Cross-Platform Ratings Get Ready For Primetime

Related: New Metrics on the Way, But the Upfront Comes First

Shortly after wrapping up its acquisition of Rentrak in January, comScore laid out an aggressive road map for rolling out a cross-platform measurement system that would employ com-Score’s digital know-how with Rentrak’s ability to access and analyze TV set-top data.

RELATED: Nielsen Makes Data Deal With Dish

RELATED: Analyst Says Dish Deal Helps Nielsen

The combined company is potentially the toughest competitor in a long time to take on Nielsen, which continues to dominate the TV measurement business. TV execs have long complained about ratings, but lately the criticism has been that some viewers, especially young viewers, aren’t included in the data because they’re not watching on TVs—they’re watching on laptops, tablets and smartphones—or when shows are scheduled; they’re watching on-demand.

Both Nielsen and Rentrak are addressing that problem this year with new cross-platform measurement systems. In this interview, B&C business editor Jon Lafayette speaks with comScore executive vice chairman and president Bill Livek, who says his company is “absolutely” on track to roll out its new metrics this month. An edited transcript follows.

When do we start to see some cross-platform numbers?

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You will start to see them soon. We have a product road map and we shared it on our earnings call [in February]. We are still on track for that and we’re not deviating from that.

Were there no hiccups along the way integrating two massive databases?

This stuff is hard. This stuff is so complicated. But it starts with two management teams that are monomaniacally focused on creating world-class products that the market is saying they want. Whether it’s the agency holding companies, whether it’s the networks or whether it’s our partners like Adobe. They all see the same thing in that the new comScore has a very special opportunity to give the marketplace precisely what they’ve been asking for.

What are you measuring, impressions or ratings points like Nielsen?

We will be announcing with a greater degree of specificity what we’re doing with Adobe here as our product plans roll out. But suffice it to say that certain segments of our market want impressions and certain segments of our market want ratings. And we will deliver on the expectations of both. What we also know is the majority of the market doesn’t necessarily want age/sex. They need the advanced demographics of the products that the viewer and the digital consumer consume, whether they buy them at a grocery store, or whether they buy them at an auto dealer. To be more efficient, digital and TV have to come together and they have to come together with the demographics of who their customer is and who their prospects are. That’s what the new comScore is doing: Producing these tools that allow television and digital to be priced correctly so deals can be cut and the targeting of those commercials can be precise.

To what degree are you adopting Adobe standards?

We are adopting many of their standards. To adopt the Adobe standards where appropriate allows us to speed up and leapfrog any other company to have information about the global consumer. And with our partnership with Adobe, comScore is the only company that will be able to measure in a complete way over-the-top, integrate it with all the other viewing in a census-like way. That’s the unique feature we have with Adobe. There are a lot of other benefits to our customer. But the headline is census measurement with over-the-top with Adobe integrated into the new comScore.

A deal was announced with Viacom, which already worked with comScore and Rentrak. What are they getting new from the combined company?

The combination is creating a multiplatform product and they are the first network holding company to subscribe to our multiplatform products. They are the first company to realize the vision that we described when we announced the deal.

Does the multiplatform product exist?

We’re on a road map and it’s nice to have subscribers understanding what we’re producing and want to be the first ones to use it to have first-mover advantages.

Viacom also subscribes to Nielsen. At some point will customers have to choose one or the other?

The marketplace decides who they want to use. It’s unusual in any market segment around the world not to have two currencies to be utilized. We are committed to being the primary currency and in many places the exclusive currency.

There are a lot of changes in the measurement business. How do you see them affecting the upfront?

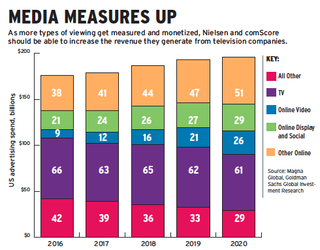

The upfronts have been evolving very quickly where the buyer wants multiplatform value and the seller wants to charge for it. When you look at the great television networks who are clients of the new com-Score and you watch television—last night on CBS for example they’re promoting their Monday content, saying watch it live, streaming live or on-demand. Our customers are training the consumer to watch whenever it’s convenient for them. And that’s a great thing. And more great content is being consumed today than 15 years ago because you can find the great content on the on–demand platforms.

Will you have syndicated data by third quarter?

We’re building all of this so it can be a syndicated platform. The road map that we laid out on the earnings call is the road map. We’re excited about achieving that road map and we’re doing everything that we can every day to achieve that.

Not every company in the measurement business seems to be able to stay on their road map.

I don’t know what other companies do because I’m not in their boardroom.

ComScore announced having “accounting problems” last month. Has that been a distraction?

Look, it’s an unfortunate situation. It is taking its course and we are not considering it a distraction at all.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.