Tribune to Explore Strategic Alternatives

Tribune Media Co. reported a fourth quarter loss, wrote off some programming assets and said that it had hired advisors to explore strategic alternatives to increase its stock price.

Strategic alternatives usually include selling or spinning off parts of the business, which could include some of Tribune Media’s TV stations, its cable network WGN America or its digital operations.

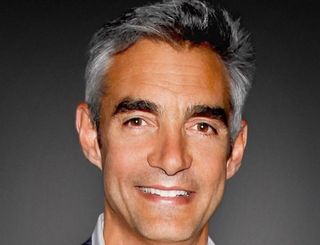

“Tribune's assets are valuable, powerful and performing well, as reflected in our full-year 2015 operating results," said CEO Peter Liguori. "However, it's our belief that our current stock price does not reflect the full value of these assets. With the help of outside advisors, we have decided to initiate a process to explore every possible strategic and financial option with one clear goal: to unlock the value of our stock.”

The company said the options include the sale or separation of select lines of business or assets, strategic partnerships, programming alliances and return of capital initiatives.

The company said its board authorized a new $400 million stock repurchase plan and gave three senior executives new employment agreements. CEO Liguori has a new two-year deal, Chandler Bigelow was named chief financial officer (he had been interim CFO) and general counsel Eddie Lazarus was named chief strategy officer, expanding his responsibilities.

In the fourth quarter, Tribune Media posted a $380.9 million net loss, or $4.07 a share, compared to a $314.7 million profit, or $3.15 cents a share.

Tribune took a $385 million non-cash impairment charge related to goodwill and other intangible assets. It also took a broadcast right impairment charge of $74 million to write down the off-network rights to Persons of Interest and Elementary at WGN America.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

For 2016, the company said it expects strong financial growth revenues to be between $2.25 billion and $.28 billion and for consolidated adjusted EBITDA to be between $615 and $645 million—up between 25% and 31%.

Television and Entertainment earnings before interest, taxes, depreciation and amortization fell to $151.2 million from $202.3 million a year ago. The drop was caused by the goodwill and program write down charges and an increase in programming expenses.

TV revenues were $464 million, down 3.4% from $480.2 million. Political advertising was down $46.5 million. Core advertising revenues were up 2.6%. Retransmission revenue was up 27% and affiliate revenue for WGN America was up 58%.

On the company's earnings conference call with anaysts, Liguori said that the programming writeoffs at WGN American reflected that the market for cable syndication has changes since the company acquired the rights to Person of Interest and Elementary. He said the networks will continue to promote those shows on air so that they’ll generate ratings.

He said cancelling Manhattan was “a tough business decision,” but in the end came down to the fact that “not enough people watching.” He said the network’s new show Outsiders was drawing record ratings and boosting its prime time performance.

In 2016, WGN American will be “a solid contributor” to the company’s earnings, he said.

Liguori said that the company expected to see about $200 million in political advertising in 2016, up 20% from the 2012 race.

The advisors hired by Tribune Media are Moelis & Co. and Guggenheim Securities.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.