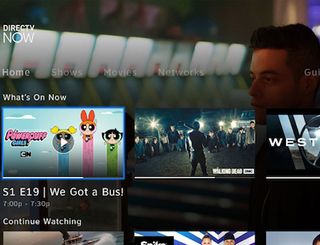

DirecTV Now Exceeding Expectations, AT&T Says

Customers signing up for DirecTV Now has "exceeded expectations," according to AT&T CEO Randall Stephenson.

Speaking at the annual UBS Global Media and Communications Conference Tuesday, Stephenson said that on its first day last Wednesday, the number of customers exceeded early projections for the month.

“It’s early. We have no idea what the churn characteristics of this are going to look like, so we’re going to be cautious about putting numbers out, but the early demand had been rather dramatic,” Stephenson said. “It’s been really, really impressive.”

He said the product was over-indexing in apartment buildings, a market DirecTV had been targeting.

"This demonstrated the demand for long-form premium content," Stephenson said. “We think we’re in the golden age of TV and we don’t see that changing and that premium long form content on a mobile device is going to be a huge demand.”

Acquiring access to long-form content was a driver for acquiring DirecTV, he said. The proposed acquisition of Time Warner would be a completion of that strategy, he added.

At $35 a month for 100 channels, analysts see little profit in DirecTV Now.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

"Early on I do expect the margins to be thin," Stephenson said. But over time, with most DirecTV customers using some form of over-the -top video, there will be increased advertising opportunities that AT&T and DirecTV can capitalize on. "Think about the advertising opportunity using data," he said. "We'll have some unique viewership data. The advertising opportunity is fairly significant."

Stephenson also minimized the threat that DirecTV Now would cannibalize his satellite business.

"You know you have something special when the great concern is are you are going to cannibalize your existing product set," he said. With DirecTV Now limited to two streams per household, "long term it's a manageable dynamic."

AT&T is offering free data—or zero rate—to customers who want to stream their DirecTV Now content to AT&T mobile phones. This has raises concerns that it violates government net neutrality regulations.

But Stephenson insisted zero-rate was a good thing. “I think free is pro-consumer,” he said.

He added that he expected that under the new Republican Trump administration, net neutrality will get “little attention.”

Although Trump has threatened to block AT&T’s acquisition of Time Warner, Stephenson said he thought Trump’s plan to lower corporate taxes would be good for business. For the first time, he said, in the company’s planning meetings, they are looking at “what happens if economic growth is more than we’re anticipating.”

He said that lower taxes should lead to higher investment which will increase productivity, creating growth.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.