changes. It’s the best [rookie crop] in a while—it

really is.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Affiliates credit NBC for tapping proven producers

like Jerry Bruckheimer (Chase) and J.J.

Abrams (Undercovers), along with Law & Order

mastermind Dick Wolf launching a Los Angeles

offshoot of the warhorse franchise. Another plus

is established talent such as Outlaw star Jimmy

Smits and The Event’s Blair Underwood.

“I think that for the first time in many years,

the programs we saw in development this

spring indicate the levels of spending we think

are probably appropriate for prime,” says Gannett

Broadcasting President Dave Lougee, who

oversees a dozen NBC affiliates. “Clearly, the behind-

the-scenes talent that they’ve gone out and

gotten gives us a lot of optimism.”

Looking for that boost

With NBC’s endlessly documented primetime

drought extending for several years, hard-bitten

affiliates have largely learned to succeed without

a boost from prime, sharpening their content

and promotions to get viewers to change the

channel from more popular programs on CBS,

ABC and Fox to late news on the local NBC.

Heavyweight stations such as KING Seattle and

WDIV Detroit are among the many NBC affi liates

nationwide that win the late news race despite

distant finishes in prime.

But the cracks were starting to show, and frustration

with prime was mounting at the station

level. Stations’ late news represents 20%-25% of

their news revenue, according to Frank N. Magid Associates, and perhaps 10% of the overall revenue

figure. Without a strong lead-in, stations

were bleeding ratings points and revenue.

“Prime is crucial—every ratings point in

prime is revenue for the station,” says KSNV

Las Vegas General Manager Lisa Howfield. “If a

decent lead-in gives you an extra ratings point,

or even half a point, it really adds up.”

General managers at NBC affiliates offer little

complaint about the network’s other daypart

properties, including morning monolith Today,

NBC Nightly News, The Tonight Show (with

Leno back in his old chair), and sports such as

the blockbuster Sunday Night Football and the

Olympics—both of which provide giant promotional

stages for the network’s shows. “News

has been phenomenal,” says WKYC Cleveland

President/General Manager Brooke Spectorsky.

“Today continues to read the audience pretty

damn well. The job [NBC News President]

Steve Capus has done is really good.”

NBC affiliates say relations with the network

have been exceedingly positive of late. While the

other networks are increasingly pushing their

affiliates for a bigger taste of the retransmission

consent cash the locals are getting from paytelevision

operators, many affiliates say NBC

appears more willing to be partners, not adversaries.

The NBC affiliates board pushed hard on

a list of assurances from Comcast should the

merger get the green light, including establishing

a “firewall” between affiliation agreements and retrans negotiations, and ensuring that bigticket

sports stay on NBC. Presumably satisfied

with Comcast’s response, the board gave the

proposed merger its blessing.

The vast majority on the affiliate side say they

expect things to stay copacetic on the retrans

front—for now. “There’s not too much to discuss,”

Blumenthal says. “I think it will remain

quiet until [Comcast-NBCU] is finalized.”

Who’ll be 2010’s

‘Bionic Woman’?

Of course, in television, optimism can drop off as

quickly as ratings after a primetime premiere. The

general managers concede that a few programs

from NBC’s new litter will meet their demise before

the leaves start to change color in New York.

(Can Paul Reiser rise again? Many affiliates think

not.) “There’s still the element of the unknown

as to how these shows will do,” says WHO Des

Moines VP/General Manager Dale Woods. “I feel

better this year than we have in a long time, but

we’ll see what it looks like a month [in].”

Others harbor concerns about whether NBC’s

big investment in programming this year is a

one-off, fueled by having huge holes to fill post-Jay Leno Show and extra wind in its sails from

the pending merger—which, of course, could

very well crater. “NBC spent this year to get decent

programming, but if there’s no Comcast,

do we still get that kind of support?” Spectorsky

wonders. “That’s the scary part.”

And it’s worth mentioning that affiliates of

ABC, CBS and Fox seem plenty stoked about

their primetime, too; the rival networks are

game for keeping NBC locked in the cellar.

“CBS has had a great prime, and everybody

came out of the upfront extremely excited,” says

Jerry Bever, general manager at Anchorage’s CBS

affiliate KTVA, of last season’s overall primetime

ratings champ. “We’re confident the dominance

will continue.”

NBC’s affiliates have a modest threshold for

success: Most would be happy with one true

stud among the 14 shows teased at the upfront

presentation, and one or two Chuck-esque

players who can hit .290 and field their position.

Many think this may be the year the network

does it. While the affiliates have learned

throughout NBC’s prime slump to control their

own destiny, they concede a little lightning out

of Rockefeller Center would significantly help

their bottom line. “We’re OK right now,” says

KING Seattle President/General Manager Ray

Heacox. “But one or two good hits out of fall

would make us feel real good.”

E-mail comments to

mmalone@nbmedia.com

and follow him on Twitter: @StationBiz

Michael Malone, senior content producer at B+C/Multichannel News, covers network programming, including entertainment, news and sports on broadcast, cable and streaming; and local broadcast television. He hosts the podcasts Busted Pilot, about what’s new in television, and Series Business, a chat with the creator of a new program, and writes the column “The Watchman.” He joined B+C in 2005. His journalism has also appeared in The New York Times, The Philadelphia Inquirer, Playboy and New York magazine.