Reeling Nickelodeon Sets Plans to Stay in Kids Game Lead

Media buyers, and in some respects the larger television world, are eager to hear how the network of SpongeBob and Dora plans to reanimate itself.

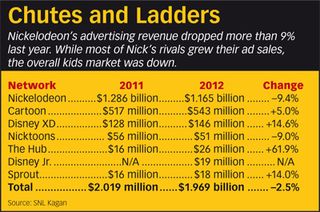

Times have certainly grown more stressful at Nickelodeon, which is preparing for a highstakes upfront presentation on Feb. 26. The network’s ratings plunge and declining revenue have echoed through the broader kids market. Even industry observers not directly involved with the sector have come to see the network’s saga as a case study in the challenges facing storied brands fighting to stay on top.

Buyers say the kids’ category was flat to down last year, with fewer family movies pumping marketing dollars into the mix. Home video and restaurant buys on kids’ shows also declined, according to Darcy Bowe, associate media director at Starcom. Those drops were balanced by increases in the toys, gaming and packaged goods categories, Bowe says.

Sales executives naturally are optimistic this year’s kids upfront market will be up from the $850 million in business that got done last year.

No company has more at stake than Viacom, whose Nickelodeon business is in the crosshairs. With its ratings down 23% among kids 2-11, Nick’s industry-leading ad sales fell more than 9% to $1.165 billion, according to SNL Kagan. In recent months, as the network’s ills hurt Viacom’s earnings, senior management took steps to reassure worried investors, including reorganizing Nick’s programming team.

Absent a persuasive plan to reverse its slide with a fresh programming approach, things could get worse for Nickelodeon, according to media buyers. So far, they say, most clients have not shifted much spending from the leader to the other players in the kids market, but that leadership position is anything but a given.

“Everyone wants to steal share from Nickelodeon,” says Bowe.

So when Nickelodeon holds its upfront presentation in New York, the audience will be eager to hear the script for getting ratings heading upward again. “We’re waiting for the big reveal of how they’re actually going to go about doing that,” says Amy Sotiridy, senior VP at Initiative.

Nickelodeon’s pitch basically will thank clients for sticking with them during the downturn and show them what’s coming, according to Jim Perry, Nickelodeon group head of sales.

“We look to deliver more value to our partners… better programs, more targeted programs, more digital video programs,” Perry says. “Obviously we’re doing something right….We still own the kids space, and we’re very appreciative of everyone who stuck by us.”

A big part of Nick’s presentation will be the network’s new app, joining rivals Disney and Cartoon Network in chasing kids and their newfangled mobile devices.

While Saturday mornings on the broadcast networks once dominated the business, it now accounts for only about 2% of kids gross ratings points, and cable dominates. “As budgets have decreased in the kids space, the broadcast players have seen less demand overall,” says Starcom’s Bowe. Cable had the run of the category for more than a decade but is facing stiff competition from digital players. Netflix, Amazon Prime and Hulu Plus subscribers consume plenty of kids content and have eroded ratings.

Perry is nevertheless expecting a strong kids upfront for cable. “The movie studios are coming back. You saw resurgence in December with the toy category,” he says. Perry says Nick is nearly sold out for pre-Easter, has only a few expensive spots left in its Kids’ Choice Awards, and cancellation options are way down. “I’m feeling good, Perry says.

Similarly, Rita Ferro, executive VP, Disney Media Sales & Marketing, says Disney had a strong fourth quarter. Budgets and pricing look good in scatter. “We are very optimistic about what this upfront could be,” she says.

Nickelodeon’s competitors are taking different approaches.

Instead of a big New York event, Turner Broadcasting’s Cartoon Network is doing a road show of individual presentations for advertisers and agencies. The network has already held about 20 presentations, according to Joe Hogan, executive VP of young adults ad sales at Turner. “We are getting questions about how kids are interacting with our brands across multiple screens and what folks can do with us from a licensing and merchandising perspective,” Hogan says.

The network is pitching a balanced and consistent schedule as well. “It’s important for folks to put their fair share of investment on Cartoon Network,” Hogan says. While not venturing a guess as to how big the overall kids market will be, Hogan says that unlike past years, “the big difference is the momentum that we have is real, and the gap is really closing.”

Disney is holding its upfront event March 12. The children of buyers and clients are invited, like last year. “Not everyone has a 4-year-old, and the reality is when clients are there and they see the reaction and the engagement that kids have with our talent and our content, nothing sells it better,” says Ferro.

Ferro adds that while Nick remains the leading ad vehicle for reaching kids, “the fact that Disney Channel passed Nickelodeon last year to become the No. 1 channel across all the key kids demos was really important for us.”

Disney is pitching sponsorships on its noncommercial Disney Channel as well as spots on commercial networks like Disney XD. The company also has websites, a radio network and new Watch Disney tablet apps to sell. “We really integrate across all of the platforms and all of the businesses,” Ferro says.

As Nickelodeon stumbled last year, upstart networks picked up some of the slack. Disney XD, The Hub and Sprout each posted doubledigit ad revenue gains.

The Hub, a joint venture of Discovery Communications and Hasbro, threw an upfront event last year. This year, the net is doing one-on-ones. “We always felt—especially being still new and so small, but growing—that having the ability to sit with clients, understand their business, crafting ideas, has been beneficial,” says Brooke Goldstein, senior VP of ad sales.

And the number of clients buying The Hub to reach young kids and moms watching classic characters like the Care Bears together has grown from 70 a year ago to more than 140 today, Goldstein adds.

“I think it’s going to be a strong upfront,” she says. “More advertisers are looking for outlets with content they feel comfortable with.”

Sprout is also approaching the upfront on a one-on-one basis. It plans to have a fall slate of original programming to announce for the first time, including The Chica Show’s return, says president Sandy Wax. The net reports ad revenue was up 20% last year—even more if Sprout’s Saturday-morning block on NBC is counted.

“Look at the networks that are growing— it tends to be the upstarts,” Wax says. “And some of the more entrenched bigger guys, like some of the Nickelodeon networks, are still seeing some ratings softness. We’ve got such a strong ratings story and such a strong brand story that we’re really optimistic.”

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

Broadcasting & Cable Newsletter

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.