Measuring TV Is Good Business

Despite the insults it gets from an industry facing falling ratings, it’s good to be Nielsen. With the media world only growing more complex, measurement is becoming increasingly important.

In a recent report, analyst Laura Martin of Needham & Co., estimated that revenue generated by companies that measure audiences will grow 25% over the next three years, reaching $3.3 billion in 2018.

International growth is moving even faster, according to Martin. She pegs that number at 44%, reaching $800 million in 2018.

Consequently, Martin is recommending the stocks of all the major companies in the measurement business, from the industry’s much maligned giant Nielsen, to its would-be competitors comScore and Rentrak.

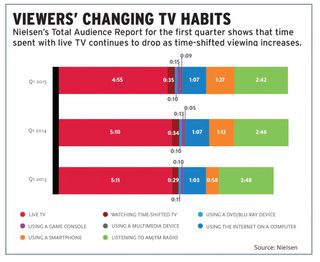

Martin’s report came out days before Nielsen released its Total Audience Report for the first quarter, a document that not only aims to track changes in how viewers consume content, but to demonstrate Nielsen’s ability to measure all viewing across emerging platforms and devices.

The fact that much of that viewing doesn’t show up in the declining ratings of traditional television networks results in Nielsen being bashed by industry executives who, Discovery CEO David Zaslav among them, have blasted Nielsen’s ratings system as “antiquated.” Nielsen’s stance is that it is able to measure nearly all viewing, but what’s included in the ratings is up to the industry, which at this point has not moved to add online viewing, for example, to the C3 totals used to sell advertising.

Despite the whining, Nielsen is well-positioned, according to Martin.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“As the global online and offline ad-driven media worlds converge, ad agencies and brands are demanding better third-party measurement that allows them to assess and compare accurate ROI’s between websites and across global distribution platforms in all media,” Martin said in her report.

She added that, “as screens proliferate, the complexity of deciding where to spend ad dollars rises, and third-party measurement and analytics are valued more highly.”

All About Delivery

In TV, numbers from an independent referee like Nielsen have been used to establish whether networks have delivered audiences as large as promised. Shortfalls have been paid off with make-good ads. If online video companies want to compete for TV dollars, they’ll have to submit to the same regimen, Martin said.

And given emerging complaints about impression fraud in online advertising, Martin added that, “by identifying and eradicating overpayment for fraud, third-party measurement companies essentially pay for themselves.”

Third-party measurement companies are needed to provide comparability of audiences across media. They are also the only ones who can determine unduplicated reach across multiplatform campaigns. Finally, as advertising becomes increasingly addressable, more granular data will be required to target those ads.

For 2015, Martin estimates that Nielsen has an 87% share of the measurement market, with comScore controlling 10% and Rentrak at 3%. She forecasts that Nielsen’s share will slip to a still-dominant 79% in 2108, while comScore (at 12%) and Rentrak (at 7%) will gain bigger slices of an even larger pie.

Martin sees mostly strengths when she looks at each of the measurement companies. She notes that Nielsen signs long-term deals with clients that all end at different times, which makes it difficult for a new company to replace Nielsen, because if one network drops it for another service, its ratings numbers would no longer be comparable with the majority of the industry, probably discouraging media buyers.

At the same time, Martin says comScore is introducing new products—including validated campaign essentials (vCE)—and gaining pricing power in the market. “We believe comScore’s viewability and de-duplication products are mission-critical for online video advertisers, implying growing demand plus pricing power, which should accelerate comScore’s revenue growth rate,” she said.

Martin sees Rentrak as a player because of growing demand for more granular U.S. TV data. That data comes from deals with cable and satellite distributors with 60 million set-top boxes.

“No other company collects the mass of datapoint that Rentrak does in its three product areas,” Martin said. Comcast and other clients could collect the clicks and the data but they have to hire measurement scientists, and Comcast would have only its own data, which is not as useful as the industry-wide perspective Rentrak now provides.

HOW NETFLIX SHARES CAN MOVE HIGHER

Netflix shares moved so high recently that the company decided to split the stock 7 to 1 to make it seem more affordable to investors.

But one analyst sees a great deal more upside to Netflix shares. Richard Greenfield of BTIG last week set a pre-split price target for a year from now of $950 per share, up 45%.

“While Netflix has exceeded our $600 one-year price target, we believe its business model is gaining meaningful momentum,”

Greenfield said. Greenfield says Netflix is winning the daily war for consumer time and attention and that new and library content is being added faster than it can be watched by subscribers.

He contrasts that to traditional media companies that “put their business model for television programming ahead of what consumers actually want.” HBO and Showtime, while offering direct-to-consumer products, are tied to legacy distribution partners and have to charge more than they would otherwise, he added.

“We found irony in the fact that the TV advertising upfront has gone nowhere-to-data, which is clearly a sign of trouble compared to prior years,” Greenfield added.

Greenfield estimates Netflix will have 108 million subscribers worldwide by 2017, up from his earlier estimate of 101 million and 57 million at the end of 2014. By 2020, Netflix could have 140 million global subscribers, he said.

Greenfield sees Netflix adding 5.6 million U.S. subscribers this year and topping 60 million by 2020.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.