The 2014-15 Season: A Downer for TV Ad Revenue

In the 2014-15 television season, advertising revenue followed ratings lower. The season started behind the eight ball with a surprisingly soft upfront, and the networks were not able to make up the shortfall in the scatter market.

According to figures from Standard Media Index, total television ad revenue during the season was down 4%.

The declines were across the board. Broadcast TV dropped 7%, while cable TV was down 1%. Syndication slid 6% and spot TV fell 7%. The sliver of light came from local and cable, which rose 3%.

Despite a big new hit for Fox with Empire, ABC’s strengthened Thursday TGIT block of soapy dramas from Shonda Rhimes and The Flash on The CW, broadcast primetime revenue was down 9%, SMI says.

In non-primetime dayparts, broadcast was down 3% and cable was up 1%. Cable got a big boost in daytime, where it was up 8% while broadcast was down 1%.

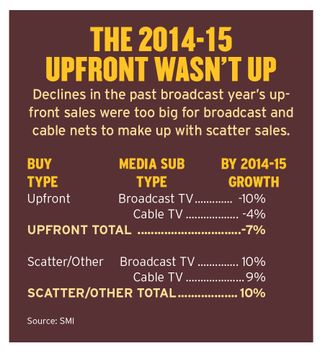

A lot of the decline came from weaker spending commitments in the upfront. Revenue generated from upfront ad sales was down 7%, according to SMI.

For broadcast, upfront sales dropped 10% compared to the prior year, while cable sales slipped 4%.

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Scatter, which accounts for a small part of ad revenue, was up, but not enough to offset the upfront. Scatter on broadcast rose 10%, while cable was up 9%.

The upfront accounted for 80% of broadcast sales in 2014-15, compared to 83% in 2013-14. Scatter accounted for 20% compared to 17% a year ago.

For cable, the upfront generated 76% of revenue, down from 78%. Scatter was 24%, up from 22%.

The turnover in late night talent didn’t appear to help ad sales. David Letterman departed the Ed Sullivan Theater in May and Stephen Colbert’s new show on CBS didn’t debut until Sept. 8.

On Comedy Central, Jon Stewart signed off of The Daily Show after 16 years in August. His successor, Trevor Noah, took over the anchor desk on Oct. 28.

Ad revenue for broadcast in late news and late fringe was down 9%. For cable, ad revenue fell 11%.

There were some major product categories that increased their spending on TV. On the broadcast side, prescription pharmaceuticals jumped 37%; toys & video games rose 23%; health & fitness was up 18%; household supplies gained 14%; and telecommunications was up 4%.

Prescription pharmaceuticals was also a big gainer for cable, up 18%. Toys & video games increased 16%, while insurance, non-alcoholic beverages and quick-serve restaurants all rose 8%.

“Results for the broadcast year decline are very much in line with how we have seen spend shaking out over the period. We knew the ‘14/’15 television upfront was weak and we saw evidence of this all year in our booking data from the agencies,” said James Fennessy, chief commercial officer at SMI. “It was hoped that scatter advertising would make up for this softness but the networks haven’t delivered the audiences they had hoped so it’s been difficult to demand pricing that would close the gap caused by the weak upfront.”

Will Things Get Better?

“Ratings for the new season haven’t set the world on fire so far and we are seeing the impact of this in our September numbers released this week,” Fennsessy said. “Everyone is hopeful that new programming will bring in strong audiences in the coming months and revenue will strengthen in line with this. We see digital continue to take dollars from traditional sources but also see video increasingly capturing these dollars, which is great news for the creators of premium content.”

While broadcast and cable network sales executives thought that they had seen the advertising market turn around during the third-quarter—and some were even predicting upfront ad sales gains next spring—a major media-buying agency was downbeat.

A recent forecast by Magna Global noted that television ad sales struggled in the first half because of poor ratings, hard comparisons and degraded pricing power. It said that, “we expect the last two factors to improve in the second half.” For the full year 2015, total TV ad revenue should decrease by 1.1% to $62.4 billion, excluding political and Olympic-year spending, Magna said.

Magna also noted that 2015-16 was down in volume while acknowledging a busier scatter market, where prices were significantly higher than upfront.

Nevertheless, Magna forecasts that for 2016, TV revenue excluding political and Olympics, would be down 0.7%.

Magna put some of the blame on the growth in digital advertising.

“It is increasingly clear that media spending lags behind economic growth and the primary factor at work is ‘digital deflation,’” the agency said in its report.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.