Super Bowl Ad Preview: The Auto Brands That Have Spent the Most Leading Up to the Big Game

After a slower start than usual this year, brands are finally beginning to let their Super Bowl ads and teasers flow. B&C has partnered with TV advertising attention analytics company iSpot.tv and its Super Bowl Ad Center to give you the very latest during the run-up to game day.

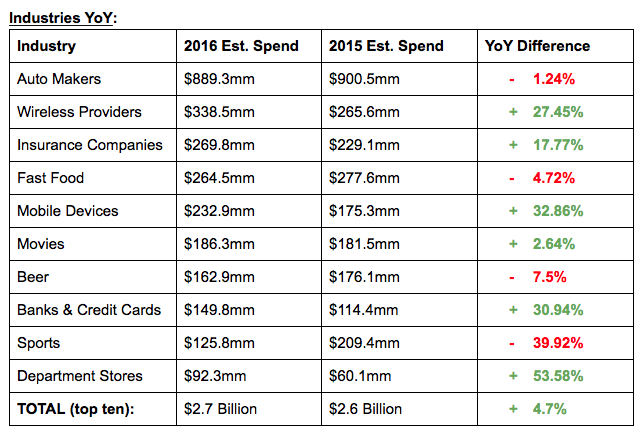

First, some context: A breakdown of the industries that advertised most heavily during the NFL season. While some industry categories dipped in 2016 vs. 2015, including automotive and fast food, others saw major gains. Wireless providers, insurance companies, banks/credit cards and department stores all showed pretty dramatic year-over-year gains in their NFL advertising spend.

2016 Estimated NFL TV Ad Spend vs. 2015 Estimated NFL TV Ad Spend

Includes playoffs through the NFC and AFC championship games

Industries YoY:

Today, our focus is on the automotive brands that dominated. Out of the 31 auto brands that aired commercials during NFL programming, Chevrolet spent the most on placements throughout the 2016-17 NFL season, accounting for 11.1% of the auto industry’s spend — an estimated $99.6 million. That spend generated nearly 1.1 billion TV ad impressions for Chevy, with an average view rate (AVR) of 83.4%. (AVR is the percentage of an ad that is watched across all views of that ad.)Throughout the 2016 NFL Season, including playoffs through the NFC and AFC championship games, 706 brands have run 2,901 spots 39,877 times across NFL broadcasts, for a total estimated spend of $4.2 billion. These brands represent 144 different industries, which spread their spots across 7 networks (CBS, Fox, NBC, ESPN, NFL Network, ABC and ESPN Deportes). The top 10 industries account for more than half of this spend.

However, second-place spender Toyota, which accounted for 10.8% of the auto industry’s NFL TV ad spend, was the most-seen brand in the category, earning nearly 1.4 billion TV ad impressions, with an average view rate of 89.6%, well above the industry average of 81.8%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Automakers’ total NFL spend decreased by over $11 million overall year-over-year. That was due in large part to reduced advertising by both Nissan and Ford. The former spent an estimated $37 million less this season vs. last, while the latter dropped about $11 million year-over-year. Despite healthy increases for many of the other top automaker brands, the near-$50 million combined drop from two of the top four on the 2015 list was enough to reduce automotive category spending a modest amount overall during the 2016 season.

Facebook, Apple, GEICO Lead Audience, Attention, Actions in NFL Playoffs

While Ford still managed to remain among the top brands in terms of exposure for its ads during NFL programming (it finished second behind Toyota both years), Nissan fell from third in 2015 to 15th in 2016. The brand’s 12-position drop was the largest of all automakers year-over-year in terms of TV ad impressions. BMW was the direct beneficiary of Nissan’s decrease, as the only newcomer on the top-10 TV ad impressions list for 2016. Nissan also had the steepest jump, going for 16th place in 2015 to 8th this year.

Check back tomorrow for another Super Bowl Ad Preview post, with more insight on the NFL’s biggest brand backers leading up to the big game.