Short-Term Outlook Is Brighter, But Long-Term Still Cloudy

During the third quarter, media company stock prices tumbled about 13%. In the next few weeks, as those companies report their third-quarter results, it might become clearer whether concerns about the industry are justified or if the beginning of a turnaround is in place.

For the analysts, there should be few surprises. Top executives at the companies in the TV business have been on the conference circuit, offering their vision for the industry, the strategies their companies are pursuing and guidance for where revenue and earnings will be for the quarter and the year.

Some analysts say the quarter will be an improvement from Q2.

“Media doesn’t feel as bad,” said Marci Ryvicker of Wells Fargo in a recent report. Ryvicker said that while ratings remained “blah”—down in the high-single-digit to low-double-digit range—the ad environment has a better tone, which has helped improve investor sentiment.

Ryvicker thinks the Walt Disney Co. is best positioned, but noted that investors seem to be buying Viacom and 21st Century Fox. Ryvicker also said her checking on video subscription trends suggests that the third quarter was better than the second quarter. “To us, this is probably more important for media than for cable—sentiment-wise,” she added.

From a more strategic point of view, Ryvicker said it sounds like media companies are “really starting to think about what is sold to Netflix vs. what stays within the ecosystem,” meaning TV Everywhere and Hulu. She noted that Netflix dollars haven’t been large enough to “offset the ad declines and are finally threatening the ‘volume’ part of the affiliate fee model.” And she added that investors applaud this shift, but are concerned that media companies might have to take some near-term pain for long-term gain. “We aren’t quite sure media execs are all that into this line of thinking.”

To Michael Nathanson of MoffettNathanson, the negativity toward media stocks might be overdone.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

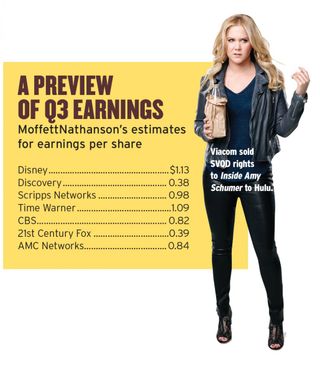

In a recent report, Nathanson increased his estimates for third-quarter earnings per share for AMC Networks, Discovery, Time Warner and Discovery. He lowered his estimates for Viacom and CBS (sorry, Sumner).

He is also revising his national TV advertising numbers up for a change, reflecting what appears to be a tight scatter market.

Currency issues remain a problem, but “the sector may be set up for a bit of a rally as 3Q national TV estimates show a sequential improvement, ratings compares for many cable networks are easy, pay-TV declines stabilize and management responds with better strategies,” Nathanson said.

While Nathanson is raising his estimates for domestic ad revenue (to down 0.7% from down 1.7%), he questions whether the trend is sustainable, or a product of make-good from earlier quarters creating limited supplies of available commercial inventory. “To this end, we look to company commentary around the pacing of fourth-quarter advertising,” he said.

Nathanson adds the media sector is rated “equal weight” as opposed to “underweight,” and he says most large diversified media conglomerates appear oversold. His “buy” choices are Disney, Fox, Time Warner and Viacom.

But David Bank, managing director at RBC Capital Markets, doesn’t think this round of results and quarterly earnings calls will go a long way toward changing Wall Street’s long-term perspective on the media business.

“The good news is I don’t expect a lot of surprises. And that’s generally a positive,” Bank said. The bad news, Bank offered, is that even if he had a crystal ball that could tell him each company’s earnings now, he wouldn’t know whether those companies’ stock would go up or down based on investors’ long-term assumptions.

And regarding longer-term issues, Bank is interested in hearing more about how the media companies are pursuing advertising technology.

“We spend so much time thinking about the fragmentation of the audience and the inevitable difficulty in growing an audience, at least the Nielsen-measured C3 audience,” Bank said. “We’re in the early innings of ad tech where while the audience gets smaller, CPMs could get bigger. I mean really bigger.”

Bank says that investors are surprised that there has been less merger and acquisition activity considering all the consolidation talk. “I think the companies are showing an intelligent amount of restraint,” Bank said.

Investors would like to know why the pace of return of capital has slowed. If finances are tight, there might be more cost-cutting. But spending on content will continue, Bank said. “Content is the most strategically valuable asset.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.