Step on the Scale!

The name of the game in local television is scale, and you have to bulk up if you want to continue playing. The fight for the almighty retrans buck has changed everything; station groups need heft to maintain previous leverage against the likewise hungry, and increasingly powerful, MVPDs and the broadcast networks.

With so much consolidation going down of late, involving many of the industry’s leading broadcast groups, you need a scorecard to keep the station group players straight. Sinclair set the pace a few years back, and has been looking for acquisitions ever since. So has Nexstar. Gannett and Tribune pulled off massive multi-billion-dollar acquisitions, as the well-known, well-respected groups they acquired ceased to exist, at least nominally. Merger-minded Media General is landing bedfellows like a crafty lothario.

Many intriguing questions remain for local television. Who’s working out their exit strategy? Are the network-owned groups in the game for the long haul? And how will the FCC’s vital ruling on joint sales agreements—the virtual duopolies that have fueled much of the growth—affect plans going forward?

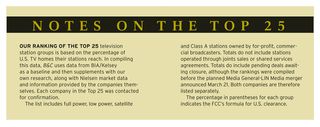

Finally, who is best positioned to withstand myriad challenges facing broadcasters today…and tomorrow? Our annual list of the Top 25 station groups offers some insights.

1 ION Media Networks

Ownership: Privately held 64.9% coverage (33.5% per FCC) 60 stations 50 markets Iontelevision.com

Brandon Burgess, chairman and CEO

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Last year’s ranking: 1

Outlook: “Positively Entertaining” Ion picked up key Top 25 market with WRBU St. Louis; it’s in a trust due to FCC ownership cap. That deal also included WZRB Columbia (S.C.). Debuts off-net Blue Bloods and Criminal Minds in prime in fall of 2014. Crime dramas dominate the primetime schedule, including Law & Order: Criminal Intent and Burn Notice. Has an enormous footprint but little local presence; operates more like a network than a station group. Digital channels include Ion Life and kid-friendly Qubo. Respected and savvy leader in NBC alum Burgess.

2 Univision

Ownership: Privately held by Broadcasting Media Partners, an investor group that includes Madison Dearborn Partners, Providence Equity Partners, Saban Capital Group, Thomas H. Lee Partners and TPG Capital. 44.2% coverage (23.2%) 62 stations 25 markets Univision.net

Randy Falco, president/CEO Kevin Cuddihy, president, Univision Television Group

Last year’s ranking: 3

Outlook: Unique connection between stations and viewers, thanks to dogged community outreach ethos that involves phone banks dedicated to healthcare, education and immigration. Launched public affairs show Conexion in California, Arizona, Texas and Chicago. Stations in major markets typically air early evening and late local news; many are adding weekend news. Juggernauts in KMEX Los Angeles and WXTV New York. Group recently expanded a deal with Bounce TV to air on multicasts; renewed in seven markets and will debut five more, including N.Y., L.A., Dallas in 2015.

3 Tribune

Ownership: Privately held by Oaktree Capital Management; JP Morgan Chase; Angelo, Gordon & Co. and others 42.8% coverage (26.3%) 42 stations 32 markets Tribune.com

Peter Liguori, president and CEO Larry Wert, president of broadcast media

Last year’s ranking: 6

Outlook: Pulled off deal of the year in the year of deals: Stunning $2.73 billion grab of Local TV. Massive new footprint with boatload of CWs, Fox’s—almost everything. Seasoned broadcaster in Wert, focus on increasing system-wide original programming, including trademark “conflict talk” in daytime and Arsenio Hall. Tapped Lynda King, former senior VP at Local TV, to be COO alongside Belo alum Kathy Clements. Shifted Rich Graziano from Hartford to run longtime also-ran WPIX New York. KTLA, under Don Corsini, is a local news power. CEO Peter Liguori will have more freedom to operate when the newspaper division is divested.

4 CBS Television Stations

Ownership: CBS Corp. (NYSE: CBS, CBS.A) 37.87% coverage (24.7%) 30 stations 18 markets cbslocal.com cbscorporation.com

Sumner M. Redstone, executive chairman Leslie Moonves, president/CEO Peter Dunn, president, CBS Television Stations

Last year’s ranking: 4

Outlook: Somewhat unique among O&O groups in the diversity of its portfolio, which includes eight CWs, three indies and a pair of MyNetworkTV affils in addition to CBS stations in most Top 20 markets. Stability in leadership: Moonves joined CBS in 1995 and WCBS GM Dunn took on grouplevel role in 2009; multiple WCBS execs do double duty with group role. Well-funded stations; early adopter of bonded cellular technology backpacks, and all the O&Os have mobile news vehicles for live reports on the go. Huge batch of radio siblings including 1010 WINS and WFAN in New York. KYW Philadelphia picked up 2013 National Murrow Award for overall excellence.

5 Sinclair Broadcast Group

Ownership: Public (NASDAQ: SBGI) 37.8% coverage (23.6%) 117 stations 78 markets sbgi.net

David D. Smith, president/CEO/chairman David Amy, executive VP/COO Steven M. Marks, VP/COO, television

Last year’s ranking: 7

Outlook: Laying low while awaiting D.C. decision on Allbritton acquisition. Proposed rejiggering the deal to win approval. Key pieces of Allbritton pact: influential WJLA Washington and sister cable net NewsChannel 8; the latter could be rolled out groupwide. Dominated much of the M&A discussion in 2011…and 2012…and 2013. The FCC’s overhaul of JSA regulations could impact Sinclair severely. Ann Ellis, former VP of sales at CCA, on board as group manager of Western stations. Board approved $150 million share repurchase authorization last month. Sinclair owns Ring of Honor wrestling franchise, Dielectric broadcast equipment outfit and an array of non-TV businesses.

6 Fox Television Stations

Ownership: 21st Century Fox., NASDAQ: FOXA 37.3% coverage (24.9%) 28 stations, 18 markets, 21cf.com

Rupert Murdoch, chairman and CEO, 21st Century Fox, Chase Carey, president and chief operating officer, 21st Century Fox, Roger Ailes, chairman/CEO, Fox News; chairman, FTS; chairman, Twentieth Television, Jack Abernethy, CEO, FTS Dennis Swanson, president, FTS Operations

Last year’s ranking: 5

Outlook: Big footprint, big drive for innovation— tests new first-run show every summer, and has added Wendy Williams, TMZ Live and Dish Nation through this strategy. Loads of local news, such as gargantuan 63-plus hours a week at WJBK Detroit. Abernethy is rethinking the local news model, which is playing out with offbeat, TMZ-esque new programs such as Chasing New Jersey at WWOR in DMA No. 1 and WJZY Charlotte’s debut newscast. Has a clean canvas in Charlotte—it acquired WJZY and made it a Fox O&O last year. Grapevine chatter says similar moves to come in other NFC football markets; owned stations in San Francisco and Seattle wouldn’t suck.

7 NBCUniversal Owned Television Stations

Ownership: Comcast (NYSE: CMCSA) 37% coverage (19.6%) 28 stations 20 markets nbcstations.com

Stephen B. Burke, CEO, NBCUniversal, executive VP, Comcast Corp. Ted Harbert, chairman, NBC Broadcasting Valari Staab, president, NBCUniversal Owned Television Stations

Last year’s ranking: 9

Outlook: Thank you, people’s cable bills—formerly neglected under GE, group gets the TLC it needed from Comcast. New investigative teams, helicopters, feet on the street, buildings—the NBC stations have the resources they need to compete, and then some. Six markets have partnerships with nonprofit news orgs, per Comcast’s deal with the FCC to close on NBC. Group has largely divorced itself from LNS partnerships in an effort to exert its independence. Comcast SportsNet franchises help out with local sports. Manuel Martinez, WTVJ Miami president/general manager, took over as president of Telemundo Stations last November. Brought Telemundo stations under Staab’s watch last year.

8 Gannett

Ownership: Public (NYSE: GCI) 28% coverage (23.4%) 40 stations 30 markets gannett.com

Gracia Martore, president/CEO, Gannett Co., Inc. Dave Lougee, president, Gannett Broadcasting

Last year’s ranking: 13

Outlook: Picked up prestige and size, not to mention a savvy operator in Peter Diaz, in its $2.2 billion acquisition of Belo last year. Forced to sell stations in overlap markets St. Louis and Phoenix. Total television revenues projected to increase almost 100% in the first quarter of 2014 with acquisition. With enormous footprint, Gannett is bullish on producing homegrown shows that capture the intersection of social media and TV. Lougee is the uncommon group president who came from news.

9 ABC Owned Television Stations Group

Ownership: Disney (NYSE: DIS) 22.6% coverage (21%) 8 stations 8 markets disneyabctv.com

Robert Iger, chairman/CEO, Walt Disney Co. Anne Sweeney, co-chair, Disney Media Networks and president, Disney/ABC Television Group Rebecca Campbell, president, ABC Owned Television Stations Group

Last year’s ranking: 10

Outlook: Is Disney committed to local broadcast TV? That’s the billion-dollar question. No M&A activity since selling Flint and Toledo in 2010. But why punt when the stations are the gold standard in majormarket TV? Well-regarded Campbell’s name popped up in the rumor mill about who would replace Anne Sweeney as TV group prez before Ben Sherwood got the nod. ABC owned stations are one heck of an incubator for group chiefs: Campbell, Valari Staab (NBC) and Emily Barr (Post- Newsweek) were GMs before moving up. Group also includes Live Well Network, a rare success story in the multicast world.

10 NRJ TV

Ownership: Private 21.4% coverage (10.7%) 15 stations 9 markets No website

Ted Bartley, CEO and president Bob Andrews, senior VP

Last year’s ranking: 11

Outlook: Has acquired small, mostly underperforming independents in Top 10 markets, including New York, LA, Chicago, Houston, looking to improve operations and perhaps prep them for auction, some believe. Acquisitions in recent years include WMFP Boston, KCNS San Francisco and WTVE Philadelphia. Launching MGM’s digi-net The Works across group.

11 Hearst Television

Ownership: Wholly owned subsidiary of the privately held Hearst Corp. 18% coverage (12.5%) 29 stations 26 markets hearsttelevision.com

Steven R. Swartz, president/CEO, Hearst Corp. Jordan Wertlieb, president, Hearst TV David J. Barrett, director, Hearst TV

Last year’s ranking: 12

Outlook: Huge holder of NBC and ABC affiliates, but where are the acquisitions? No significant station pickups in years, but plenty of leadership moves. David Barrett wrapped up brilliant CEO run at the end of 2013, with Jordan Wertlieb increasing his presence. Mike Hayes, former WTAE Pittsburgh GM, was named senior VP and group head last year. Eric Meyrowitz, formerly WPIX New York GM, joins Kathleen Keefe as sales VP. Taken private in 2009, Hearst TV isn’t saying boo about its growth plans. Barrett told B&C last year: “We are certainly in the deal flow. We know everything that is out there.” Hearst Corp. owns 20% of ESPN.

12 Nexstar Broadcast Group

Ownership: Public (NASDAQ: NXST) 16% coverage (8.9%) 108 stations 56 markets nexstar.tv

Perry Sook, chairman, CEO and president Thomas Carter, executive VP/CFO Timothy Busch, executive VP/co-COO Brian Jones, executive VP/co-COO

Last year’s ranking: 18

Outlook: Desperately wants in on Top 10 party but FCC rule on JSAs is a direct hit. Nexstar essentially coined the phrase “virtual duopoly.” Sook rang the NASDAQ bell in November to mark 10 years as a public company. Works closely with Mission Broadcasting on acquisitions and subsequent services arrangements. Deals include piece of Newport TV ($286 million), CCA ($270 million), Citadel trio ($88 million) and Grant ($87.5 million). Nexstar-Mission bought six-pack from Gray/ Excalibur for $37.5 million before Christmas. Acquiring digital outfits, including Inergize and, as of March, Internet Broadcasting. Julie Pruett upped to regional manager last year, Tom O’Brien named chief revenue officer.

13 Media General

Ownership: Public (NYSE: MEG) 14% coverage (9.3%) 31 stations 28 markets mediageneral.com

George L. Mahoney, president and CEO James R. Conschafter, VP, broadcast markets John R. Cottingham, VP, broadcast markets

Last year’s ranking: 24

Outlook: Merger mania! The marriage with Young Broadcasting, which closed in November and gave Media General a dozen more stations, was the warm-up act for Media General’s pending $1.6 billion merger with LIN Media in March. The deal is expected to close early in 2015, with LIN CEO Sadusky taking over. Good footprint—lots of market leaders and a southeastern regional cluster. Will have to part with five markets, including Providence and Charleston, for the deal to go through. Divested the bulk of its newspapers in 2012, a significant pivot for a group with ink-stained 164-year-old roots.

14 E.W. Scripps

Ownership: Public (NYSE: SSP) 13.7% coverage (7.9%) 21 stations 14 markets scripps.com

Richard A. Boehne, president/CEO Brian G. Lawlor, senior VP, television

Last year’s ranking: 15

Outlook: Stellar reputation for local news and digital distribution, but a $110 million grab for a pair of Rust Belt stations may not keep Scripps running with the big boys. Sean McLaughlin named VP of news in February. Scripps was ahead of the curve in producing its own shows. A partner on RightThisMinute. Next up: a 4 p.m. news-ish program that can play nationwide. Many inside and outside Scripps alike are watching how WCPO.com’s premium content paywall, introduced in January, works out. KMGH Denver earned DuPont-Columbia award last December. Substantial newspaper holdings, too.

15 Entravision Holdings

Ownership: Public (NYSE: EVC) 13.1% coverage (7.6%) 58 stations 23 markets entravision.com

Walter F. Ulloa, chairman/CEO

Last year’s ranking: 16

Outlook: Consists primarily of powerhouse Univision and UniMás affiliates, with one of each in 20 of group’s 24 markets. Big presence in California and Texas, and stockpiles stations along the border; Entravision owns the local Univision, UniMás, Fox and MundoFox stations in Tex-Mex market of Harlingen-Brownsville. Huge radio presence: 48 stations, including 46 in the top 50 U.S. Hispanic markets, and six in Los Angeles, five in El Paso, four in Phoenix, three in Denver. Eleven markets feature TV and radio. Innovative digital play in search engine Entraleads, which links users with advertisers.

15 Raycom Media

Ownership: Employee-owned 13.1% coverage (8.8%) 53 stations 35 markets raycommedia.com

Paul McTear, president/CEO

Last year’s ranking: 17

Outlook: Largely a bridesmaid in the M&A bacchanalia, though Raycom did swing a smallish shared services deal with Tom Benson for WVUE New Orleans. CEO Paul McTear has been bullish on replacing costly syndicated shows with homegrown fare—Raycom is partner on RightThisMinute—but will pull the plug on newsmag America Now following the current fourth season. VP/COO Wayne Daugherty, former CBS affiliates board chair, retired late last year.

17 Liberman Broadcasting

Ownership: privately held 11.3% coverage (5.7%) 5 stations 5 markets lbimedia.com

Jose Liberman, founder Lenard Liberman, president/CEO Winter Horton, COO

Last year’s ranking: 19

Outlook: Founded by father-son pair Jose and Lenard Liberman, broadcaster has quietly grown into a Spanish-language power. Owns Empire Burbank Studios and produces 56 hours of network programming per week. Liberman bucks telenovelas for more general market approach— dramas, comedies, variety, occasional miniseries. Its multicast net Estrella TV presents its upfront pitch May 12. Liberman owns TV and radio stations in L.A., Houston and Dallas, and TV in New York, Chicago and Phoenix, among others.

18 Cox Media Group

Ownership: subsidiary of Cox Enterprises 10.59% coverage (5.3%) 14 stations 10 markets coxmediagroup.com

John Dyer, president and CEO, Cox Enterprises Doug Franklin, executive VP and CFO, Cox Enterprises Bill Hoffman, president

Last year’s ranking: 22

Outlook: Another boutique-ish group that prompts the pundits to wonder if it’s a buyer or seller. Will Cox deal Bay Area jewel KTVU to Fox? Increased focus on larger markets, which prompted the sale of four smaller market stations to Sinclair. Picked up Jacksonville and Tulsa stations from Newport two years ago but is due for a deal. A truly integrated group with newspaper and radio; in Atlanta alone, Cox has monster ABC outlet WSB, four radio stations and the big daily newspaper. Bill Hoffman, respected former ABC affiliate board chair, marks a year in the top post this month.

19 LIN Media

Ownership: Public (NYSE: TVL) 10.5% coverage (8.7%) 39 stations (7 digital) 23 markets linmedia.com

Vincent Sadusky, president/CEO Jay Howell, VP, television

Last year’s ranking: 20

Outlook: Loses its name in the Media General merger, but keeps its CEO as Sadusky gets the nod to run expanded Media General. Stockpiling digital companies, including Federated Media, Dedicated Media and HYFN, under digital chief Robb Richter. Showed its digital intent by switching from LIN TV name to LIN Media last year. Industry go-to guy Scott Blumenthal retired as executive VP at the end of 2013, with Jay Howell stepping up to oversee the group. Shifted HQ from Providence to Austin last year. Before we say good-bye to the name, here’s where LIN comes from: Louisville, Indianapolis and Nashville, where the group first owned radio stations.

20 Meredith

Ownership: Public (NYSE: MDP) 10.3% coverage (6.3%) 14 stations 11 markets meredith.com

Stephen M. Lacy, chairman/CEO Paul Karpowicz, president, Meredith Local Media Group

Last year’s ranking: 23

Outlook: Got off the sidelines with strategic grab just before Christmas: KMOV St. Louis and KTVK-KASW Phoenix, formerly of Gannett-Belo, for $408 million. President Paul Karpowicz liked the growth and political spend in those markets. May wish to get bigger still to compete in the modern age. Lone Top 10 station WGCL Atlanta, rebranded itself CBS46, scrapping “CBS Atlanta.” Better known for magazines such as More, Family Circle and Better Homes and Gardens. Speaking of Better, Meredith created a model for homegrown syndication success with Better show, which went national in 2008. Its next syndicated program might stem from AllRecipes.com acquisition.

21 Gray Television

Ownership: Public (NYSE: GTN) 7.4% coverage (5.3%) 68 stations 41 markets gray.tv

Hilton H. Howell Jr., president and CEO James C. Ryan, senior VP and CFO

Last year’s ranking: —

Outlook: Lost key figures from its history when Bob Prather, COO and president, resigned last summer, and J. Mack Robinson, former CEO, died in February. The two had acquired Gray in 1993. Gray got in on the M&A fun when it and sidecar group Excalibur, run by former Gray regional VP Don Ray, acquired Hoak Media and Parker Broadcasting stations for $335 million. Picked up little WQCW in West Virginia in February. Likes stations in state capitals, university towns, or both. Active users of multicast channels, often airing Big Four nets on the dot-twos. Has 22 CBS affiliates, including KNPL, which went live in little North Platte, Neb., in September.

22 Stephen Mumblow

Ownership: Stephen Mumblow 6% coverage (3.2%) 9 stations 8 markets no website

Stephen Mumblow, founder and president Danielle Turner, chief administrator William (Ray) Wilson, director of programming

Last year’s ranking: —

Outlook: Former CCA president Mumblow has Deerfield Media and Manhan Media, which are named for rivers near his Christmas tree farm in Massachusetts. Both are duopoly partners with Sinclair in markets where Sinclair cannot own another station. Late in 2012, Fox Television Stations sold WUTB Baltimore to Deerfield, with Sinclair operating. Holdings include KMYS San Antonio; WSTR Cincinnati; WPMI-WJTC Mobile/ Pensacola; KBTV Beaumont, Tex.; KAME Reno; and WTLF Tallahassee.

23 Cunningham Broadcasting

Ownership: Private 5.7% coverage (2.9%) 18 stations 15 markets no website

Michael Anderson, president

Last year’s ranking: —

Outlook: Formerly known as Glencairn, it’s another Sinclair sidecar operation. Ostensibly named for Carolyn Cunningham Smith, David Smith’s mother, who had voting control until her death in 2012. Stations include WTTE Columbus, WTAT Charleston, WRGT Dayton. Picked up licenses in Peoria, Flint and Traverse City, Mich., in Sinclair’s deal for Barrington. Got a foothold in Tallahassee, Wilkes-Barre and Gainesville when Sinclair acquired New Age.

24 Mission Broadcasting

Ownership: Private 5.1% coverage (3.2%) 13 stations 13 markets no website

Dennis Thatcher, president Nancie J. Smith, chairman

Last year’s ranking: —

Outlook: Nexstar holds a controlling interest in Mission, according to its SEC filings, and operates all of Mission’s stations. Mission picked up a $15 million pair in Binghamton, N.Y., in September, which Time Warner Cable objected to, saying it gave Nexstar too much control in the market. Other holdings include KODE Joplin and KLRTKASN Little Rock.

25 Graham Holdings

Ownership: Public (NYSE: GHC) 4.8% coverage (3.4%) 5 stations 5 markets ghco.com

Donald E. Graham, chairman and CEO Veronica Dillon, general counsel and secretary Emily Barr, president and CEO, Post-Newsweek

Last year’s ranking: 25

Outlook: Graham’s Post-Newsweek group will get smaller by one when Berkshire Hathaway’s acquisition of WPLG Miami closes, but CEO Emily Barr says the group is not for sale. Strong, independentminded stations— WJXT Jacksonville is the model of a station making its way without an affiliation—but it is increasingly hard to hold one’s own without scale. May be due for a name change: parent company owns neither The Washington Post nor Newsweek anymore. Is Berkshire chief Warren Buffett keen on more broadcast assets?

—with reporting by Dade Hayes, Luke McCord and Jessika Walsten

Michael Malone, senior content producer at B+C/Multichannel News, covers network programming, including entertainment, news and sports on broadcast, cable and streaming; and local broadcast television. He hosts the podcasts Busted Pilot, about what’s new in television, and Series Business, a chat with the creator of a new program, and writes the column “The Watchman.” He joined B+C in 2005. His journalism has also appeared in The New York Times, The Philadelphia Inquirer, Playboy and New York magazine.