TV’s Troubles Aired Out During Earnings Calls

During their third-quarter earnings calls, the captains of the television industry felt they needed to push back against the growing sentiment that the fundamentals of the business are eroding.

Based on numbers they reported, the ad market was weak. The question is whether or not that weakness is temporary or a longterm result of falling ratings, competition for eyeballs from overthe- top entries and a shift of marketer spending from traditional commercials to digital video.

“We believe ad-supported TV is in the early stages of a structural decline,” said Sanford Bernstein analyst Todd Juenger in a research note last week. Juenger downgraded CBS and Discovery. “The content companies, however, are in denial—selling more content to SVOD to offset ad revenue shortfalls, which accelerates the problem. We expect increased content investment, against a declining domestic end market, will reduce ROI and margins over time.”

At the same time, execs had to explain how they would take advantage of digital opportunities to distribute their valuable content without tearing apart the cable bundle that generates the subscriber fees that have powered earnings since the recession.

Some executives were blunt. “My first observation is that these concerns are overblown, particularly in the short-term,” said 21st Century Fox COO Chase Carey. The television ad market is a mixed story, but the issue is primarily the economy.

The traditional cable bundle “continues to have real legs,” Carey insisted, “But [while] all the concerns may be overblown today, these are real issues that while challenging also present real opportunities for us.”

Carey said he looked at this period of change as “a glass-half-full opportunity. There’s a real chance for us to build exciting new areas of growth if we can create more exciting choices for customers, and a more valuable proposition for advertisers while maintaining a discipline that enables us to manage the trade-off required to ensure fair value for our product.”

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Meanwhile, the Walt Disney Co., under CEO Bob Iger, has been an early mover when it comes to digital distribution. But Iger cautionedthat you don’t want to push change to the point “where you are endangering your own business model, which is already facing a fair amount of challenge.”

Iger allowed that some “may call that a conservative approach.”

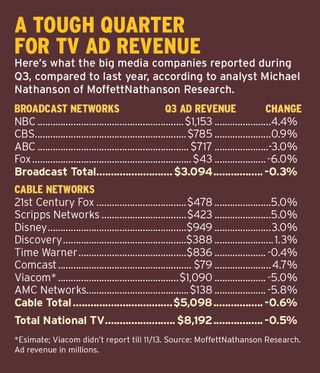

According to analyst Michael Nathanson of MoffettNathanson Research, ad revenue went from flat in the second quarter to down 0.5% in the third quarter, producing what he said was the worst quarter for ad growth since the recession, after adjusting for the Olympics.

In that environment it’s not surprising that Time Warner, Scripps Networks Interactive and AMC Networks all discussed plans to reducepersonnel costs.

Some executives were bullish on the fourth quarter. “Advertising is growing again here in the fourth quarter. Our local businesses have benefited from some tough political campaigns,” said CBS CEO Les Moonves.

Others were more cautious, saying agencies were buying time later, making it harder to gauge where ad sales were likely to settle.

“The fact of the matter is the next five or 10 years in basic entertainment cable as it relates to ratings are going to be much more difficult than the last five to 10 years, simply because it’s more competitive and there’s more technological change out there,” NBCUniversal CEO Steve Burke said.

Nathanson also sees more trouble ahead. “We were surprised with the end of Q3 and start of Q4 that the ad market didn’t show some renewed vigor. With the NFL back on the air, with premium CPMs and steady audience growth and marketers—especially autos and retail—looking to the eight-to-10 weeks before Christmas to move product in hopefully an improving economy, it is very troubling that the ad market is so slow 4Q,” he said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.