News

Latest News

Tegna Brings Caitlin Clark Effect To Local Broadcast With Fever Deal

By Jon Lafayette published

Group’s Indianapolis stations will air 17 of WNBA team’s games

Charlotte Deleste, WISC Madison Anchor, Gives Notice

By Michael Malone published

Final day on the job is April 24 for 6 p.m. and 10 p.m. anchor

Nexstar Dropping Scripps-Owned The CW Affiliates in 7 Markets

By Jon Lafayette published

Nexstar stations will add The CW in Norfolk, Va., and Lafayette, La.

‘Kelly Clarkson,’ ‘Jennifer Hudson,’ ‘Tamron Hall’ Score Daytime Emmy Nods

By Paige Albiniak published

51st Annual Daytime Emmys to air Friday, June 7 on CBS and will stream on Paramount Plus

Fremantle Hires Jeff Boone as VP, Scripted Development

By Jon Lafayette published

Exec had been at Bad Wolf

CBS News and Stations Premieres Romance Scam Investigation April 21

By Michael Malone published

‘Anything For Love: Inside the Romance Scam Epidemic’ on network and local news

‘Fallout’ Gets Quick Renewal on Prime Video

By Michael Malone published

Ella Purnell, Aaron Moten, Kyle MacLachlan and Walton Goggins are in cast of videogame brought to TV

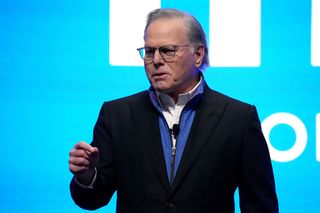

Warner Bros. Discovery CEO David Zaslav Got 27% Raise to $49.7 Million in 2023

By Jon Lafayette published

Other top WBD execs also saw their compensation increase

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below